Mortgage rates drove many consumers to rent, but inventory and pricing have created a positive buying landscape for 2024

For the second year in a row, economic forces affecting the entire country caused its share of disruption to the Houston housing market. While 2023 saw significant growth in housing inventory and moderation in pricing, it was ultimately mortgage interest rates, which leapt to 20-year highs, that prompted many would-be buyers to scrap purchasing plans or pivot to rental housing in 2023. As 2024 gets underway, Houston’s residential housing landscape is considered to be on solid footing if you factor out the uncertainty of what the Federal Reserve may do with interest rates and lingering consumer jitters over inflation.

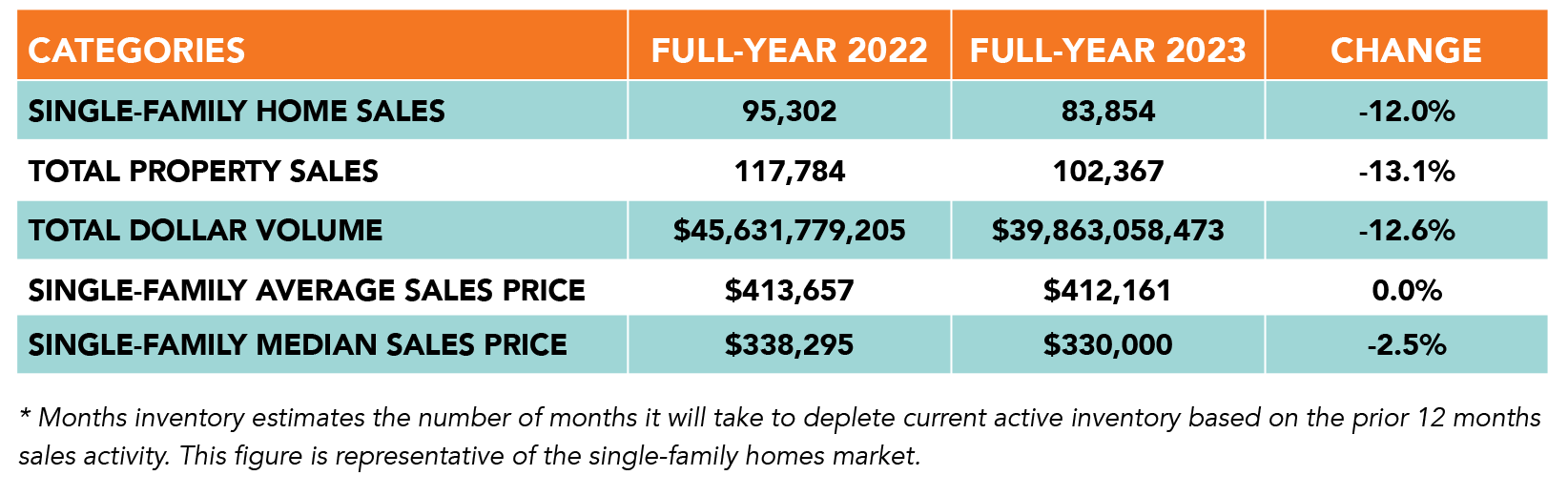

A decline in single-family home sales and total property sales made 2023 the second consecutive negative year for Houston housing. According to HAR’s December/Full-Year 2023 Housing Market Update, single-family home sales fell 12.0 percent to 83,854. Sales of all property types totaled 102,367, down 13.1 percent from 2022. Total dollar volume dropped 12.6 percent to $40 billion versus $45.6 billion in 2022.

“It is disappointing to have a down year for home sales, but the economic forces affecting Houston affected housing markets across the U.S., so this was not a uniquely Houston situation,” said HAR Chair Thomas Mouton with Century 21 Exclusive. “We believe that home sales will pick up once consumer confidence is restored, and that depends on what the Federal Reserve does with interest rates and evidence that inflation is no longer a threat. The expanded housing inventory and moderation in pricing we saw throughout 2023 have created a positive buying landscape for 2024.”

For December, single-family home sales fell 6.2 percent year-over-year. That comes on the heels of November’s 4.7 percent sales increase that marked the first upward sales move in 19 months. Most segments of the housing market experienced declines, however the heaviest volume segment – consisting of homes between $250,000 and $500,000 – was unchanged compared to December 2022. Homes priced from $1M and above declined 2.1 percent.

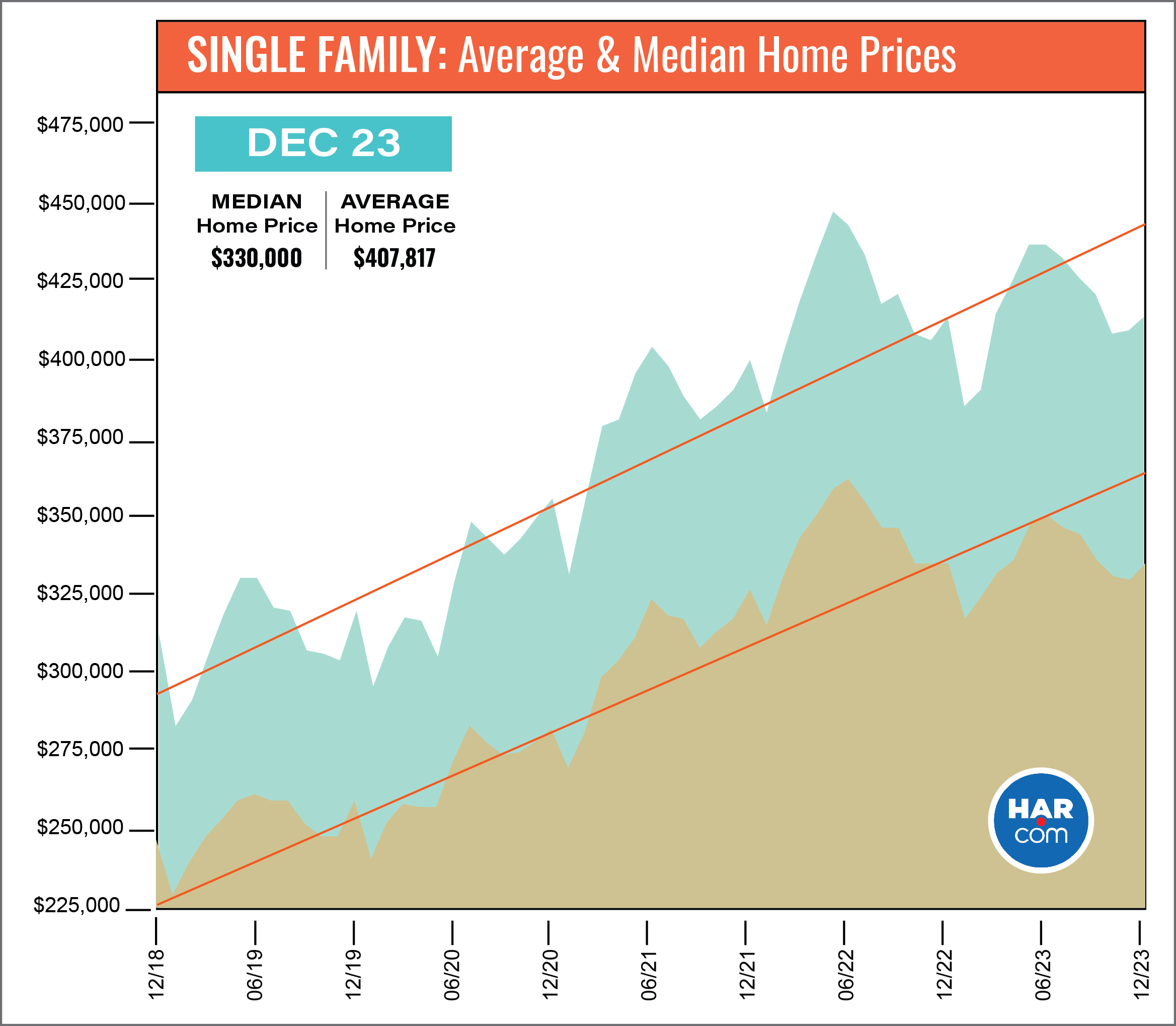

The median price of a single-family home – the figure at which half of the homes sold for more and half sold for less – was $330,000 in December, unchanged from a year earlier. The average price of $407,817 was also statistically flat.

2023 Annual Market Comparison

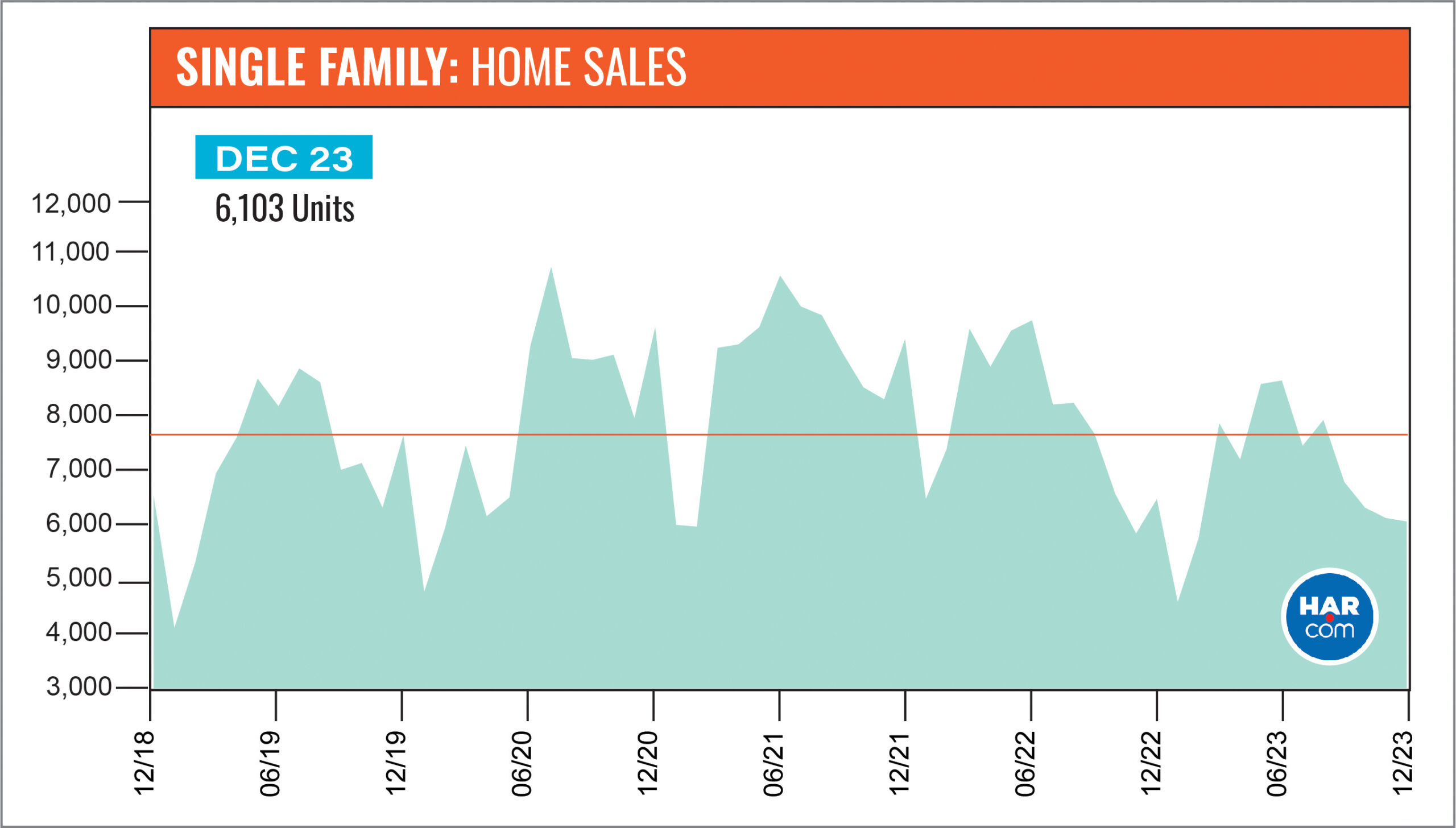

Rising mortgage rates were the primary deterrent to homebuying throughout 2023, with some consumers scrapping plans to purchase a home and many others opting to rent instead. Houston real estate kicked off the year with double-digit declines in sales volume that began to ease by the spring. Slower sales combined with a steady influx of new listings enabled inventory to grow and eventually match healthier 2019 and 2020 levels. By October, as the Fed continued its efforts to stave off inflation, mortgage rates climbed to levels not seen in 20 years when they exceeded 8 percent. Despite that, and just in time for the holidays, home sales registered a 4.7 percent increase in November – the first increase the market had seen in 19 months, but not enough to prevent 2023 from becoming the second consecutive down year.

At the outset of 2023, inventory was at a 2.6-months supply. In October and November, it grew to a 3.5-months supply, the greatest level since November 2019 when the market had a 3.6-months supply. In December, inventory registered a 3.3-months supply. A 4.0- to 6.0-months supply has traditionally been considered a “balanced market” in which neither buyer nor seller has an advantage.

June scored the year’s greatest sales volume with 8,723 single-family units sold during the month. By the time the books were closed on December transactions, 83,854 single-family homes had sold across greater Houston in 2023. That is down 12.0 percent from the 95,302 homes sold in 2022.

On a year-to-date basis, the average single-family home price was statistically flat at $412,161 while the median price fell 2.5 percent to $330,000. Total dollar volume for full-year 2023 fell 12.6 percent to about $40B.

Houston’s lease market had a strong 2023 as prospective buyers secured homes to rent until they are prepared to resume the buying process – most likely once they observe stability or declines in mortgage interest rates and are convinced that inflation is no longer a concern. HAR will report on rental trends in the December 2023 Rental Market Update, to be released next Wednesday, January 17.

December Monthly Market Comparison

The Houston housing market produced mixed results in December. Single-family home sales, total property sales and total dollar volume fell compared to December 2022 while pricing was statistically flat. Month-end pending sales for single-family homes totaled 5,723, up 14.5 percent from a year earlier. Total active listings, or the total number of available properties, rose 13.9 percent to 38,028.

Single-family homes inventory grew from a 2.6-months supply to 3.3 months. For perspective, housing inventory across the U.S. currently stands at a 3.5-months supply, according to the latest National Association of Realtors (NAR) report.

Single-Family Homes Update

Single-family home sales totaled 6,103, down 6.2 percent from December 2022. That followed November’s surprising 4.7 percent sales volume increase – the first upward sales trend in 19 months. The median price was flat at $330,000. The average price was statistically flat at $407,817. Those figures culminate a year of gradual but consistent moderation in home prices. Days on Market (DOM), or the number of days it took the average home to sell, went from 57 to 56 days.

- Broken out by housing segment, December sales performed as follows:

- $1 – $99,999: increased 23.3 percent

- $100,000 – $149,999: decreased 20.5 percent

- $150,000 – $249,999: decreased 10.4 percent

- $250,000 – $499,999: unchanged

- $500,000 – $999,999: decreased 10.3 percent

- $1M and above: decreased 2.1 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 3,928 in December. That is down 6.6 percent versus the same month last year. The average sales price was unchanged at $399,841 while the median sales price edged up 1.6 percent to $315,000.

For HAR’s Monthly Activity Snapshot (MAS) of the December 2023 trends, please CLICK HERE to access a downloadable PDF file.

Townhouse/Condominium Update

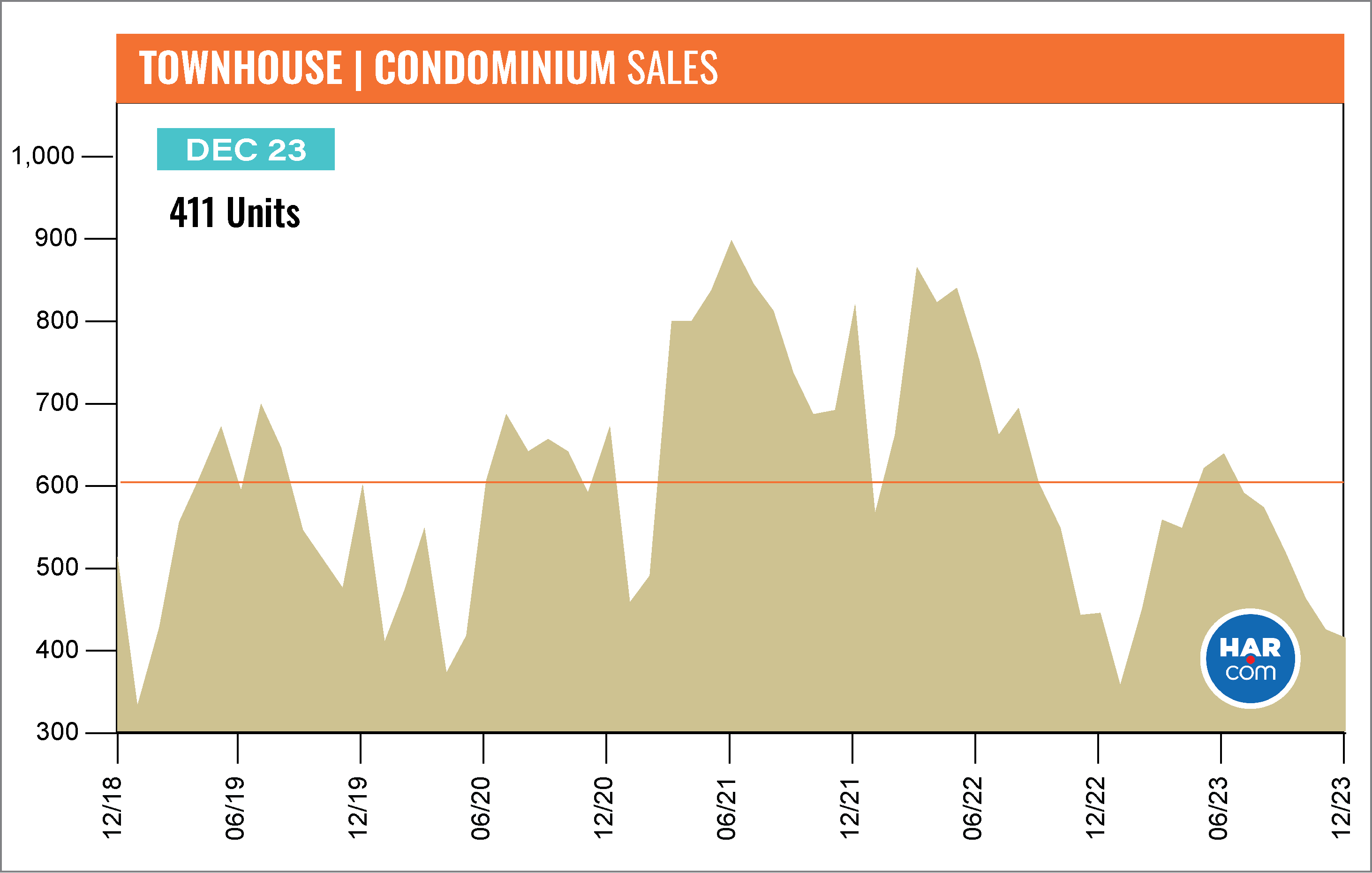

Townhome and condominium sales were in decline for the entirety of 2023, although the rate of decline slowed during the final two months of the year. December volume fell 7.0 percent with 411 units sold versus 442 a year earlier. The average price rose 6.7 percent in December to $258,137 and the median price rose 9.3 percent to $235,000. Inventory improved from a 2.0-months supply to 3.5 months.

Houston Real Estate Highlights for December and Full-Year 2023

- 2023 marked the second consecutive year of declining home sales with 83,854 single-family homes sold versus 95,302 in 2022 – a decline of 12.0 percent; .

- Total dollar volume for full-year 2023 fell 12.6 percent to $40B;

- December single-family home sales fell 6.2 percent year-over-year with 6,103 units sold;

- Total December property sales declined 4.9 percent to 7,395 units;

- Total dollar volume for December fell 3.7 percent to $2.9B;

- At $330,000, the single-family home median price was unchanged;

- The single-family home average price was also unchanged at $407,817;

- Single-family homes months of inventory expanded to a 3.3-months supply;

- The townhome/condominium market experienced declining sales throughout 2023, and in December, volume fell 7.0 percent with the average price up 6.7 percent to $258,137 and the median price down 9.3 percent to $235,000;

- Townhome/condominium inventory grew from a 2.0-months supply to 3.5 months.