With mortgage rates at their highest level in 20 years and home prices gradually retreating from record highs, consumers continue to flock toward rental housing across the Greater Houston area.

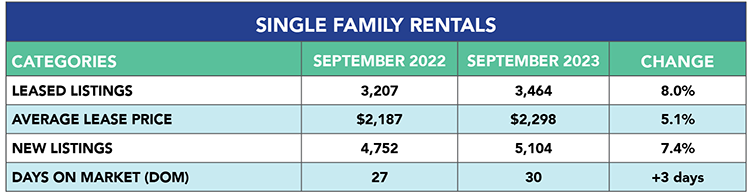

According to the Houston Association of Realtors’ (HAR’s) September 2023 Rental Market Update, rentals of single-family homes rose 8.0 percent year-over-year with the average lease price climbing 5.1 percent to $2,298. A total of 3,464 leases were signed compared to 3,207 in September 2022.

New listings of single-family rentals rose 7.4 percent in September, providing an ample supply of homes to meet the steady demand. Days on Market, or the actual number of days it took to lease a home, increased slightly from 27 to 30 days.

“Rental homes are still highly sought after throughout the Houston housing market and that is the direct result of elevated mortgage rates and home prices overall,” said HAR Chair Cathy Treviño with LPT, Realty. “We have seen moderation of home prices in recent months, but I believe most consumers right now are more concerned about where interest rates are than about pricing.”

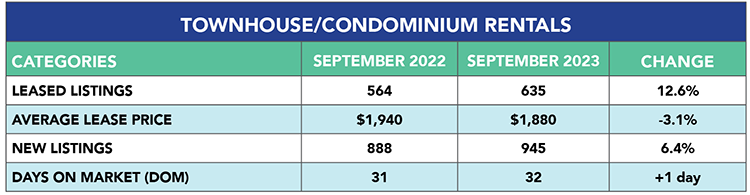

The townhome/condominium rental market saw gains in September. Leases of those properties jumped 12.6 percent with 635 units leased compared to 564 last year. The average lease price fell 3.1 percent to $1,880. New listings rose 6.4 percent and Days on Market went from 31 to 32 days.

Pre-pandemic Perspective: Compared to the last September before the pandemic, single-family home rentals are up 19.2 percent. In September 2019, leases were signed for 2,905 single-family homes. The average rent is currently 25.0 percent higher than it was back then – $1,839. Townhome/condominium rentals totaled 552 in September 2019. That is 13.1 percent below the September 2023 volume. The average townhome/condo rent is currently 18.5 percent above its September 2019 price of $1,587.

HAR’s Rental Market Update is distributed on the third Wednesday of each month, one week after the release of the monthly Home Sales Market Update. An archive of all these reports is available in the HAR Online Newsroom.