Home prices moderate as inventory rises from record lows

Rapidly-rising mortgage rates dampened home sales in the Greater Houston area in October as the housing market cooldown continues. However, home prices are still well above where they were a year ago. October marked the seventh consecutive month of declining sales and rising inventory as the market continues toward a more normalized, pre-pandemic pace.

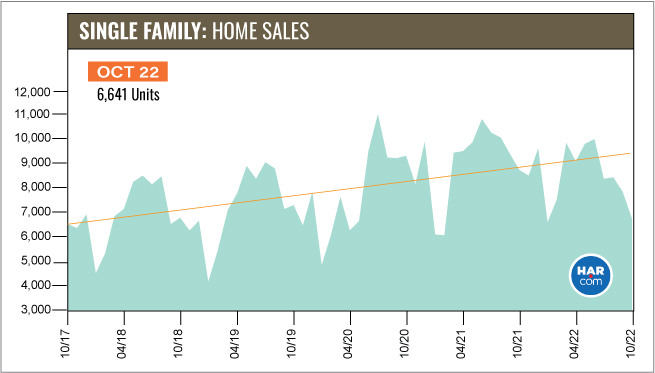

According to the Houston Association of REALTORS’ (HAR) October 2022 Market Update, single-family home sales fell 22.8 percent, with 6,641 units sold compared to 8,597 in October 2021. On a year-to-date basis, the market now trails 2021’s record-setting volume by 6.7 percent.

All housing segments experienced negative sales in October. The smallest decline in sales was recorded among homes priced $500,000 and $999,999, which fell 6.6 percent. With fewer homes priced below $250,000, some consumers pivoted to the rental market. HAR examines those trends in the October 2022 Rental Home Update, which was released on Wednesday, November 16.

“The Houston housing market is heading towards more balanced conditions,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “We saw years of unprecedented growth, and it appears the market is finally nearing pre-pandemic levels. Higher mortgage rates are softening buyer demand. But as prices level off and inventory grows, we’re going to see more consumers move from the sidelines to the marketplace.”

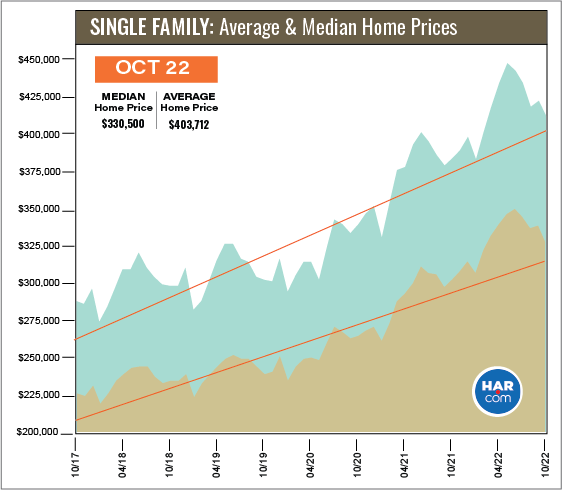

The average price of a single-family home rose 7.2 percent in October to $403,712 –below the record high of $438,290 reached earlier this year in May. The median price jumped 8.4 percent to $330,500, which is also below the highest median of all time, $354,000, reached in June 2022. The average price for a single-family home in Houston first broke the $400,000 mark in March of this year. The median price has held above $300,000 since May of 2021.

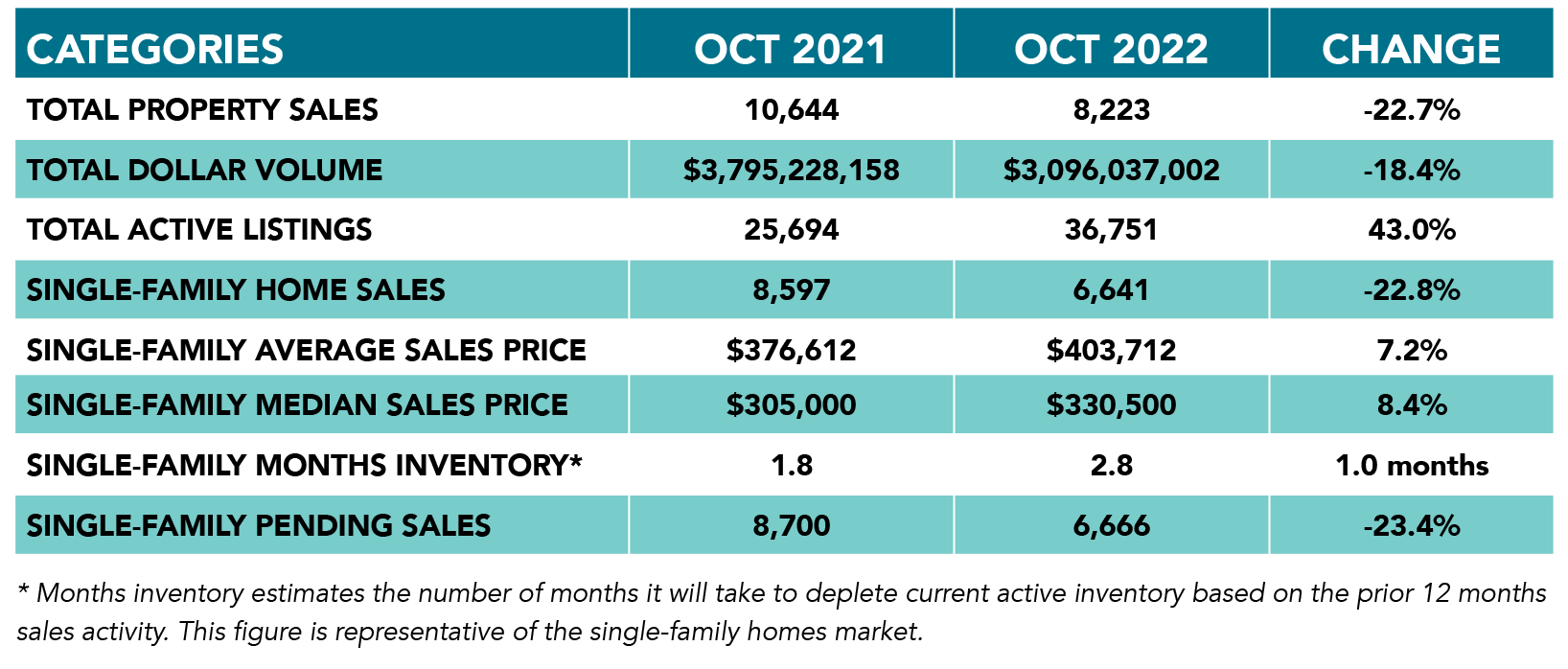

October Monthly Market Comparison

Homebuying activity slowed for a seventh straight month in October, with mortgage interest rates hovering around seven percent, more than double what it was a year ago, as well as a lack of housing inventory below $400,000. Year-over-year single-family home sales fell 22.8 percent. On a year-to-date basis, sales are trailing last year’s record pace by 6.7 percent.

The monthly housing measurements for October yielded mixed readings. In addition to the drop in single-family home sales, total property sales and total dollar volume declined and pending sales fell 23.4 percent. Active listings (the total number of available properties) jumped 43.0 percent.

Months of inventory continues to grow, reaching a 2.8-months supply in October. That is the highest level since July of 2020 when it was 2.9 months. Housing inventory nationally stands at a 3.2-months supply, according to the latest report from the National Association of Realtors (NAR). A 6.0-months supply is generally considered make up a “balanced market,” in which neither the buyer nor the seller has an advantage.

Single-Family Homes Update

Single-family home sales fell 22.8 percent in October with 6,641 units sold across the Greater Houston area compared to 8,597 a year earlier. In October, the median price increased 8.4 percent to $330,500 while the average price rose 7.2 percent to $403,712.

For a pre-pandemic perspective, October sales are down 7.6 percent compared to October 2019, when a total of 7,187 single-family homes sold. The median price then was 37.7 percent lower, at $240,000, and the average price, at $298,158, was 35.4 percent lower. Sales are 3.5 percent above where they were five years ago, in October 2017, when volume totaled 6,417. Back then, the median price was $226,500 and the average price was $284,659 – reflecting pricing jumps of 45.9 percent and 41.8 percent, respectively

Days on Market, or the actual time it took to sell a home, grew from 32 to 43 days. Inventory registered a 2.8-months supply compared to 1.8 months a year earlier. That is the greatest supply of homes on the market since July 2020. The current national inventory stands at 3.2 months, as reported by NAR.

Broken out by housing segment, October sales performed as follows:

- $1 – $99,999: decreased 42.3 percent

- $100,000 – $149,999: decreased 34.8 percent

- $150,000 – $249,999: decreased 41.6 percent

- $250,000 – $499,999: decreased 18.7 percent

- $500,000 – $999,999: decreased 6.6 percent

- $1M and above: decreased 28.0 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 5,021 in October, down 30.4 percent from the same month last year. The average sales price rose 5.9 percent to $395,627 while the median sales price increased 5.4 percent to $315,000. Those figures continue to be significantly below the pricing records that were set earlier this year.

For HAR’s Monthly Activity Snapshot (MAS) of the October 2022 trends, please click HERE to access a downloadable PDF file.

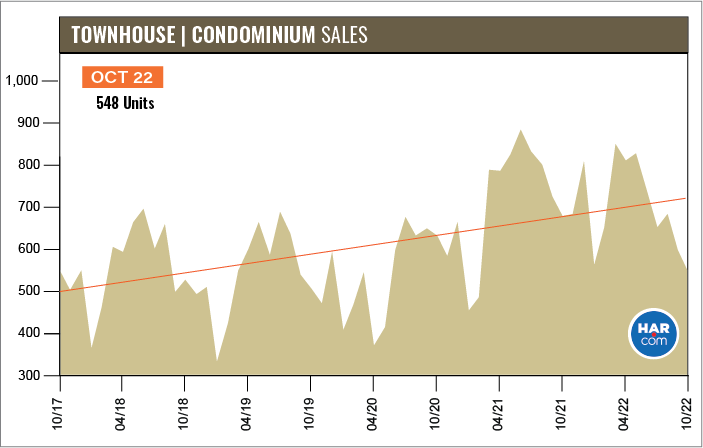

Townhouse/Condominium Update

Townhouses and condominiums experienced their fifth consecutive monthly decline, falling 19.4 percent year-over-year with 548 closed sales versus 680 a year earlier. The average price increased 9.3 percent to $269,936 and the median price rose 3.9 percent to $226,500. Both figures are below the historic highs reached in April 2022. Inventory fell slightly from a 2.3-months supply to 2.1 months.

Houston Real Estate Highlights in OCTOBER

- Single-family home sales fell 22.8 percent year-over-year, the seventh consecutive decline of 2022 as the market returns to pre-pandemic levels;

- All housing segments experienced negative sales in October. The smallest decline in sales

- Days on Market (DOM) for single-family homes grew from 32 to 43 days;

- Total property sales were down 22.7 percent with 8,223 units sold;

- Total dollar volume declined 18.4 percent to a little over $3 billion;

- The single-family average price rose 7.2 percent to $403,712;

- The single-family median price increased 8.4 percent to $330,500;

- Single-family home months of inventory registered a 2.8-months supply, up from 1.8 months a year earlier. That is the greatest inventory level since July of 2020;

- Townhome/condominium sales experienced their fifth consecutive monthly decline, falling 19.4 percent, with the average price up 9.3 percent to $269,936 and the median price up 3.9 percent to $226,500.