The Houston real estate market plowed through October at full-throttle, driving prices up once again and ensuring that the supply of homes remained at historic lows. The greatest sales activity took place among homes priced between $250,000 and the millions.

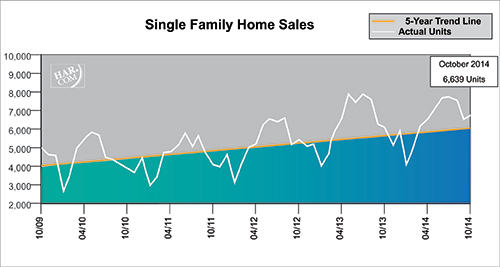

According to the latest monthly report prepared by the Houston Association of Realtors® (HAR), single-family home sales totaled 6,639 units, an increase of 12.3 percent compared to October 2013. Months of inventory, an approximation of how long it will take to deplete the current active housing inventory based on the previous 12 months of sales, dipped to a 2.8-months supply versus a 3.1-months supply last October. That is down slightly from a 2.9-months supply in September 2014 and compares to the current national supply of 5.3 months of inventory.

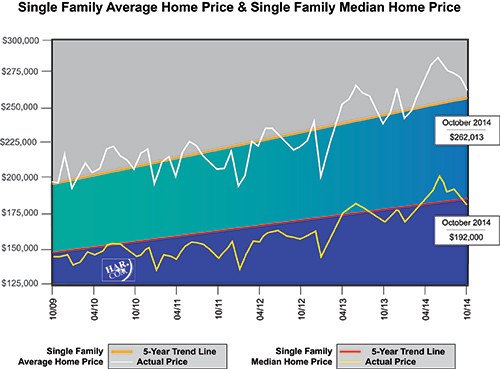

Home prices climbed to record highs for an October. The average price of a single-family home jumped 9.8 percent year-over-year to $262,013. The median price—the figure at which half the homes sold for more and half for less—rose 8.3 percent to $192,000.

October sales of all property types totaled 8,106 units, a 12.9-percent increase compared to the same month last year. Total dollar volume for properties sold rocketed 22.2 percent to $2 billion versus $1.7 billion a year earlier.

“Most Realtors® are not accustomed to this brisk a pace of home sales in Houston this late in the year,” said HAR Chair Chaille Ralph with Heritage Texas Properties. “This is typically when thoughts turn to the holidays and sales volume slows. Much of this year has defied prediction, but what helped the market keep up with buyer demand in October was an 11.1 percent increase in new listings.”

Job growth continues to serve as one of the principal drivers of the Houston housing market. The November edition of the Greater Houston Partnership’s (GHP) Economy at a Glance reports that employment in the greater Houston area grew 4.3 percent in the 12 months ending September 2014, leading the nation’s major metro areas in the pace of job growth. The report cites U.S. Bureau of Labor Statistics data stating that the Houston metro-area created 120,700 jobs on a seasonally adjusted basis, a close second to the 129,100 jobs added in the New York metro area during the same period. “This level of job creation is remarkable given that Houston is home to 2.9 million jobs, a third of New York’s 8.8 million jobs,” the GHP report concludes.

October Monthly Market Comparison

October delivered across-the-board gains for the Houston real estate market, with total property sales, total dollar volume and average and median pricing all up when compared to October 2013.

Month-end pending sales for all property types totaled 4,355. That is up 9.0 percent compared to last year and is considered a harbinger of more positive sales activity when the November sales figures are tallied. Active listings, or the number of available properties, at the end of October was 28,333, 10.4 percent below last year.

After holding steady at a 3.0-months supply in July and August and slipping to a 2.9-months supply in September, Houston’s housing inventory declined to a 2.8-months supply in October. One year earlier, it stood at a 3.1-months supply. According to the National Association of Realtors®, the current supply of homes for the U.S. stands at a 5.3-months supply.

Single-Family Homes Update

October single-family home sales totaled 6,639, up 12.3 percent from October 2013.

Home prices reached record highs for an October in Houston. The single-family average price increased 9.8 percent from last year to $262,013 and the median price climbed 8.3 percent year-over-year to $192,000. The number of days it took a home took to sell¬, or Days on Market, was 51 versus 57 last October. In July 2014, it reached a record low of 45 days.

Broken out by housing segment, October sales performed as follows:

- $1 – $79,999: decreased 25.7 percent

- $80,000 – $149,999: decreased 2.4 percent

- $150,000 – $249,999: increased 14.9 percent

- $250,000 – $499,999: increased 27.1 percent

- $500,000 – $1 million and above: increased 31.9 percent

HAR also breaks out the sales figures for existing single-family homes. In October, existing home sales totaled 5,746. That is up 14.9 percent from the same month last year. The average sales price increased 8.7 percent year-over-year to $241,287 while the median sales price rose 8.8 percent to $179,500.

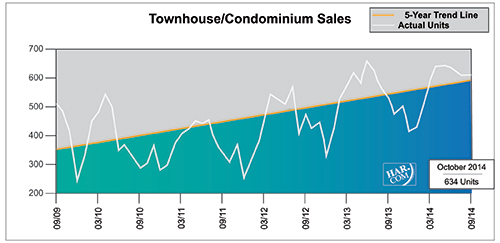

Townhouse/Condominium Update

Sales of townhouses and condominiums jumped 12.4 percent in October versus one year earlier. A total of 634 units sold last month compared to 564 properties in October 2013. The average price increased 3.1 percent to $193,635 and the median price shot up 9.9 percent to $147,750. Inventory matched September’s 2.5-months supply but was down compared to the 2.9-months supply a year earlier.

Lease Property Update

Demand for lease properties persisted in October as inventory of for-sale properties shrank. Single-family home rentals climbed 13.1 percent compared to October 2013, while year-over-year townhouse/condominium rentals were unchanged. The average rent for a single-family home was up 4.0 percent to $1,711 and the average rent for a townhouse/condominium was up 8.5 percent at $1,592.

Houston Real Estate Milestones in October

- Single-family home sales rose 12.3 percent versus October 2013;

- Total property sales were up 12.9 percent year-over year;

- Total dollar volume increased 22.2 percent, from $1.7 billion to $2 billion on a year-over-year basis;

- At $192,000, the single-family home median price achieved a record high for an October;

- At $262,013, the single-family home average price also reached an October high;

- Days on Market for single-family homes was 51, slightly above July’s record low of 45 days;

- Rentals of single-family homes shot up 13.1 percent year-over-year and the cost of renting those homes increased 4.0 percent to $1,711.

- Townhouse/condominium rentals were flat, with rents up 8.5 percent at $1,592.