Homes appear to be high on holiday shopping lists as consumers continued to snap up properties in November, pushing prices up once again while driving the supply level down. The majority of the month’s sales activity took place among homes priced between $250,000 and the millions.

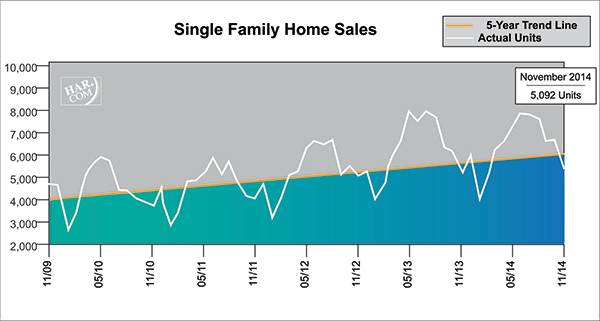

According to the latest monthly report prepared by the Houston Association of REALTORS® (HAR), single-family home sales totaled 5,092 units, an increase of 1.8 percent compared to November 2013. Months of inventory, the estimated time it would take to deplete the current active housing inventory based on the previous 12 months of sales, dipped to a 2.7-months supply versus a 2.9-months supply last November. That is markedly lower than the current national supply of 5.1 months of inventory.

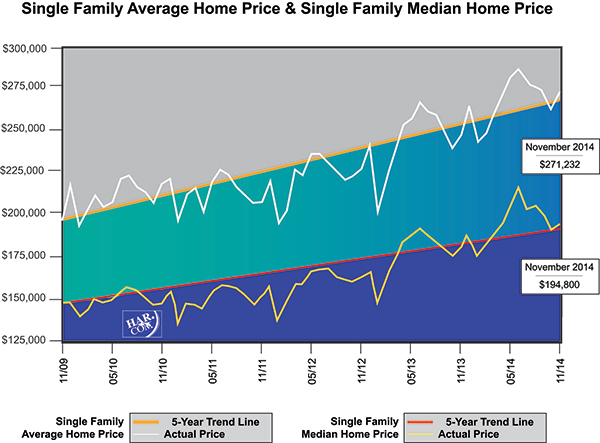

Home prices achieved record highs for a November. The average price of a single-family home jumped 10.3 percent year-over-year to $271,232. The median price—the figure at which half the homes sold for more and half for less—rose 6.7 percent to $194,800.

November sales of all property types totaled 6,212 units, a 2.8-percent increase compared to the same month last year. Total dollar volume for properties sold rose 12.3 percent to $1.6 billion versus $1.4 billion a year earlier.

“The Houston housing market has shown only the slightest let-up over the past couple of months, but not enough to enable inventory levels to grow,” said HAR Chair Chaille Ralph with Heritage Texas Properties. “I have been asked whether falling oil prices could impact housing in 2015, and Stewart Title Chief Economist and former HAR Chairman Ted C. Jones, Ph.D., has forecast a 10 to 12 percent decline in home sales in the next 12 months, with about a 6.0 percent increase in prices.”

Jones predicts that $60 to $70 per barrel oil prices will cause Houston’s job growth to slow significantly in the new year, with about 65,000 net new jobs created versus the nearly 123,000 jobs seen in the past 12 months.

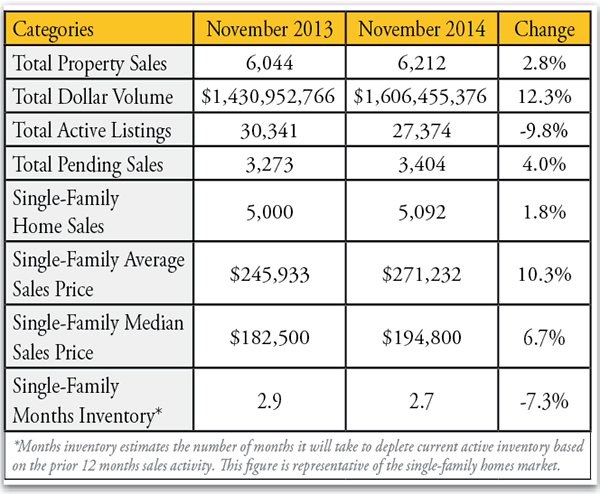

November Monthly Market Comparison

The Houston real estate market grew in all categories in November, with total property sales, total dollar volume and average and median pricing all up when compared to November 2013.

Month-end pending sales for all property types totaled 3,404. That is up 4.0 percent compared to last year and suggests another possible increase when December’s sales numbers are crunched. Active listings, or the number of available properties, at the end of November was 27,374, down 9.8 percent from last year.

Houston’s housing inventory slipped to a 2.7-months supply in November. One year earlier, it stood at a 2.9-months supply. According to the National Association of REALTORS, the current supply of homes for the U.S stands at a 5.1-months supply.

Single-Family Homes Update

November single-family home sales totaled 5,092, up 1.8 percent from November 2013.

Home prices reached record highs for a November in Houston. The single-family average price increased 10.3 percent from last year to $271,232 and the median price climbed 6.7 percent year-over-year to $194,800. The number of days it took a home took to sell¬, or Days on Market, was 54 versus 60 last November. In July 2014, it fell to an historic low of 45 days.

Broken out by housing segment, November sales performed as follows:

- $1 – $79,999: decreased 28.6 percent

- $80,000 – $149,999: decreased 7.7 percent

- $150,000 – $249,999: increased 2.6 percent

- $250,000 – $499,999: increased 7.8 percent

- $500,000 – $1 million and above: increased 19.4 percent

HAR also breaks out the sales figures for existing single-family homes. In November, existing home sales totaled 4,361. That is up 6.3 percent from the same month last year. The average sales price shot up 11.7 percent year-over-year to $252,576 while the median sales price rose 6.6 percent to $180,000.

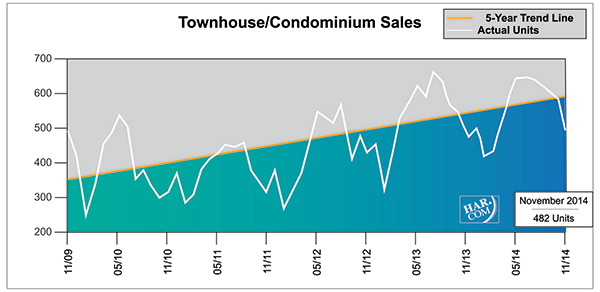

Townhouse/Condominium Update

Sales of townhouses and condominiums declined fractionally in November versus one year earlier. A total of 482 units sold last month compared to 487 properties in November 2013. The average price was flat at $201,390 and the median price rose 8.6 percent to $152,000. Inventory reached a 2.4-months supply, which is down compared to the 2.8-months supply a year earlier.

Lease Property Update

Demand for lease properties rose again in November, as inventory of for-sale properties shrank. Single-family home rentals climbed 4.2 percent compared to November 2013, while year-over-year townhouse/condominium rentals increased 5.7 percent. The average rent for a single-family home was up 5.0 percent to $1,669 and the average rent for a townhouse/condominium was up 3.6 percent to $1,520.

Houston Real Estate Milestones in November

- Single-family home sales rose 1.8 percent versus November 2013;

- Total property sales were up 2.8 percent year-over year;

- Total dollar volume increased 12.3 percent, from $1.4 billion to $1.6 billion on a year-over-year basis;

- At $194,800, the single-family home median price achieved a record high for a November;

- At $271,232, the single-family home average price also reached a November high;

- Days on Market for single-family homes was 54 days;

- Rentals of single-family homes rose 4.2 percent year-over-year and the cost of renting those homes increased 5.0 percent to $1,669.

- Townhouse/condominium rentals climbed 5.7 percent, with rents up 3.6 percent at $1,520.