TREPAC’s Most Recent Victory:

During the recent government shutdown, initially people couldn’t close on a home requiring flood insurance. The shutdown meant no new flood policies could be written.

We immediately got on the phones, worked with our legislators and were quickly able to get this fixed. The government shutdown continued, but closings were allowed to take place.

If that had been your closing you would be giving TREPAC a big hug right now! – Jennifer Wauhob

TREPAC– Support for real estate-friendly officials TREPAC backs local, state, and national candidates and elected officials who have a record of protecting private property rights, preserving the dream of homeownership, and supporting the real estate industry.

Legislative Affairs – A Voice at the Capitol

Texas REALTOR® volunteers and association staff craft the association’s agenda for each session of the Texas Legislature. Then, during the session, they read every bill and work with lawmakers to promote that agenda.

Political Affairs – Grassroots involvement

The large number of Texas REALTORS® and the association’s well-orchestrated grassroots programs enable the Texas Association of REALTORS® to exert a powerful influence on behalf of private property rights and the real estate industry. We offer a myriad of tools to keep you up-to-date on public policy that affects your business.

Issues Mobilization –Local issues advocacy

The Issues Mobilization Committee exists to help local REALTOR® associations identify and act on local ordinances that affect Texas REALTORS® or private property owners.

2017

Linkage Fee – Supported legislation prohibiting cities from imposing fees on all new residential and commercial construction.

Seller’s Disclosure – Supported a bill providing buyers with information about the impact of nearby military installations.

Annexation Reform – Required cities in polpulous counties that want to annex an area to receive voter approval in the area to be annexed.

2015

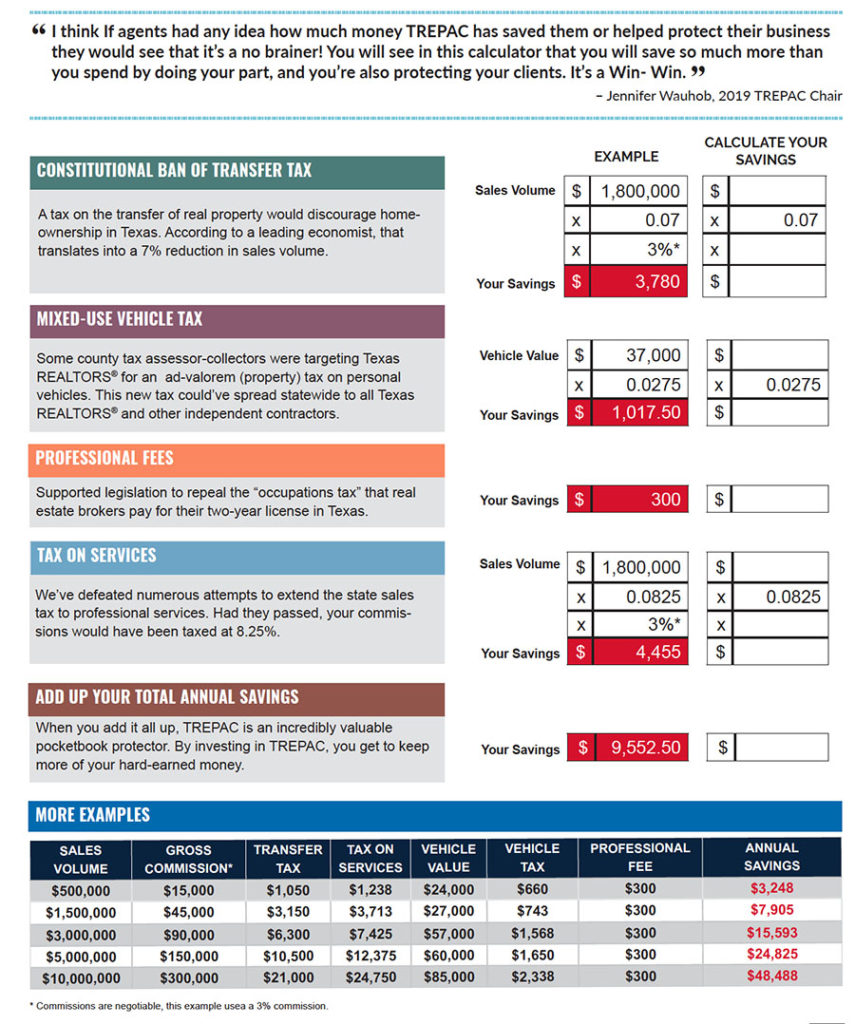

Transfer Tax/Homestead increase

Supported a constitutional ban on any tax on real estate transfers and a $10,00 increase iof the homestead exemption.

Occupations Tax – Repealed a fee that double-taxed brokers for their two year license.

Equal and Uniform – Required residential and commercial property appraisers adhere to “generally accepted appraisal methods and techniques” when using the equal and uniform provision for property valuation.

Transportation

Supported legislation for directing TxDOT planning, funding and prioritization of future road projects and ended diversions from the Texas Highway Fund to support the Department of Public Safety.

Required Texas Mobility Funds to be used to decrease debt and eventually pay for roads without the costs associated with borrowing through bonds.

Passed a measure to dedicate sales-tax revenue and allocate motor vehicle sales taxes to the state highway fund.

Property Tax Transparency

Required a super majority vote and notification on the taxing unit’s website before a local taxing jurisdiction may increase a property-tax rate.

Patent Trolls – Enacted protections against bad-faith claims of patent infringement against end users located in or doing business in Texas.

TWIA – Changed funding structure of the Texas Windstorm Insurance Association. Additionally, changed the composition of the board of directors and required a biennial study to promote private market participation.

2013

Infrastructure – Played a key role in addressing the state’s long-term water and public education needs.

Property Tax Loans – Helped enact critical consumer-protection laws in the property-tax lending industry.

2011

Eminent Domain – Enacted strong consumer protections in emninent-domain proceedings.

Transfer Fees – Passed a measure that eliminates most privated transfer fees on real estate transactions.

TREC – Helped the Texas Real Estate Commission attain a self-directed, semi-independent status, insulating the agency from future state-mandated budget cuts and enabling TREC to better serve licensees and consumers.

DTPA – Passed a revision to the Deceptive Trade Practices Act that effectively exempts real estate brokerage from liability under the act—as long as the broker or agent hasn’t committed an unscrupulous or illegal act.