All housing segments were affected by the first sales decline of 2024.

As the spring homebuying season got underway in March, the Greater Houston housing market continued to blossom with a robust inventory ready to meet impending demand. Active listings remained strong year-over-year amid the first sales decline of 2024.

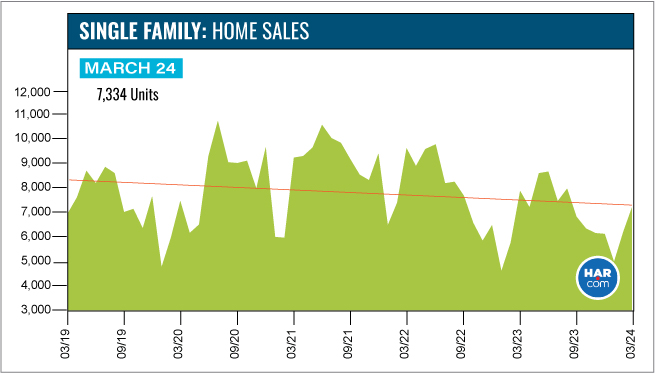

According to the Houston Association of Realtors’ (HAR) March 2024 Market Update, the Houston area saw a 7.5 percent dip in single-family home sales compared to last March. The Houston Multiple Listing Service (MLS) recorded sales of 7,334 units compared to 7,926 in March 2023. Months supply of homes climbed from 2.6 to 3.5, matching a level last seen in October and November 2023.

All housing segments experienced slower sales in March. The low end of the market saw the biggest decline with the sales down 28.9 percent while the luxury segment ($1 million+) saw a modest decline of 0.4 percent. There was no let-up in demand for rentals of single-family homes in March. HAR will publish its March 2024 Rental Home Update on Wednesday, April 17.

“We’re seeing a spring cleaning of sorts in the housing market,” said HAR Chair Thomas Mouton with Century 21 Exclusive. “The rise in active listings indicates more homeowners are testing the waters and putting their properties on the market, but some buyers may be taking a cautious approach due to continued interest rate fluctuations.”

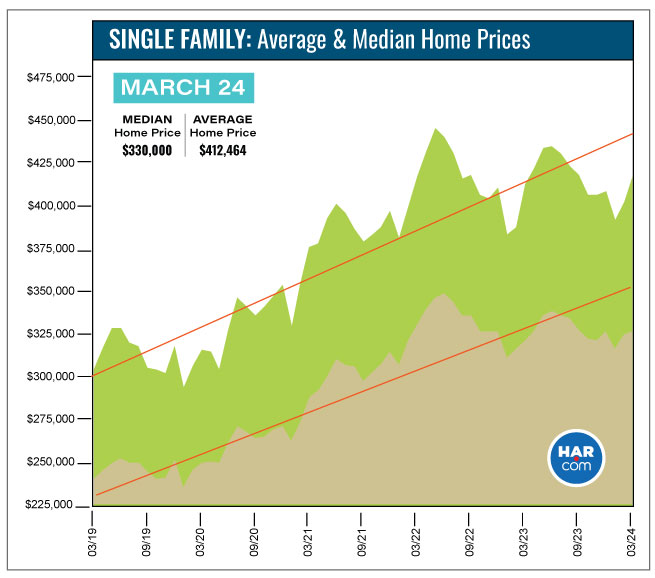

The average price of a single-family home throughout Greater Houston rose 1.3 percent to $412,464 and the median price increased 1.6 percent to $330,000.

March Monthly Market Comparison

March marked the first decline of single-family homes sales this year. Sales were down 7.5 percent year-over-year.

Total property sales also dropped 7.0 percent and total dollar volume fell 5.6 percent from $3.7 billion to $3.5 billion. Active listings, or the total number of available properties, were 26.1 percent ahead of March 2023. Single-family pending sales rose 4.9 percent.

Months of inventory grew from a 2.6-months supply last March to 3.5 months. Housing inventory nationally is at a 2.9-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-month supply is generally considered a “balanced market” in which neither buyer nor seller has an advantage.

Single-Family Homes Update

The Houston housing market saw a 7.5 percent dip in single-family home sales in March, with 7,334 units sold compared to 7,926 last year. The average price edged up 1.3 percent to $412,464 while the median price rose 1.6 percent to $330,000.

Days on Market, or the actual time it took to sell a home, was down from 62 to 55 days. Months of inventory increased to a 3.5-months supply compared to 2.6 months a year earlier.

The current national supply stands at 2.9 months, according to NAR.

Broken out by housing segment, March home sales performed as follows:

- $1 – $99,999: decreased 28.9 percent

- $100,000 – $149,999: decreased 12.9 percent

- $150,000 – $249,999: decreased 11.1 percent

- $250,000 – $499,999: decreased 6.2 percent

- $500,000 – $999,999: decreased 5.3 percent

- $1M and above: decreased 0.4 percent.

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 5,075 in March, down 7.9 percent from the same time last year. The average price rose 3.0 percent to $415,594 and the median sales price rose 2.7 percent to $323,500.

For HAR’s Monthly Activity Snapshot (MAS) of the March 2024 trends, please click HERE to access a downloadable PDF file.

Townhouse/Condominium Update

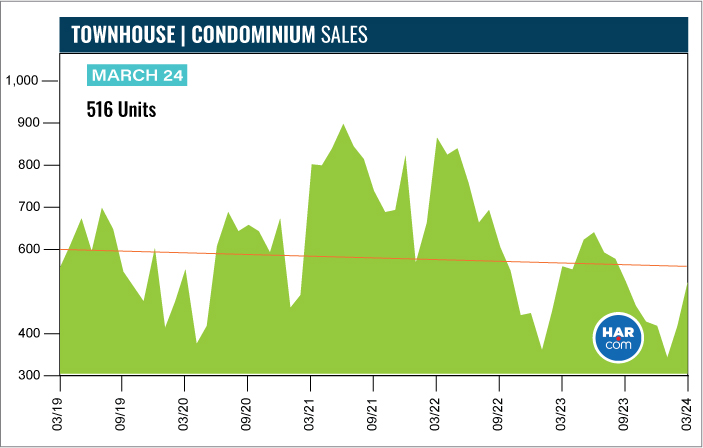

In March, the inventory of townhome and condominiums grew from a 2.1-months supply to 4.3 months, which is the highest since May 2020. This is the second consecutive month that inventory matched levels last seen more than three years ago.

Sales of townhomes and condominiums fell 6.7 percent year-over-year with 516 closed sales versus 553 in March 2023. The average price of townhomes and condominiums rose 2.2 percent to $276,262 while the median price was up 5.1 percent to $235,000.

Houston Real Estate Highlights in March

- Single-family home sales declined 7.5 percent year-over-year;

- Days on Market (DOM) for single-family homes went from 62 to 55 days;

- Total property sales were down 7.0 percent with 8,939 units sold;

- Total dollar volume fell 5.6 percent to $3.5 billion;

- The single-family median price rose 1.6 percent to $330,000;

- The single-family average price rose 1.3 percent to $412,464;

- Single-family home months of inventory registered a 3.5-months supply, up from 2.6 months a year earlier;

- Townhome/condominium sales continued to decline, falling 6.7 percent, with the median price up 5.1 percent to $235,000 and the average price up 2.2 percent to $276,262.