Houston’s sublease office market continues to grow as numerous brokers have forecast all year. The market did reach the predicted 10 million square feet of available sublease space during the first half of this year. During the third quarter, 84 more sublease spaces totaling almost 1.9 million square feet were added to the list, according to Commercial Gateway statistics. The positive side of that is the net gain in sublease space was only 700,000 square feet for the quarter, which means the other listings were either leased, taken off the market for some reason – some may have been retained by the current tenant, or the sublease term expired.

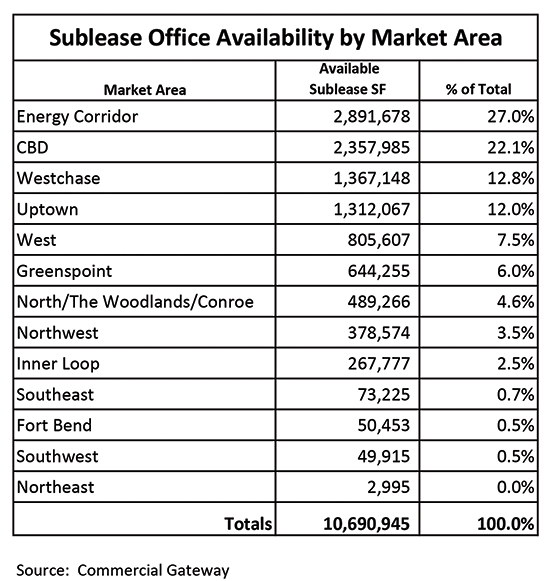

Currently at 10.7 million square feet, Houston’s office sublease market has doubled in the past year, when Third Quarter 2015 statistics reported by Commercial Gateway totaled 5.7 million square feet. Regarding location, almost three-fourths of all sublease space is located in four market areas with the top two representing almost half of the overall total. The Energy Corridor leads the way with 27.0%, the Central Business District with 22.1%, followed by Westchase and Uptown markets at 12.8% and 12.0%, respectively. Broken down by space, currently 26 sublease listings are marketing more than 100,000 square feet, with 10 of those reporting contiguous blocks of more than 100,000 square feet.

The energy downturn may be leveling out, but companies are still tightening their belts and re-evaluating their office and industrial space needs based on the current economic climate. The recent announcement by Shell to vacate the majority of its One Shell Plaza space and consolidate employees in their own buildings on the west side is just one example. Shell reportedly leases about 800,000 square feet and currently has 350,000 square feet already on the sublease market. Time will tell when the balance hits the market. A bit of history: Shell’s two direct leases signed in 2011 totaling 1,276,353 square feet in One Shell and Two Shell made global news as the world’s largest office lease transaction of the year. Reported by Hines, then the building owner, the 15-year lease was to expire in 2025, at which time Shell would have been a tenant for more than 55 years. Since that time, Shell is now vacating after 45 years as a tenant, while Hines, still the building manager, sold the property in 2012. Built in 1971, One Shell Plaza was then the tallest building in Texas.

Sublease space historically has fluctuated through the years. In 2011, only 2.5 million square feet was being marketed as sublease space. That number dropped to 1.6 million in 2012 and then back up to 2.6 million square feet in 2014, when the sublease market started the ascent to its current level. Today’s sublease space represents about 5% of our total tracked office market, but if counted as vacant, the overall vacancy changes from an estimated 15.0% to 20.0%. Tenants will clearly come out the winner in this scenario since 81% of the sublease space represents Class A space, and sublease space is normally marketed at lower rates than direct. In addition, there is a limited supply of new space under construction. Preliminary third-quarter totals report about 2.9 million square feet under construction with 44.1%, or 1.3 million square feet, available and not preleased.

Mergers and acquisitions are still affecting the commercial real estate market as energy companies look to cut costs. The recent merger of Shell and BG Group created a 299,757-square-foot sublease vacancy at BG Group’s building in the Central Business District. Dr. Mark G. Dotzour, a leading real estate economist, reported in a recent presentation that mergers and acquisitions between oil and gas companies are increasing as oil prices remain low, creating more vacancy in office and industrial projects. He cited Spectra Energy and Enbridge’s recent announcement as an example.

Dotzour, the former chief economist of the Real Estate Center at Texas A&M University, noted emerging technologies, as reported recently at the University of Houston, are helping some oil and gas companies increase their return even at a lower oil price. He also said commercial real estate investment will continue to be attractive to all investors globally until another asset class can complete.