The Houston housing market carried its positive momentum from 2016 into the new year, with single-family home sales and pricing both on the rise in January. Homes priced between $500,000 and $750,000 showed the strongest sales activity, and the luxury market ($750,000 and above) enjoyed its third consecutive month in the black, reflecting resistance to any lingering effects of the ailing energy industry.

According to the latest monthly report produced by the Houston Association of REALTORS® (HAR), a total of 4,080 single-family homes sold in January compared to 4,011 a year earlier. That represents an increase of 1.7 percent. Housing inventory grew from a 3.3-months supply to 3.5 months.

“The Houston real estate market is off to an impressive start for 2017, with the end of the holidays and rising interest rates spurring many on-the-fence buyers to take action in January,” said HAR Chair Cindy Hamann with Heritage Texas Properties. “It is especially encouraging to see vitality in the high end of the market, which faltered in response to falling oil prices, but has now registered positive sales for three straight months.”

The single-family home median price (the figure at which half of the homes sold for more and half sold for less) rose 4.0 percent to $210,000. That marks the highest median price ever for a January. The average price jumped 5.3 percent to $275,696, which also represents a January high.

January sales of all property types in Houston totaled 4,997, up 0.9 percent from the same month last year. Total dollar volume for properties sold in January increased 6.2 percent to $1.3 billion.

January Monthly Market Comparison

The Houston housing market saw across-the-board gains in January, with single-family home sales, total property sales, total dollar volume and pricing all up compared to January 2016.

Month-end pending sales for single-family homes totaled 6,286, an increase of 24.7 percent compared to last year. Total active listings, or the total number of available properties, rose 8.6 percent from January 2016 to 34,958.

Single-family homes inventory grew from a 3.3-months supply to 3.5 months. For perspective, housing inventory across the U.S. currently stands at a 3.6-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales totaled 4,080, up 1.7 percent from January 2016, when sales volume totaled 4,011. The median price rose 4.0 percent to a January high of $210,000. The average price climbed 5.3 percent to $275,696, also a record high for a January. Days on Market (DOM), or the number of days it took the average home to sell, edged up to 64 days versus 63 last year.

Broken out by housing segment, January sales performed as

follows:

- $1 – $99,999: decreased 16.3 percent

- $100,000 – $149,999: decreased 9.4 percent

- $150,000 – $249,999: increased 4.1 percent

- $250,000 – $499,999: increased 3.7 percent

- $500,000 – $749,999: increased 16.5 percent

- $750,000 and above: increased 14.3 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 3,429 in January, up 2.6 percent versus the same month last year. The average sales price rose 6.5 percent to $259,865 while the median sales price jumped 5.4 percent to $195,000.

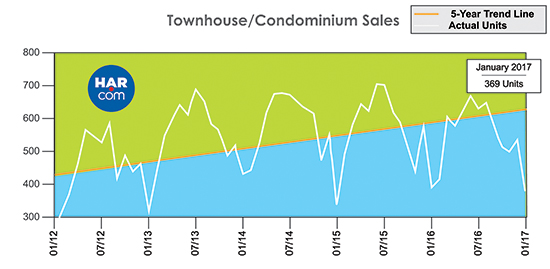

Townhouse/Condominium Update

Townhome and condominium sales fell in January, with 369 units selling versus 390 a year earlier. That represents a decline of 5.4 percent. The average price rose 1.4 percent to $187,176, while the median price slipped 1.1 percent to $138,000. Inventory jumped from a 3.0-months supply to 3.6 months.

Lease Property Update

The lease market had a strong showing in January. Single-family home leases climbed 5.7 percent and townhome/condominium leases increased 6.0 percent. The average rent for single-family homes dropped 1.3 percent to $1,718, while the average rent for townhomes/condominiums fell 4.7 percent to $1,497.

Houston Real Estate Highlights in January

- Single-family home sales rose 1.7 percent with 4,080

units sold; - Total property sales edged up 0.9 percent with 4,997

units sold; - Total dollar volume jumped 6.2 percent to $1.3 billion;

At $210,000, the single-family home median price rose 4.0 percent to a January high; - The single-family home average price climbed 5.3 percent to $275,696, which was also the highest level for a January;

- Single-family homes months of inventory climbed to a 3.5-months supply;

Townhome/condominium sales fell 5.4 percent, with the average price up 1.4 percent to $187,178 and the median price down 1.1 percent to $138,000; - Leases of single-family homes rose 5.7 percent with average rent down slightly to $1,718;

- Leases of townhomes/condominiums increased 6.0 percent with average rent down 4.7 percent to $1,497.