Single-family home sales return to pre-pandemic levels as prices moderate

The Houston housing market in 2025 reflected a return to a more balanced pace, making it a solid year overall for both buyers and sellers. After several years of ups and downs, the Greater Houston market returned to pre-pandemic norms, even as many other large U.S. markets continue to lag.

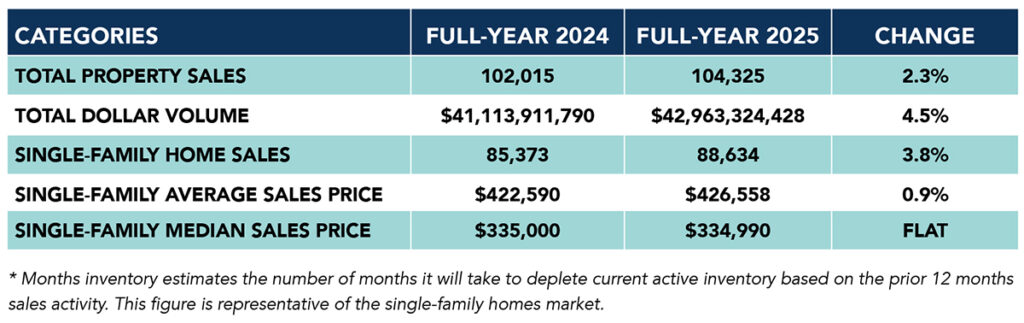

According to the Houston Association of Realtors’ December/Full-Year 2025 Housing Market Update, total property sales for the full year were 2.3 percent above the 2024 level, highlighting continued demand across the region. Total dollar volume rose 4.5 percent to $42.9 billion. Single-family home sales also outpaced 2024 figures, climbing 3.8 percent, with 88,634 properties sold during the year compared to 85,373 in 2024.

“The past year brought a welcome sense of balance back to the Houston housing market,” said HAR Chair Theresa Hill with Compass RE Texas, LLC – Houston. “Buyers had more choices, prices were more stable and homes continued to sell at a steady pace. As we head into the new year, that stability will provide a solid foundation for continued growth.”

2025 Annual Housing Market Comparison

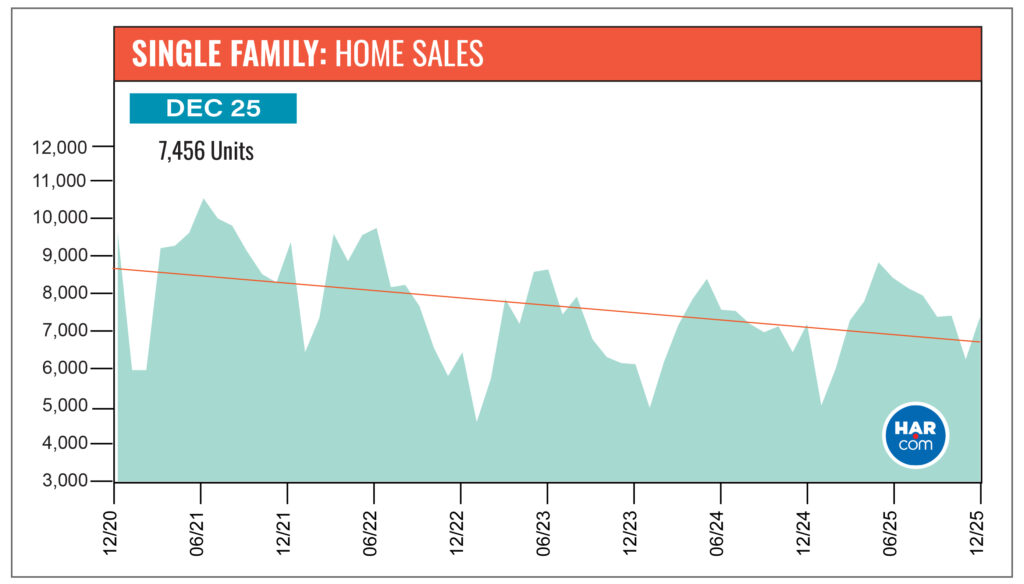

Easing interest rates and a return to pre-pandemic market conditions shaped the Houston housing market in 2025. Sales activity remained consistent for most of the year, with only three months — February, April and November — posting year-over-year declines. The summer months were especially strong, helping sustain momentum and reinforce confidence among both buyers and sellers.

One of the defining trends of the year was the continued expansion of housing inventory. Active listings climbed throughout the year and reached a record high in July at 39,490, giving buyers more options and easing the competitive pressure seen in recent years. Supply climbed to a 5.5-months inventory in July, which was the highest level since June 2012.

As inventory expanded, home prices moderated. The median home price was flat year-over-year at $334,990, posting modest increases only in January (1.6 percent) and March (1.5 percent), with no additional gains recorded in other months. This marked a notable shift from the rapid price growth of prior years and contributed to a healthier market environment.

In 2025, the average home price rose 0.9 percent year-over-year to $426,558. Strong demand in the luxury market pushed the average price to a record high of $449,561 in June.

“We’re selling just as many homes in the Houston area now as we did in 2019, which shows how far this market has come,” said HAR Chief Economist Dr. Ted C. Jones. “Houston is one of the few markets in the country that’s truly back to normal. The recovery a lot of people have been waiting for showed up in our region in 2025, and I think we’ll continue to see sales increase in 2026.”

Affordability improved in 10 out of 12 months when comparing 2025 to 2024, assuming a 20 percent down payment on a median-priced home with monthly interest rates as reported by Freddie Mac. The typical homebuyer in December 2025 saw an $87.72 reduction in their monthly principal and interest payment compared to a consumer purchasing the same median-priced home in December 2024 — a savings of more than $1,000 on an annualized basis. You may view the full breakdown of monthly principal and interest payments ONLINE HERE.

December Monthly Market Comparison

The Houston housing market wrapped up 2025 on a positive note. Total property sales rebounded in December, increasing 1.2 percent year-over-year while total dollar volume rose 2.1 percent to $3.6 billion. The total number of available properties was 16.5 percent ahead of the December 2024 volume with 52,727 active listings.

Screenshot

Single-Family Homes Update

In December, single-family home sales totaled 7,456, up 2.8 percent from a year earlier. The median price was statistically flat at $335,000, while the average price rose 0.8 percent to $425,535. The average price per square foot was $174, slightly lower than $177 last December.

Days on Market, or the actual time it took to sell a home, increased from 59 to 64, which is the highest since February 2020 when homes spent an average of 68 days on the market.

Months of inventory expanded from a 4.0-months supply last December to 4.5 months. The current national supply stands at 3.3 months, as reported by the National Association of Realtors.

Broken out by housing segments, single-family home sales performed as follows:

- $1 – $99,999: decreased 5.6 percent (85 transactions)

- $100,000 – $149,999: increased 8.0 percent

(176 transactions) - $150,000 – $249,999: increased 9.1 percent

(1,350 transactions) - $250,000 – $499,999: increased 0.5 percent

(4,221 transactions) - $500,000 – $999,999: increased 13.4 percent

(1,313 transactions) - $1M and above: decreased 0.3 percent (310 transactions)

HAR’s breakdown of existing single-family home sales shows December closings rose 8.9 percent year over year, with 4,885 homes sold versus 4,484 in December 2024. The average sales price increased 2.5 percent to $439,557, while the median price was up 1.5 percent to $330,000.

For HAR’s Monthly Activity Snapshot (MAS) of the December 2025 trends, please CLICK HERE to access a downloadable PDF file.

Townhouse/Condominium Update

Despite a rollercoaster year for the townhome and condo market, demand picked up in December, with closings climbing 5.5 percent year-over-year. It marked the largest year-over-year increase in sales since January 2025. A total of 422 units were sold compared to 400 during the same time last year. The average price edged up by 0.8 percent to $269,502, while the median price slid 4.4 percent to $224,500.

Inventory expanded in December to a 7.1-months supply compared to 5.3 the prior year.

Houston Real Estate Highlights for December/Full-Year 2025

- In 2025, sales of single-family homes increased 3.8% with 88,634 units sold compared to 85,373 in 2024.

- Total property sales for full-year 2025 were up 2.3% with 104,325 units sold while the total dollar volume increased 4.5% to $42.9 billion.

- Single-family home sales increased 2.8% year-over-year.

- Days on Market (DOM) for single-family homes went from 59 to 64 days.

- The single-family median price was statistically flat at $335,000.

- The single-family average price edged up by 0.8% to $425,535.

- Single-family home months of inventory expanded to a 4.5-months supply, up from 4.0-months a year ago.

- Townhome and condominium sales rose 5.5% with 422 units sold. The median price declined 4.4% to $224,500, and the average price increased 0.8% to $269,502.

- Total property sales increased 1.2% with 8,707 units sold.

- Total dollar volume was up 2.1% to $3.6 billion.