Houston Office Market

Houston’s commercial real estate market continues to be affected by the energy downturn with mixed results: the office market struggles while the industrial market keeps building.

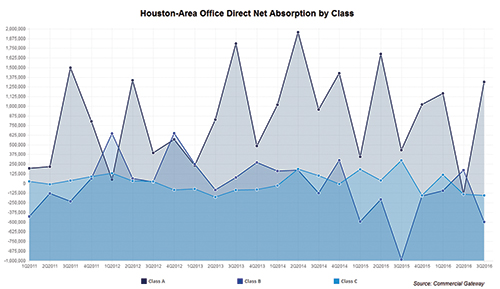

Office absorption year-to-date is totals almost 1.5 million square feet, according to market research compiled by Commercial Gateway, the commercial division of the Houston Association of Realtors (HAR). This positive absorption is primarily due to multiple owner-occupied projects including Phillips 66 and National Oilwell Varco in Westchase, accounting for more than 1.6 million square feet in their new buildings, and Hillcorp with another 515,025 square feet in the Central Business District.

Space left behind by various firms occupying those new properties are showing up as direct space and affecting the vacancy rate, which climbed to 15.5%. One of the larger spaces to recently hit the market was Halliburton’s 560,000-square-foot building at 10200 Bellaire, part of the company’s Oak Park Campus. Halliburton completed its employee relocation to its corporate headquarters in North Houston during the third quarter and placed the entire 48.9566-acre campus on the market.

Halliburton’s decision is just one example of the changing economy related to the energy downturn, which is clearly reflected in the record-level direct vacancy when combined with the almost 11 million square feet of sublease space, which has doubled in just 12 months. New announcements by Shell, GE Oil and Gas and Baker Hughes regarding new sublease spaces are steadily increasing that number, with possibly more to come throughout next year.

Construction starts have halted for the most part since the first quarter, with only office buildings in mixed-use or boutique office projects breaking ground. Overall, the Houston under-construction office market has 10 properties totaling 2.3 million square feet, of which 609 Main at Texas represents almost half of the total and is the largest spec building. Collectively, the under-construction buildings are about 45.3% preleased, with two scheduled for completion by yearend.

Concessions are becoming more commonplace in the market, even though quoted rental rates have remained steady. Rental rates showed an increase to $28.15, up from $27.20 recorded in third quarter 2015. Class A rates, now at $33.49 citywide and at $42.67 in the CBD, experienced slight increases from the previous quarter. Quoted rents for sublease space decreased almost a full $2, or 7.4%, from $24.31 last quarter to $22.41 this quarter.

Following are state-of-the-market comments from leading Houston-area office brokers and Commercial Gateway members:

Mario A. Arriaga, First Group “Office tenants looking to move or expand their space will have more options than they can imagine as leasing activity slows and sublease space multiplies. The housing market continues to experience healthy sales as the multi-family market adjusts to an oversupply of Class A apartments. Both office tenants and apartment tenants will benefit from the oversupply, with new construction at a standstill in both those segments.

“Although the large amounts of sublease office space hitting the market will continue to affect the overall office market for the next 18 months, office tenants will emerge the winners as they determine their best deal from numerous available and attractive options.”

David Baker, Executive Vice President, Transwestern “The market has continued to add space on a direct and sublease basis. At the same time, it appears that the energy business has hit bottom and is starting to rebound, and Houston is expected to have positive overall job growth for 2016. So we anticipate that this will minimize or eliminate further increases in new space availabilities and help moderate the level of concessions and stabilize rental rates in 2017.”

Kevin Kushner, First Vice President, CBRE Group Inc. “This is a great time to be a tenant in Houston. There so many more options available in this market. With sublease space totaling more than 12 million square feet, including 500,000 that was added during the last 15 days, tenants have more options (as a percentage of the overall market) than at any time since the 1990s.This large amount of sublease space – specifically high quality space with strong sub-landlords – in turn forces building owners to become more competitive. While landlords are not decreasing quoted rates to sublease rate levels, landlords are offering significant concessions and often agreeing to rates far below their quoted terms.

“Regarding concessions, whereas landlords were offering $50 to $60 per square foot in tenant improvement dollars on long-term deals a few years ago, some are now offering up to $90 per square foot. Landlords are seeing very little activity. There just are not many tenants in the market at this time. As a result, landlords can easily justify offering free rent for a period of time to entice tenants to sign a lease.

“Advising clients through the leasing process is far different now than a couple years ago. New options come online almost daily – as more firms add space to the sublease market. My team and I are constantly evaluating and updating our data to ensure we are presenting clients with all possible options – often re-evaluating previously identified options against what has recently come available. The process becomes more of a struggle for the tenant, but tenants who are patient and diligent can reap big rewards by ensuring they are thoroughly evaluating all the options.”

John Spafford, Executive Vice President, Director of Leasing, PM Realty Group “Houston continues to feel the effects of the energy sector’s downturn, which has cast a shadow of uncertainty over the office leasing market, creating sluggish demand and rising sublease availabilities on top of numerous new office buildings entering the market. Overall leasing activity declined for the seventh consecutive quarter as many companies are delaying their long-term leasing decisions due to uncertainty in the local economy, resulting in overall transaction volume dropping to its lowest level since 2009. The dramatic decline in leasing volume is also attributed to small- and mid-sized leases accounting for the bulk of activity. Only four lease transactions above the 100,000-square-foot mark have been signed year-to-date, with three of these deals taking place in new construction projects.

“During the third quarter of 2016, Houston’s office leasing market fundamentals softened further as the citywide Class A direct occupancy level declined by 60 basis points to 83.4%, reaching its lowest level since 2005….Meanwhile, sublease availability has soared … Consequently, total space availability has significantly increased by 7.2 million square feet within the past 12 months, primarily due to this sublease space and newly delivered office space.

“As office leasing volume remains slow and the number of available space options continue to grow, asking rents have begun to adjust and more concessions are being offered to stimulate leasing activity and combat increased vacancies. Even though face rates remain relatively steady…actual effective rates at which deals are being done have decreased, and the value of concession packages increased. In addition, the spread between quoted rates and actual deal rates is widening significantly.

“Houston’s office leasing market fundamentals are expected to remain soft as new supply is expected to outpace demand through 2017…Current oil market conditions suggest downsizing will continue and additional sublease blocks will hit the market due to job cuts, bankruptcies and merger and acquisition activity, adding to the oversupply problem.

“The key areas for office property owners to focus on during these challenging times will be the careful evaluation of near-term rollover and the retention of value by securing early lease renewals and/or or extensions to combat potential increased vacancies. Even though office-using job growth is expected to return sometime in 2018, future leasing demand from the energy sector will likely remain suppressed with an abundance of sublease and shadow space that must be dealt with before tenants will absorb additional space. Another factor that could impact future absorption trends in the competitive leasing market is the continuing trend of consolidation into owned facilities by large companies such as ExxonMobil, Phillips 66, Shell Oil, Southwestern Energy, Halliburton, FMC Technologies, Hillcorp and others.”

Alex Taghi, Vice President, NAI Partners “Houston is an incredibly resilient city; it’s much ballyhooed economic diversity is certainly not without merit. That said, the ‘lower for longer’ reality for oil prices has been felt nowhere more acutely than the office sector, the one sector tied directly to oil and gas job creation. As such, we continue to see an incredibly favorable tenant market with a couple of major caveats, however. Smaller tenants, say under 10,000 rentable square feet, are seeing a slightly tighter market than their larger counterparts, particularly in regards to sublease space.

“Additionally, although the market as a whole is as favorable to tenants as we’ve seen in recent memory, it can still differ greatly on a building-by-building basis. The constant barrage of reports and news clippings about the demise of the Houston office market is not entirely overblown (12 million square feet of sublease space alone), but many of the ultra-aggressive deals are tied to large block availabilities where a smaller tenant may have a hard time taking advantage.

“NAI research indicates there is about a 35% delta between direct rates and sublease rates – in specific instances that delta is even greater. It’s easy to see why subleases are gaining so much traction – they offer premium built-out space, often fully furnished, at very attractive economics. Terms vary greatly, though, and it requires a thorough understanding of market dynamics to educate your clients accordingly as expectations and reality don’t always align. With the unprecedented amount of sublease space in addition to new office deliveries (as dwindling as those are becoming), many landlords are being forced to make difficult decisions – attempt to protect rates or be proactive and maximize tenancy today but take a haircut on economics. Even though we’ve seen a modest rebound in oil prices, it will take time to backfill all the space on the market, pushing back any true office market recovery until late 2017 at the earliest and likely into 2018 or beyond.

“Heady tenants will take full advantage of current market conditions, whether locking in lower rates and increased concessions, taking advantage of a plethora of sublease options, or simply leveraging the negative news into a more favorable restructure. As Warren Buffett famously said, ‘Be fearful when others are greedy, and be greedy when others are fearful…’ For the able tenant, now may be the time to get greedy.”

Houston Industrial Market

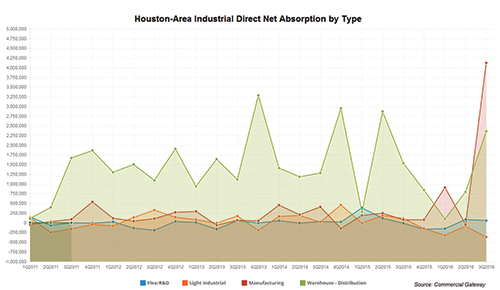

Houston’s industrial market has continued to expand dramatically during 2016 with large facilities completed and underway. Daikin Industries’ manufacturing and distribution facility, reported as the largest concrete tilt-wall building in the world at 4 million square feet, accounts for about two-thirds of the quarter’s 6.1 million square feet of absorption. Located off U.S. Highway 290 about three miles west of State Highway 99, the $417 million campus represents the consolidation of four existing facilities in the U.S. Built by the Japan-based HVAC manufacturer, the facility will eventually employ up to 5,000 people.

The third quarter represents the 27th consecutive quarter – over six years – of positive absorption, with seven quarters recording more than 2 million square feet each and more than half recording more than 1 million square feet. Activity is slowing for some product in some areas but the vacancy rate is remaining steady at 6.1%.

Almost 6 million square feet in 11 buildings came online during the third quarter. Year-to-date, 39 industrial buildings totaling almost 9 million square feet were completed in 2016 and are collectively 79.1% leased.

Construction activity is still high with many projects underway and other build-to-suit (BTS) projects getting ready to start construction before the end of the year. Currently, 42 buildings representing 6.4 million square feet are underway. The largest BTS is FedEx’s new 800,000-square-foot distribution facility in the Northwest near the Grand Parkway and west of U.S. Highway 290. The bulk of the remainder under construction is concentrated in the Southeast with 14 projects and 3.1 million square feet followed by the Southwest with eight projects and 1.1 million square feet. Overall, the under-construction market is 54.5% preleased.

Following are state-of-the-market comments from leading Houston-area industrial brokers and Commercial Gateway members:

Peyton Easley, Associate, ICO Commercial

“The Houston industrial market continues to trend in a positive direction with vacancy rates remaining low and strong levels of activity. Despite the headlines throughout 2016, properties are continuing to perform well and there is a healthy amount of new construction. However, each submarket has its own story.

“The Northwest and Southeast continue to get the spotlight because of the softening of the oil industry and the rise of the petrochemical sector. However, one submarket that has been relatively unchanged from the oil-and-gas struggles is the Southwest submarket. In fact, rental rates have increased every quarter since the end of 2014; this is possible because the tenant mix has few oil- and gas-related tenants.

“Despite the success in the Southwest, the vacancy rate rose in the second quarter of 2016 to 5.6% but has since dropped back down to 4.7% in the third quarter. This short-term increase in vacancy rates was due to the increased construction in late 2015 and early 2016; developers were making up for the construction slowdown in the market since mid-2014.

“Current market conditions surprise tenants when they realize rental rates are increasing in spite of the Houston storyline. However, the increases are fairly small as the market has seen a meager 7.5% increase since 2013.Tenants looking to move away from leasing will be amazed by the lack of product for sale. Only 2.3% of the market’s properties are currently available for purchase. That being said, the Southwest submarket clearly favors landlords and owners.”

Michael Keegan, SIOR, Senior Vice President, NAI Partners “The Houston industrial market remains steady over the third quarter with absorption and deliveries gaining momentum. Supply is up compared to the second quarter, and demand sees a slow uptick.

“Leasing activity was a bit slower compared to the second quarter with a 3.6% decrease. Vacancy also saw a slight decrease of 5.2% while 6.5 million square feet of industrial product type was delivered in the third quarter. Although that seems like a large number, 4 million of that was the Daikin Industries facility in Waller, Texas.

“Low oil prices continue to impact Houston’s local economy and development. We are still seeing landlord concessions being offered along with reduced sale prices and substantial amounts of free rent for both dock-high distribution and free-standing manufacturing facilities. The free-standing manufacturing market is still bearing the brunt of low oil prices and continues to perform at the lowest of all product classes.

“The Northwest Houston submarket continues to be impacted the most by low oil prices. North Houston showed signs of growth in the first and second quarter but slowed down towards the end of summer. South and Southwest Houston submarkets are getting more and more attention from big-bulk distribution developers while Southeast Houston remains strong thanks to the healthy petrochemical industry.

“We expect positive growth in the fourth quarter specifically in the big-bulk distribution markets, and if oil continues to climb, we’ll hopefully see growth in the manufacturing arena.”