Slumping oil prices and limited inventory slow home buying for a third straight month in December

Houston real estate faced a stiff challenge in 2015. It followed the best year on record for home sales. Add plunging oil prices and the resulting layoffs into the mix along with persistently low levels of housing inventory, and the result was the drop in sales that economists had forecast. While there were single-digit declines in sales volume at different times throughout the year, more substantial ones struck during the fourth quarter, including December. Nonetheless, the total number of 2015 single-family home sales as well as sales of all property types achieved the second highest levels of all time, behind 2014.

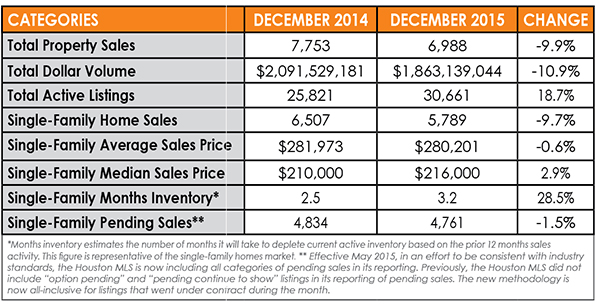

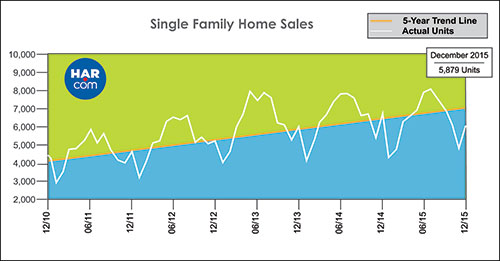

December single-family home sales tumbled 9.7 percent versus December 2014 while total property sales dropped 9.9 percent. The latest monthly report prepared by the Houston Association of REALTORS® (HAR) shows a total of 5,879 single-family home sales compared to 6,507 a year earlier. The sales slowdown did allow inventory to grow from a 2.5-months supply, the lowest level of all time, to 3.2 months. Homes priced between $150,000 and $500,000 saw flat year-over-year sales, while homes below $150,000 and above $500,000 experienced declines.

“With oil dropping to levels around $30 a barrel, I think it’s fair to say that the Houston housing market is going to remain cooler for at least a little while,” said HAR Chairman Mario Arriaga with First Group. “The good news is the local economy is vastly more diversified than it was during the oil bust of the 80s and other industries are continuing to hire, so it really is going to come down to consumer confidence.”

A year ago, Houstonians were hailing a surge in employment that drew home buyers and renters from across the U.S. and around the world. By contrast, the latest Texas Workforce Commission report states that the Houston metro area added just 4,800 jobs in November, making it the third weakest November in 25 years, according to the Greater Houston Partnership, which notes that the region typically adds 10,000 to 12,000 jobs in the month.

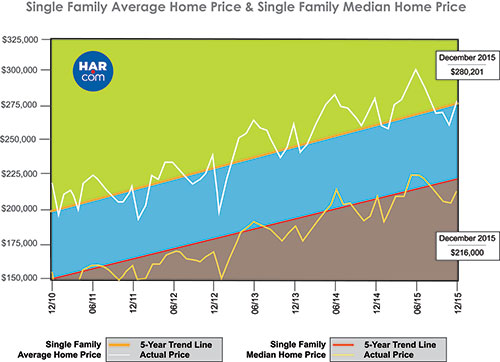

In December, the single-family home average price dipped a fractional 0.6 percent year-over-year to $280,201 while the median price—the figure at which half of the homes sold for more and half sold for less—rose 2.9 percent to $216,000. The median figure represents an all-time high for a December in Houston.

December sales of all property types in Houston totaled 6,988, a 9.9-percent decrease from the same month last year. Total dollar volume for properties sold in December slid 10.9 percent to $1.8 billion versus $2.0 billion a year earlier.

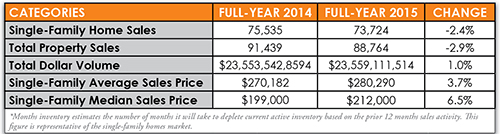

2015 Annual Market Comparison

While 2015 began at levels comparable to the record-setting 2014, home sales began to falter as plummeting oil prices and energy industry layoffs sparked jitters throughout the Houston market. Even so, there were 73,724 single-family home sales and 88,764 total property sales, with both numbers representing the second most transactions in the history of Houston real estate, behind 2014.

Single-family home sales fell 2.4 percent for the year and sales of all property types dropped 2.9 percent. On a year-to-date basis, the average price climbed 3.7 percent to $280,290 while the median price increased 6.5 percent to $212,000. Total dollar volume for full-year 2015 matched last year’s record high of $23.5 billion.

The greatest one-month sales volume of 2015 was recorded in July with 7,895 single-family home sold. By contrast, the lightest one-month sales volume took place in January with 4,109 sales.

Months inventory began the year at a 2.5-months supply, and while it grew to a 3.5-months supply over the summer, it ended 2015 at a 3.2-months supply. Months of inventory estimates the number of months it will take to deplete current active inventory based on the prior 12 months sales activity.

December Monthly Market Comparison

December delivered largely negative results compared to home sales readings for December 2014. On a year-over-year basis, total property sales, total dollar volume and average sales price declined while the median price rose.

Month-end pending sales for single-family homes totaled 4,761. That is down 1.5 percent compared to last year and suggests the possibility of another sales decline when the January numbers are tallied. Total active listings, or the total number of available properties, at the end of December rose 18.7 percent from December 2014 to 30,661.

Houston’s housing inventory has held above a 3.1-months supply since May 2015, getting as high as a 3.5-months supply during the summer months and settling at a 3.2-months supply in December. That compares to a 2.5-months supply in December 2014. The national supply of homes reported by the National Association of REALTORS® (NAR) currently stands at 5.1 months.

Single-Family Homes Update

Single-family home sales totaled 5,879 in December, down 9.7 percent from December 2014. That marks the third consecutive monthly decline.

The average price declined a fractional 0.6 percent to $280,201. However, the median price achieved the highest level ever for a December in Houston, rising 2.9 percent year-over-year to $216,000. Days on Market (DOM), or the number of days it took the average home to sell, edged up to 57 days versus 56 in 2014.

Broken out by housing segment, December sales performed as follows:

- $1 – $79,999: decreased 25.6 percent

- $80,000 – $149,999: decreased 25.5 percent

- $150,000 – $249,999: unchanged

- $250,000 – $499,999: unchanged

- $500,000 and above: decreased 17.2 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 4,858 in December, down 7.9 percent versus the same month last year. The average sales price rose 2.5 percent year-over-year to $257,399 while the median sales price climbed 3.7 percent to $196,000.

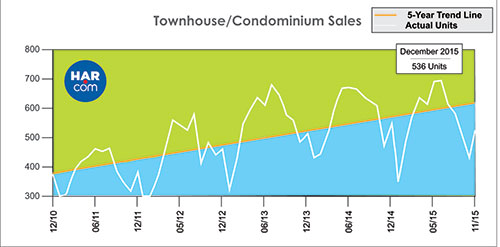

Townhouse/Condominium Update

Sales of townhouses and condominiums declined 2.9 percent in December. A total of 536 units sold compared to 552 properties in December 2014. The average price dropped 14.6 percent to $197,904 and the median price edged up 1.2 percent to $159,900. Inventory grew from a 2.3-months supply to 2.9 months.

Lease Property Update

Demand for single-family lease homes rose 2.9 percent in December while townhomes/condominiums saw demand tumble 3.6 percent. The average rent for single-family homes was unchanged at $1,710 while the average rent for townhomes/condominiums dropped 3.1 percent to $1,459.

Houston Real Estate Highlights in December

- Single-family home sales fell 9.4 percent compared to December 2014, marking the third consecutive monthly decline;

- Total property sales dropped 9.9 percent (6,988 units);

- Total dollar volume decreased 10.9 percent to $1.8 billion;

- At $216,000, the single-family home median price achieved a December high;

- Single-family homes months of inventory climbed to a 3.2-months supply versus 2.5 months a year earlier;

- Townhomes/condominium sales dropped 2.9 percent with the average price down 14.6 percent to $197,904 and the median price up 1.2 percent to $159,900;

- Leases of single-family homes rose 2.9 percent with rents flat at $1,710;

- Leases of townhomes/condominiums declined 3.6 percent with rents down 3.1 percent at $1,459.