By Patsy Fretwell

National consumer confidence is rising in spite of the federal government’s actions, according to Dr. Harold Hunt, a research economist with Texas A&M University’s Real Estate Center. Hunt recently presented an overview on the current economic outlook for real estate decision makers to the Commercial Real Estate Research Forum at HAR.

Opening the presentation with a slide titled “(Most of) the Federal Government is Still Broken,” noting “The NSA (National Security Agency) as the only part of government that actually listens,” Hunt then provided a multitude of statistics and surveys to support his economic outlook.

Focusing on three areas of the economy that could affect commercial real estate, Hunt asked his No.1 question: Is lingering uncertainty over ‘Obamacare’ holding back the economy?

Saying no one knows for certain how health care premiums will be affected, Hunt then cited several major health care providers as projecting consumer premium increases ranging from 40% to 116%. The major providers included United Healthcare, Aetna and Blue Cross & Blue Shield.

Regarding new hiring, however, he cited several studies refuting the belief that uncertainty over health care will adversely affect new hiring. A recent survey by the National Federation of Independent Business reported that a majority of small businesses believe now is a good time to expand and plan on hiring people in the next three months. Another group reported that 32% of companies surveyed said they would be hiring for more new jobs within the next six months; 26% reported hiring for fewer jobs. He also reported that some industries were cutting back workers’ hours to avoid the health care issue but others were attributing cutbacks to lack of demand.

Hunt detailed recent statistics which show consumers are spending more money while holding down their household personal debt and keeping personal savings solid. On the corporate front, banks are reporting stronger loan demand from both large and small firms.

The No. 2 economic harbinger could be the effect on cap rates: Will they increase as much as projected interest rates? Hunt described cap rates as “just a ratio” comparing net operating income divided by purchase price, but said major factors affecting cap rates include the cost of capital, equity’s required rate of return, and certainty and direction of annual property income. He explained that cap rates are perceived to align with interest rates but the reality is that rent and/or income cannot always be increased.

The No. 3 issue: With the slowing of oil and gas employment, is the U.S. economy becoming a drag on Texas and Houston? Hunt said the federal government is hurting some industries such as manufacturing by holding back jobs due to regulatory and tax laws. However, after analyzing each industry’s growth rate derived from Texas Workforce Commission numbers, Hunt showed the Houston Metropolitan Statistical Area (MSA) outperforming the state and nation in the majority of industry categories.

Houston experienced employment growth in all industry categories but one during the past 12 months, according to the Texas Workforce Commission. The Construction industry reported the largest gain with a 7.4% rate increase followed by the Leisure and Hospitality industry at 5.7% and the Mining and Logging industry at 5.5%. The category Other Services recorded the only negative for Houston at -1.5%. Other Services includes those employed in the repair industries, such as car repair, etc., which reflects consumers buying new items rather than repairing older items, Hunt explained.

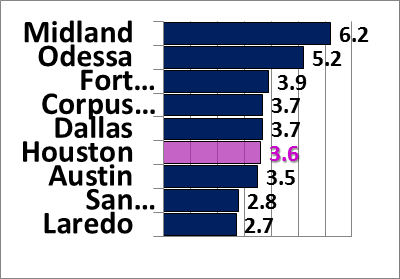

Concerning the area’s overall job growth, the Houston MSA posted a 3.6% job growth rate for the past 12 months, ranking sixth among Texas MSAs. At the top of the list is Midland at 6.2% followed by Odessa at 5.2%, Fort Worth at 3.9%, and Corpus Christi and Dallas at 3.7%.

Ranking the Texas MSAs Job Growth

Past 12 Months Ending July 2013

Source: Texas Workforce Commission

Hunt’s overall conclusions for the nation are:

- Interest rates are likely to increase as the Fed talks more about slowing their bond purchasing (but local cap rates may not be greatly affected).

- The national economy keeps improving, barring any unexpected international economic downturn.

- More inactivity from federal government stifles any hope of a robust economic recovery by the American public.

- Look for slow, positive job growth in 2013-2014.

- Unemployment should continue trending down.

- Despite government inaction, business decisions do seem to be occurring.

With regard to Texas and Houston, Hunt’s conclusions are:

- The sluggish U.S. economy doesn’t seem to be having a marked effect on our state and local economy.

- Besides manufacturing, other job sectors do seem to be stepping in for slower oil and gas employment.

- As a result, all areas of commercial real estate should continue to perform well over the next year.