Mortgage rates and depressed inventory keep rental demand strong

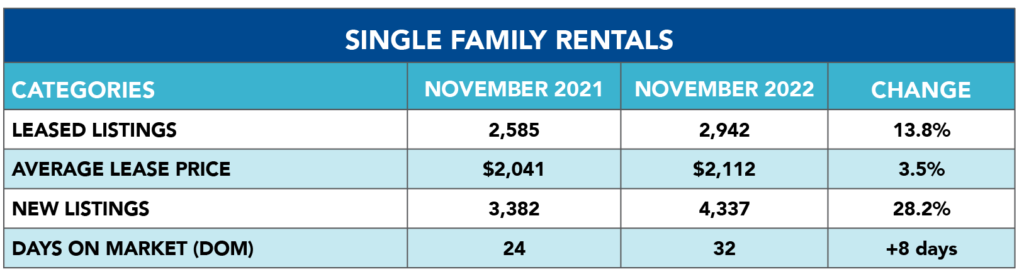

Despite relief from mortgage rates that topped seven percent last month and have since fallen for five straight weeks, would-be homebuyers continued to turn to the rental market as limited affordable inventory continued to prevail among for-sale homes. According to the Houston Association of Realtors’ November 2022 Rental Market Update, single-family home rentals jumped 13.8 percent year-over-year, with the average lease price up 3.5 percent to $2,112. A total of 2,942 leases were signed versus 2,585 in November 2021.

New listings of single-family rentals surged 28.2 percent in November, ensuring that supply can meet the increasing demand. Days on Market, or the actual number of days it took to lease a home, rose from 24 days to 32.

“Houston’s single-family home rental market is red-hot and will likely remain that way as we enter the new year,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “It isn’t just interest rates that have driven this trend, but the continued lack of affordable inventory and, of course, inflation. Fortunately, there is a healthy supply of new listings among rentals, so there is no concern about being able to meet the growing demand.”

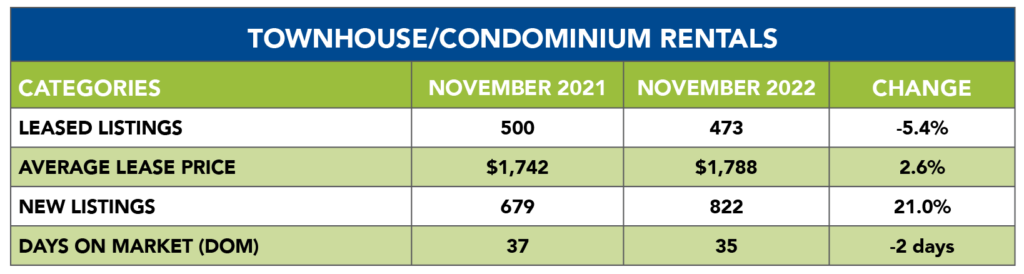

The townhome and condominium rentals market slowed for a second consecutive month in November. Leases of those properties fell 5.4 percent with 473 units leased compared to 500 last year. The average lease price rose 2.6 percent to $1,788. New listings increased 21.0 percent and Days on Market dipped from 37 to 35 days.

The townhome and condominium rentals market slowed for a second consecutive month in November. Leases of those properties fell 5.4 percent with 473 units leased compared to 500 last year. The average lease price rose 2.6 percent to $1,788. New listings increased 21.0 percent and Days on Market dipped from 37 to 35 days.

HAR’s Rental Market Update is distributed on the third Wednesday of each month, one week after the release of the monthly Sales Market Update. An archive of all these reports is available in the HAR Online Newsroom.