Market continues to outpace last year’s record performance

Sales and rentals of homes throughout greater Houston continue to outpace 2016’s record performance, as May marked another month of strong consumer activity and growing inventory. The greatest sales gains took place among homes priced from $750,000 and above (categorized as the luxury market), followed by homes in the $150,000 to $249,999 range. May marked the seventh consecutive month of rising sales in the luxury segment.

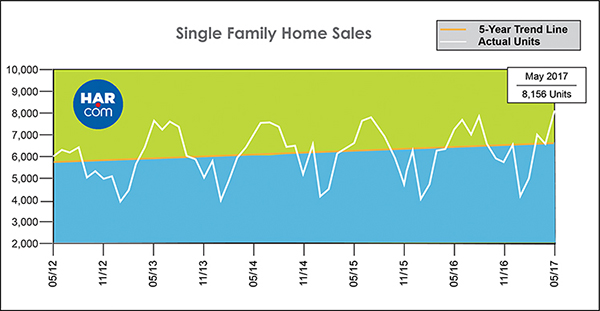

A total of 8,156 single-family homes sold in May versus 7,315 a year earlier, according to the latest monthly report produced by the Houston Association of REALTORS® (HAR). That represents an 11.5 percent increase. On a year-to-date basis, home sales are ahead of 2016’s volume by 7.4 percent. New listings elevated inventory levels from a 3.6-months supply to 4.1 months, the highest in nearly five years.

“The Houston housing market had another strong showing in May with sales and rental properties alike, and inventory continues to accommodate the growing demand,” said HAR Chair Cindy Hamann with Heritage Texas Properties. “If we can maintain this pace, there’s no doubt that 2017 will be a record year for Houston real estate.”

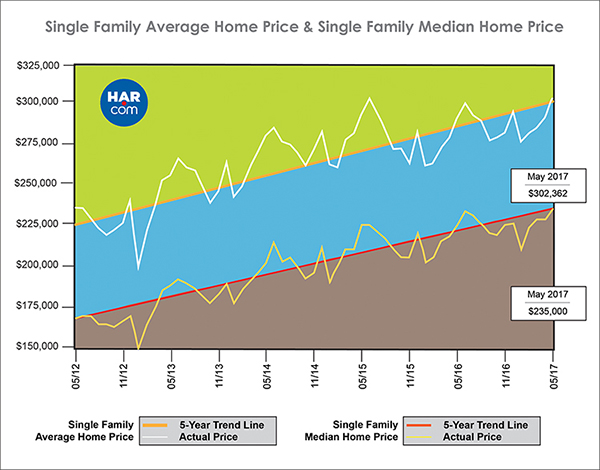

The single-family home median price (the figure at which half of the homes sold for more and half sold for less) climbed 4.4 percent to $235,000. That marks the highest median price of all time. The average price rose 4.3 percent to $302,362, the second highest average ever.

May sales of all property types in Houston totaled 9,744, up 12.3 percent from the same month last year. Total dollar volume for properties sold in May shot up 17.4 percent to $2.8 billion.

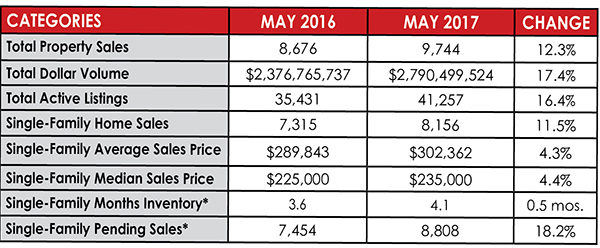

May Monthly Market Comparison

The Houston real estate market benefited from gains in all measurements during the month of May, with single-family home sales, total property sales, total dollar volume, inventory and pricing all up compared to May 2016.

Month-end pending sales for single-family homes totaled 8,808, up 18.2 percent compared to last year. Total active listings, or the total number of available properties, jumped 16.4 percent from May 2016 to 41,257.

Single-family homes inventory grew from a 3.6-months supply to 4.1 months. For perspective, housing inventory across the U.S. currently stands at a 4.2-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales totaled 8,156, up 11.5 percent from May 2016, when it was 7,315. The median price rose 4.4 percent to an all-time record high of $235,000. The average price climbed 4.3 percent to $302,362, the second highest of all time. The highest average price was $302,629, reached in June 2015.

Days on Market (DOM), or the number of days it took the average home to sell, declined slightly to 51 days versus 53 last year. Inventory rose from a 3.6-months supply to 4.1 months, matching a level not seen since November 2012.

Broken out by housing segment, May sales performed as follows:

- $1 – $99,999: unchanged

- $100,000 – $149,999: decreased 5.3 percent

- $150,000 – $249,999: increased 13.7 percent

- $250,000 – $499,999: increased 12.9 percent

- $500,000 – $749,999: increased 8.5 percent

- $750,000 and above: increased 27.6 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 6,891 in May, up 13.3 percent versus the same month last year. The average sales price increased 5.2 percent to $290,696 while the median sales price also rose 5.2 percent to $221,000.

Townhouse/Condominium Update

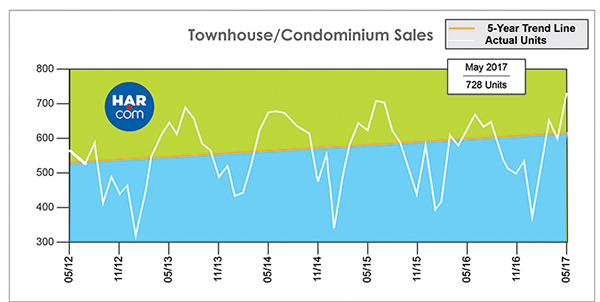

Townhome and condominium sales were up again in May, soaring 16.5 percent with a total of 728 units sold. The average price increased 3.1 percent to $206,363, while the median price edged up 0.9 percent to $163,500. Inventory grew from a 3.4-months supply to 4.2 months.

Lease Property Update

Houston’s lease market surged in May, with strong consumer demand among both single-family and townhome/condominium properties. Single-family home leases shot up 31.0 percent while townhome/condominium leases rocketed 46.2 percent. The average rent for single-family homes declined 4.2 percent to $1,779, while the average rent for townhomes/condominiums dropped 6.7 percent to $1,565.

Houston Real Estate Highlights in May

- Single-family home sales rose 11.5 percent year-over-year with 8,156 units sold;

- Total property sales increased 12.3 percent with 9,744 units sold;

- Total dollar volume jumped 17.4 percent to $2.8 billion;

- The single-family home median price rose 4.4 percent to a record high of $235,000;

- The single-family home average price climbed 4.3 percent to $302,362, which was the second highest level of all time (highest was $302,629 in June 2015);

- Single-family homes months of inventory grew to a 4.1-months supply, the highest level since November 2012;

- Townhome/condominium sales surged 16.5 percent, with the average price up 3.1 percent to $206,363 and the median price up 0.9 percent to $163,500;

- Leases of single-family homes soared 31.0 percent with average rent down 4.2 percent to $1,779;

- Volume of townhome/condominium leases rocketed 46.2 percent with average rent down 6.7 percent to $1,565.