A fourth straight month of declining sales brings the market closer to more normal, pre-pandemic conditions

The frenetic pace of home sales that dominated the Houston housing market throughout most of the pandemic continues to slow its roll. Some consumers, facing record pricing, rising interest rates and limited inventory, have moved to the sidelines or opted to rent. Home sales experienced their fourth consecutive monthly decline in July, while new listings buoyed inventory to the highest level in two years.

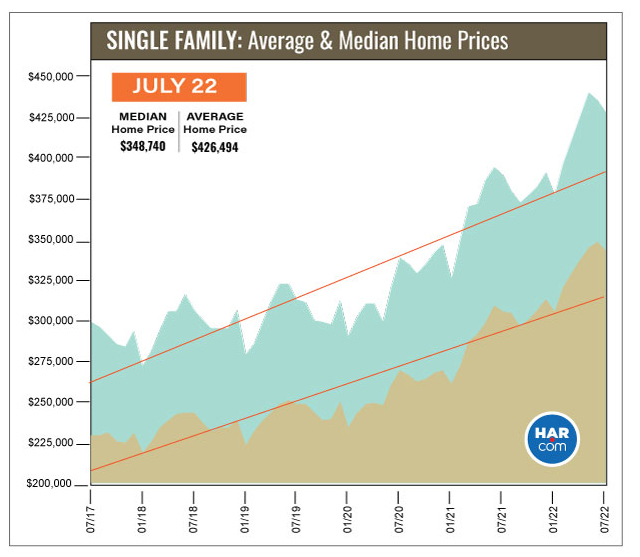

According to the Houston Association of Realtors®’ (HAR) July 2022 Market Update, single-family home sales dropped 17.1 percent, with 8,370 units sold compared to 10,102 in July 2021. That is the lowest one-month sales volume since January 2022. On a year-to-date basis, the market is now trailing 2021’s record-setting pace by 1.3 percent.

The only housing segment that did not experience negative sales in July was the $500,000 to $1 million segment, which rose 10.1 percent. The smallest decline in sales was registered among homes priced between $250,000 and $500,000, which fell 9.2 percent. With a scant assortment of homes priced below $250,000, consumers have had to weigh more expensive property options, shift their focus to rental homes or postpone buying or renting plans altogether. [See HAR’s Monthly Rental Home Update for July on page 12].

“The scorching pace of Houston housing throughout most of the pandemic was completely unsustainable, so the cooling that we have experienced over the past four months was expected and is all part of a market normalization,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “As long as we continue to see inventory grow and prices level off, I believe homebuyers will move off the sidelines and back into the marketplace. An easing of interest rates would help as well, particularly for first-time buyers who desperately want to seize the American Dream of homeownership.”

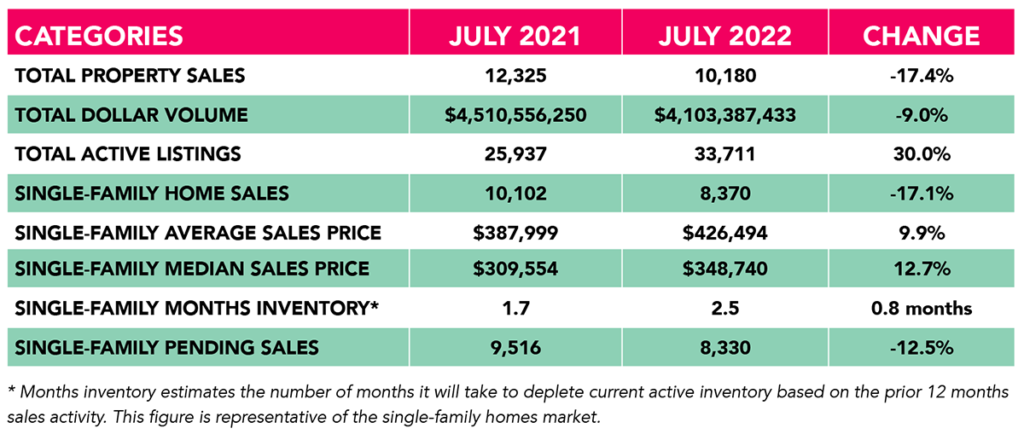

The average price of a single-family home rose 9.9 percent in July to $426,494 – well below the record high of $438,844 reached in May 2022. The median price jumped 12.7 percent to $348,740, which is well below highest median of all time, $354,613, reached last month. The average price for a single-family home in Houston first broke the $400,000 mark in March of this year. The median price has remained above $300,000 since May of 2021.

After surpassing the 100-percent mark for three straight months, the ‘Close to Original List Price Ratio’ for single-family homes fell to 98.9 percent in July. A reading above 100 percent signals that a majority of buyers paid above list price for homes on the market.

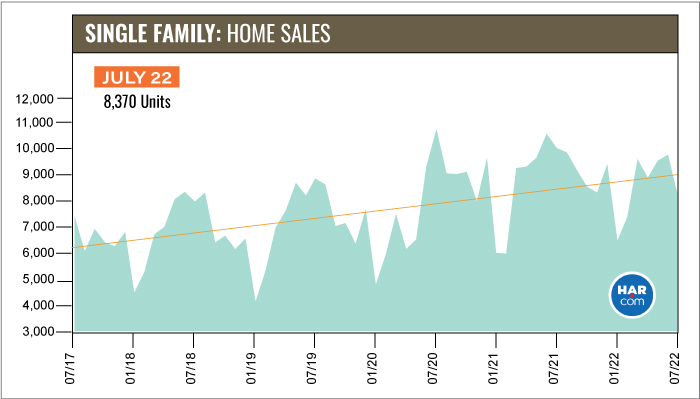

July Monthly Market Comparison

With prospective homebuyers facing record prices, rising interest rates and a limited supply of homes on the market on top of general consumer inflation, home sales were down again in July. Single-family home sales fell 17.1 percent. On a year-to-date basis, sales are 1.3 percent behind last year’s record pace.

The housing measurements for July generated mixed readings. In addition to the drop in single-family home sales, total property sales experienced declines and pending sales slid 12.5 percent. Active listings (the total number of available properties) jumped 30.0 percent but total dollar volume fell 9.0 percent to $4.1 billion.

Months of inventory grew again in July, reaching a 2.5-months supply. That is the highest level since August of 2020 when it was 2.6 months. Housing inventory nationally stands at a 3.0-months supply, according to the latest report from the National Association of Realtors® (NAR). A 6.0-months supply is generally considered a “balanced market,” in which neither the buyer nor the seller has the upper hand.

Single-Family Homes Update

Single-family home sales fell 17.1 percent in July with 8,370 units sold across the Greater Houston area compared to 10,102 a year earlier. Strong sales among higher-end homes pushed pricing up again but not to record levels. The median price climbed 12.7 percent to $348,740 while the average price rose 9.9 percent to $426,494.

Days on Market, or the actual time it took to sell a home, held steady year-over-year at 26 days. Inventory registered a 2.5-months supply compared to 1.7 months a year earlier. That is the greatest supply of homes on the market since August of 2020. The current national inventory stands at 3.0 months, as reported by NAR.

Broken out by housing segment, July sales performed as follows:

- $1 – $99,999: decreased 39.4 percent

- $100,000 – $149,999: decreased 34.9 percent

- $150,000 – $249,999: decreased 49.6 percent

- $250,000 – $499,999: decreased 9.2 percent

- $500,000 – $999,999: increased 10.1 percent

- $1M and above: decreased 11.6 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 6,921 in July, down 20.3 percent from the same month last year. The average sales price rose 10.4 percent to a $427,931 while the median sales price jumped 11.5 percent to $340,000, the second highest of all time.

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 6,921 in July, down 20.3 percent from the same month last year. The average sales price rose 10.4 percent to a $427,931 while the median sales price jumped 11.5 percent to $340,000, the second highest of all time.

For HAR’s Monthly Activity Snapshot (MAS) of the July 2022 trends, please click HERE to access a downloadable PDF file.

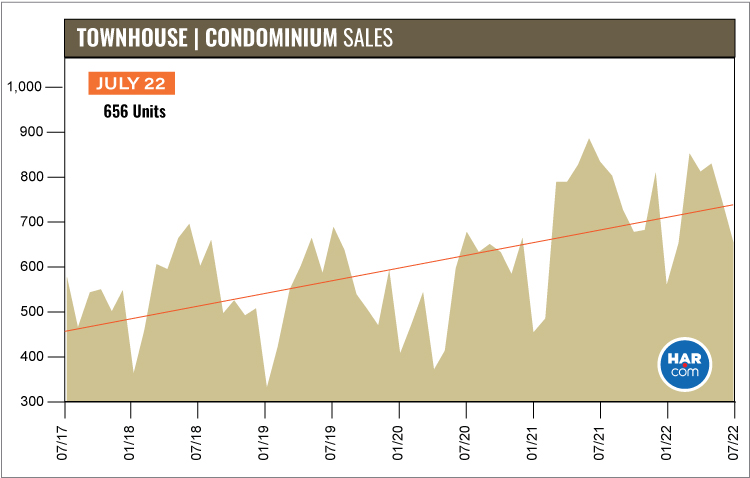

Townhouse/Condominium Update

Townhouses and condominiums experienced their second consecutive monthly decline, dropping 21.5 percent year-over-year with 656 closed sales versus 836 a year earlier. Last month’s sales drop was the first one since August of 2020. The average price increased 5.0 percent to $257,834 and the median price rose 9.7 percent to $220,000. Both figures are below the historic highs reached in April 2022. Inventory fell from a 2.5-months supply to 2.0 months.

Houston Real Estate Highlights in July

- Single-family home sales fell 17.1 year-over-year, their fourth and biggest decline of 2022 as the market continues on the path toward a more normalized, pre-pandemic pace;

- Days on Market (DOM) for single-family homes was flat at 26;

- The ‘Close to Original List Price Ratio’ for single-family homes fell below 100 percent for the first time since April 2022, meaning that most buyers did not pay above list price for homes on the market;

- Total property sales were down 17.4 percent with 10,180 units sold;

- Total dollar volume was off 9.0 percent at $4.1 billion;

- The single-family average price rose 9.9 percent to $426,494;

- The single-family median price increased 12.7 percent to $348,740;

- Single-family home months of inventory registered a 2.5-months supply, up from 1.7 months a year earlier. That is the greatest inventory level since August of 2020;

- Townhome/condominium sales experienced their second consecutive monthly decline, falling 21.5 percent, with the average price up 5.0 percent to $257,834 and the median price up 9.7 percent to $220,000.