Low interest rates buoy sales for a fifth straight month

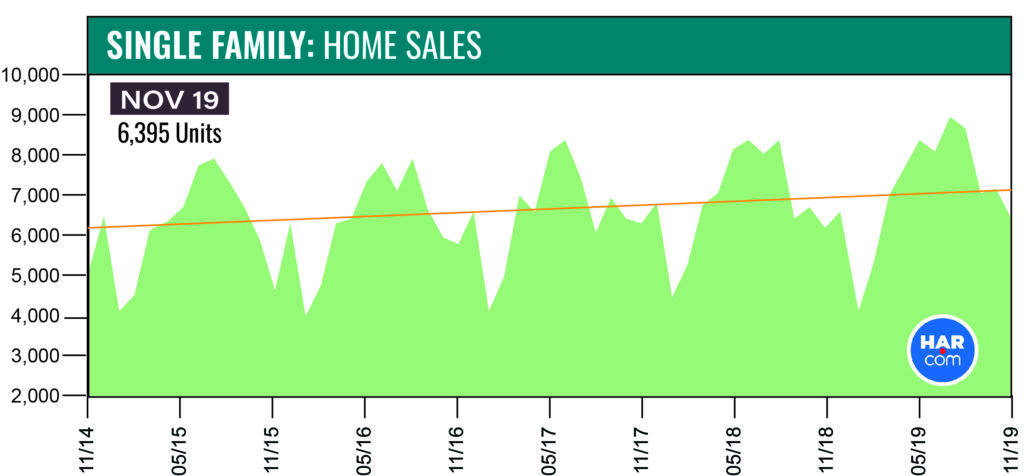

November marked the fifth consecutive positive month of home sales with continued low mortgage interest rates helping to keep the Houston real estate market on track for a record 2019. Single-family home sales across greater Houston totaled 6,395 in November, according to the latest monthly report from the Houston Association of REALTORS® (HAR). That is up 3.6 percent from one year earlier. On a year-to-date basis, home sales are running 4.1 percent ahead of 2018’s record volume.

The strongest sales activity took place among homes priced between $250,000 and $500,000, which rose 12.5 percent. Homes in the $500,000 to $750,000 range ranked second place, climbing 5.2 percent. The luxury segment, made up of homes priced from $750,000 and above, fell 9.1 percent.

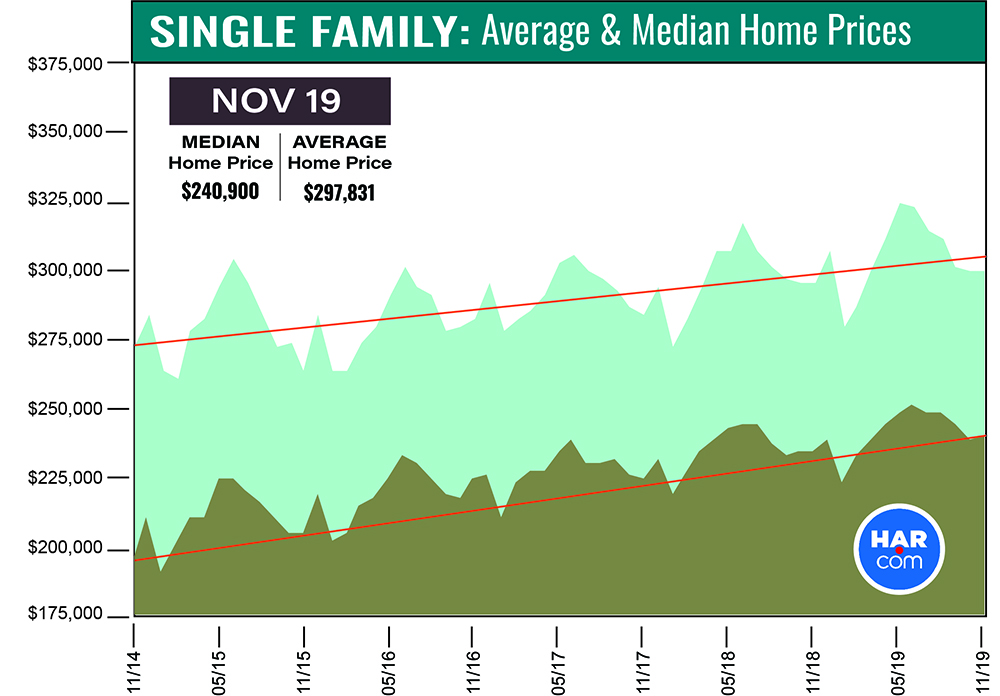

Single-family home prices set new November highs. The median price (the figure at which half of the homes sold for more and half sold for less) rose 2.5 percent to $240,900 while the average price edged up 1.1 percent to $297,831. Despite the record prices, pricing increases in general have shown moderation as the end of the year draws closer.

Inventory was unchanged in November, holding steady at a 3.8-months supply. That is the first time this year that the market saw no growth in the supply of homes, which is not uncommon during the holidays when fewer homes are traditionally listed for sale.

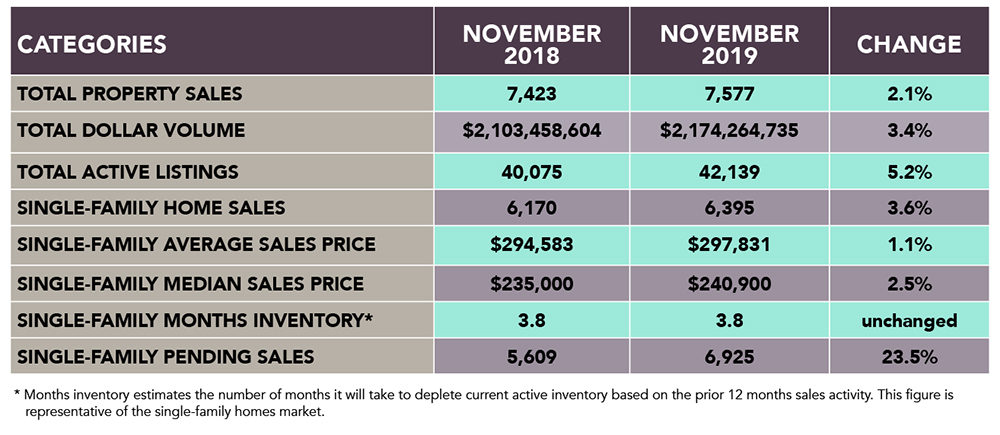

Sales of all property types increased 2.1 percent in November, totaling 7,577 units. Total dollar volume rose 3.4 percent to $2.2 billion.

“The end of the year typically brings a slower pace of home sales, so we welcome another month of gains and attribute it to continued low interest rates in a market that has added more than 80,000 jobs over the past year, according to the Texas Workforce Commission,” said HAR Chair Shannon Cobb Evans with Better Homes and Gardens Real Estate Gary Greene.

The 30-year fixed mortgage rate averaged 3.68 percent during the week ending December 5, according to figures released by Freddie Mac. Compared to a year ago, mortgage rates were more than a full percentage point lower. During the same week last year, the 30-year fixed-rate mortgage averaged 4.75 percent.

Lease Property Update

November marked a down month for lease properties. Single-family home leases dipped 1.3 percent while leases of townhomes and condominiums fell 8.7 percent. The average rent for single-family homes increased 2.6 percent to $1,775 while the average rent for townhomes and condominiums was unchanged at $1,500.

November Monthly Market Comparison

The Houston real estate market generated positive readings overall in November. Single-family home sales, total property sales, pricing and total dollar volume all increased compared to November 2018, however inventory held steady. Month-end pending sales of single-family homes totaled 6,925. That represents a 23.5 percent increase over last year. Total active listings, or the total number of available properties, rose 5.2 percent to 42,139.

The November inventory of single-family homes was flat at a 3.8-months supply. It is the first time in 2019 that the Houston area saw no growth in the supply of homes – not unusual given that fewer homes are typically listed during the holidays. For perspective, housing inventory across the United States currently stands at a 3.9-months supply, according to the latest report from the National Association of Realtors® (NAR). That is down from 4.1 months.

Single-Family Homes Update

November became the fifth consecutive positive month of single-family home sales, with 6,395 units sold across greater Houston compared to 6,170 a year earlier. That represents a 3.6 percent increase in volume. On a year-to-date basis, sales are running 4.1 percent ahead of 2018’s record pace.

Home prices reached the highest levels ever for a November. The median price was $240,900, up 2.5 percent from the year prior. The average price edged up 1.1 percent to $297,831. Despite that, the increases are among the smallest of 2019 and reflect continued pricing moderation as the year draws to a close.

Days on Market (DOM), or the number of days it took the average home to sell, was 59 compared to 60 a year ago. Inventory was flat at a 3.8-months supply. The national inventory stands at 3.9 months, according to NAR.

Broken out by housing segment, November single-family sales performed as follows:

- $1 – $99,999: decreased 13.8 percent

- $100,000 – $149,999: decreased 6.1 percent

- $150,000 – $249,999: increased 1.3 percent

- $250,000 – $499,999: increased 12.5 percent

- $500,000 – $749,999: increased 5.2 percent

- $750,000 and above: decreased 9.1 percent

HAR also breaks out sales activity for just existing single-family homes. Existing home sales totaled 5,103 in November. That is up 4.8 percent versus the same month last year. The average sales price eked out a 0.5 percent gain to $284,055 while the median price increased 3.2 percent to $225,000.

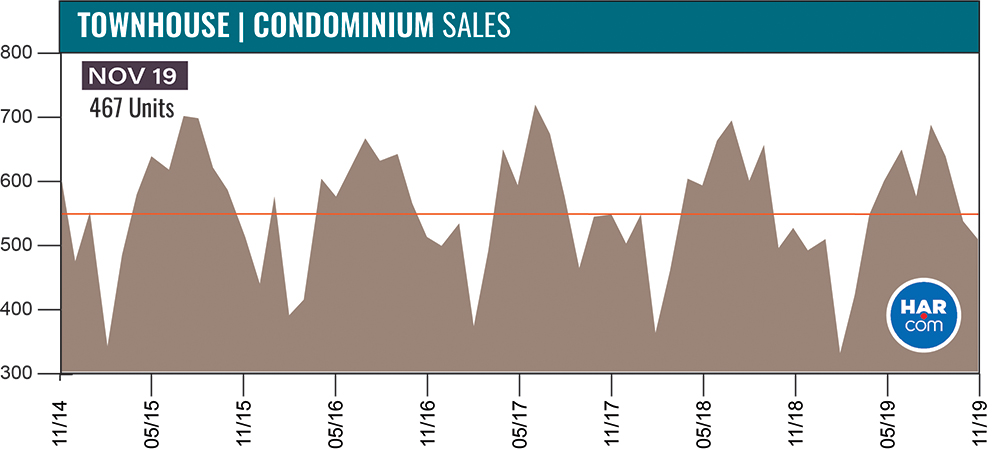

Townhouse/Condominium Update

The roller coaster townhouse and condominium segment registered its second straight monthly decline. Sales tumbled 5.1 percent in November with 467 units sold compared to 492 in November 2018. The average price rose 3.4 percent to $218,440 while the median price increased 2.5 percent to $168,625. Inventory expanded from a 4.1-months supply to 4.6 months.

Houston Real Estate Highlights in November

- Single-family home sales rose 3.6 percent year-over-year, with 6,395 units sold;

- On a year-to-date basis, single-family home sales are running 4.1 percent ahead of 2018’s record pace;

- Days on Market (DOM) for single-family homes went from 60 to 59 days;

- Total property sales increased 2.1 percent, with 7,577 units sold;

- Total dollar volume rose 3.4 percent to $2.2 billion;

- The single-family home median price increased 2.5 percent to $240,900, achieving a November high;

- The single-family home average price ticked up 1.1 percent to $297,831 – also a record high for a November;

- Single-family homes months of inventory was flat for the first time in 2019, holding steady at a 3.8 months supply. For comparison, the national housing inventory is at a 3.9-months supply, according to NAR;

- Townhome/condominium sales fell 5.1 percent year-over-year, with 467 units sold. The average price increased 3.4 percent to $218,440 while the median price rose 2.5 percent to $168,625;

- Single-family home leases fell 1.3 percent with the average rent up 2.6 percent to $1,775;

- Volume of townhome/condominium leases dropped 8.7 percent with the average rent unchanged at $1,500.