Historic storm slams the door on home sales during the last week of August

Hurricane-turned-Tropical Storm Harvey’s torrential rains and devastating floodwaters not only disrupted life and destroyed properties throughout the Houston area and Texas Gulf coast. It also dealt a heavy blow to a real estate market that, until now, was on track to set new records. However, the full effects of the historic storm may not be realized for weeks to come as the market rebuilds and recovers.

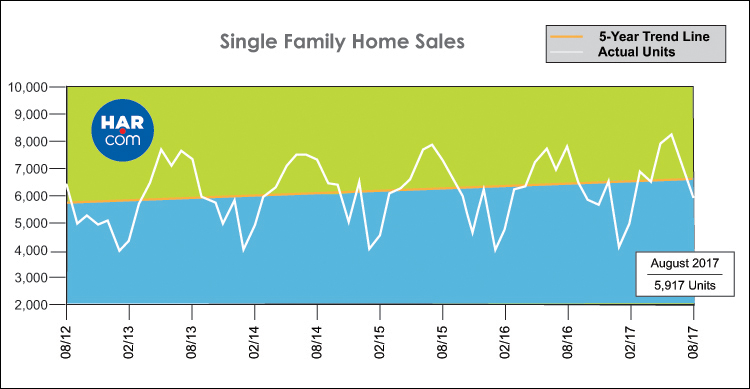

According to the latest monthly report prepared by the Houston Association of REALTORS® (HAR), single-family home sales plunged 25.4 percent, marking the first decline in almost a year. All segments of the housing market felt the strain.

Nonetheless, on a year-to-date basis, home sales remain 1.8 percent ahead of the 2016 volume. Housing inventory grew from a 4.0-months supply to 4.4 months, but is expected to shrink as undamaged and repaired homes continue to be snapped up by those in need of housing.

“Hurricane Harvey dealt a severe blow to the Houston area and Texas Gulf coast and it will probably be several weeks until we can gauge the storm’s full impact on our housing market,” said HAR Chair Cindy Hamann. “Home sales were humming throughout the first three weeks of August, but the moment Harvey struck the region, everything came to a screeching halt.”

Hamann added: “HAR continues to encourage anyone who has housing available for temporary occupancy (up to 12 weeks) to please post it on our Harvey Temporary Housing page as soon as possible at www.har.com/temporaryhousing to provide housing to those in need.”

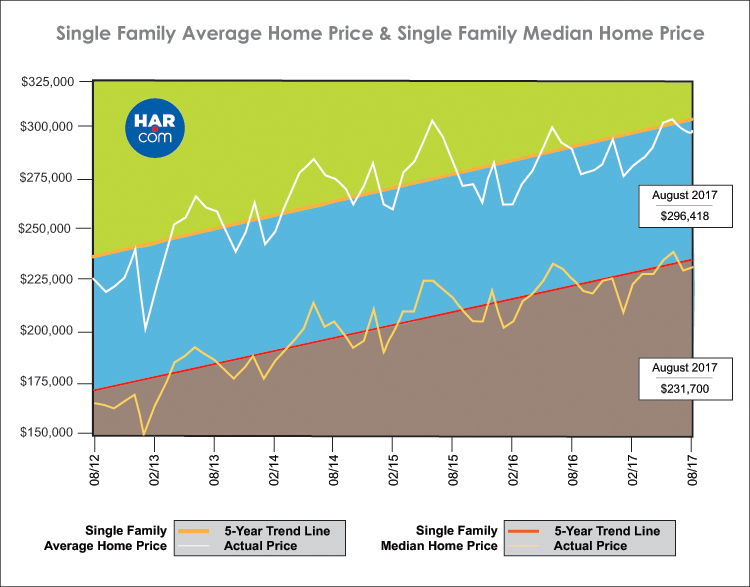

Pricing seemed unaffected by Harvey. The single-family home median price (the figure at which half of the homes sold for more and half sold for less) rose 3.0 percent to $231,700. The average price increased 2.6 percent to $296,418.

August sales of all property types in Houston totaled 7,077, a decline of 24.2 percent versus the same month last year. Total dollar volume for properties sold in August dropped 22.2 percent to $2.0 billion.

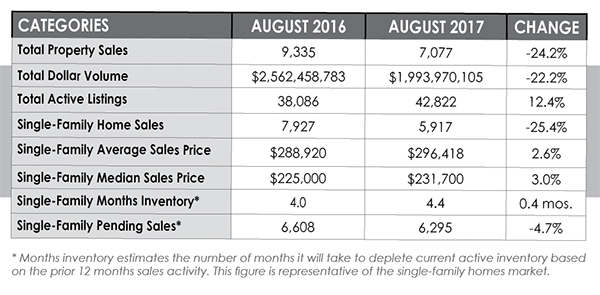

August Monthly Market Comparison

Houston’s monthly housing market indicators yielded mixed readings in August thanks to Harvey, with single-family home sales, total property sales and total dollar volume down sharply compared to August 2016, while median and average price and inventory all increased.

Month-end pending sales for single-family homes totaled 6,295, down 4.7 percent compared to last year. Total active listings, or the total number of available properties, increased 12.4 percent from August 2016 to 42,822.

Single-family homes inventory grew from a 4.0-months supply to 4.4 months, but is expected to decline as demand for undamaged and repaired homes outpaces supply. For perspective, housing inventory across the U.S. currently stands at a 4.2-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales, which had been on track for a record-setting year with 10 consecutive months of gains before Harvey struck, totaled 5,917. That is down 25.4 percent from August 2016 when sales volume was 7,927. All housing segments experienced declines.

Pricing appeared largely unaffected as a result of Harvey. The median price increased 3.0 percent to $231,700. The average price rose 2.6 percent to $296,418.

Days on Market (DOM), or the number of days it took the average home to sell, was unchanged at 50. Inventory rose from a 4.0-months supply to 4.4 months, but is expected to shrink as Harvey flooding victims snap up available housing inventory.

Broken out by housing segment, August delivered across-the-board sales declines as follows:

- $1 – $99,999: decreased 40.0 percent

- $100,000 – $149,999: decreased 40.0 percent

- $150,000 – $249,999: decreased 21.7 percent

- $250,000 – $499,999: decreased 20.6 percent

- $500,000 – $749,999: decreased 31.9 percent

- $750,000 and above: decreased 17.2 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 5,129 in August, down 23.8 percent versus the same month last year. The average sales price increased 4.2 percent to $283,066 while the median sales price rose 4.8 percent to $220,000.

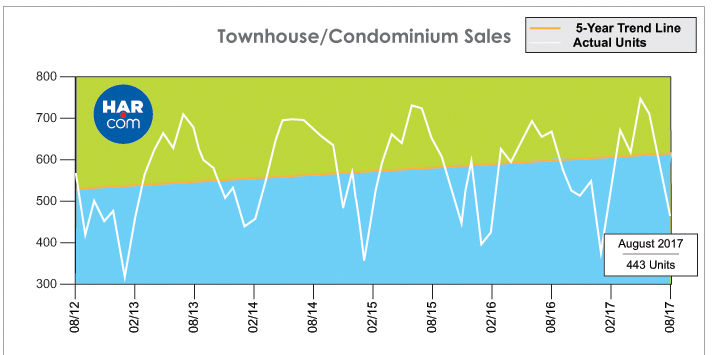

Townhouse/Condominium Update

Hurricane Harvey took a toll on the townhome and condominium market as well, as sales fell 31.4 percent in August with a total of 443 units sold. The average price declined 1.1 percent to $196,230 while the median price edged up 2.0 percent to $159,000. Inventory expanded from a 3.7-months supply to 4.6 months.

Lease Property Update

Consumer demand for lease properties across Houston soared as a result of the late August weather catastrophe. Single-family home leases jumped 9.4 percent while townhome/condominium leases shot up 17.0 percent. The average rent for single-family homes was unchanged at $1,857 while the average rent for townhomes/condominiums declined 2.2 percent to $1,551.

Houston Real Estate Highlights in August

- Hurricane Harvey ended ten consecutive months of positive single-family home sales, as volume plunged 25.4 percent percent year-over-year with 5,917 units sold;

- Despite Harvey’s rampage, single-family home sales remain 1.8 percent ahead of the 2016 volume on a year-to-date basis;

- Total property sales dropped 24.2 percent with 7,077 units sold;

- Total dollar volume fell 22.2 percent to $2.0 billion;

- The single-family home median price rose 3.0 percent to $231,700;

- The single-family home average price increased 2.6 percent to $296,418;

- Single-family homes months of inventory grew to a 4.4-months supply, but is expected to shrink with strong consumer demand for housing in the wake of Harvey;

- Townhome/condominium sales dropped 31.4 percent, with the average price down 1.1 percent to $196,230 and the median price up 2.0 percent to $159,000;

- Leases of single-family homes rose 9.4 percent with average rent unchanged at $1,857;

- Volume of townhome/condominium leases jumped 17.0 percent with average rent down 2.2 percent to $1,551.

- HAR continues to encourage anyone who has housing available for temporary occupancy (up to 12 weeks) to please post it on our Harvey Temporary Housing page as soon as possible at www.har.com/temporaryhousing to provide housing to those in need.