An uptick in new listings of homes apparently helps meet buyer demand

Houston’s housing market refuses to lie down and take it. After the first decline in three years in May, home sales charged back into the black in June, most likely the result of an increase in new listings of properties. Those new listings may finally be helping feed the voracious appetites of home buyers who have been stymied by the lowest inventory levels in 40 years.

While inventory improved slightly to a 2.9-months supply, the month of May also saw home prices reach new record highs, with sales among homes priced between $250,000 and $500,000 showing the greatest strength. Days on Market, or the number of days a home takes to sell, reached the lowest level of all time – 46.

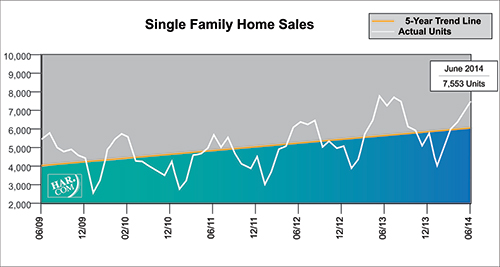

Single-family home sales totaled 7,553 units in June, up 4.5 percent compared to June 2013, according to the latest monthly report prepared by the Houston Association of REALTORS® (HAR). New listings rose 6.7 percent, helping nudge inventory up from May’s 2.8-months supply to 2.9 months. However, that is still lower than the 3.3-months supply of inventory in June 2013 and significantly below the national supply of 5.6 months of inventory.

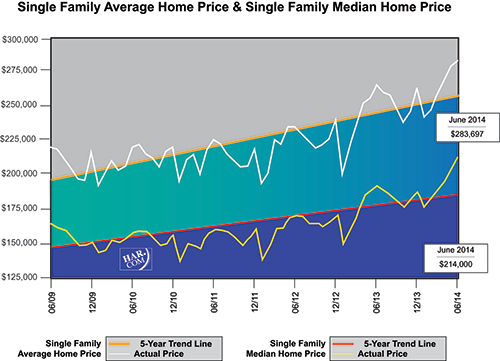

The average price of a single-family home jumped 6.6 percent year-over-year to $283,697. The median price—the figure at which half the homes sold for more and half for less—soared 11.3 percent to $214,000. Both are historic highs for Houston.

“June’s positive sales performance is a testament to the strength of the Houston housing market,” said HAR Chair Chaille Ralph with Heritage Texas Properties. “We were thrilled to see home sales rebound after May’s decline and we hope that as new listings come onto the market and home construction continues, inventory levels will rise to a point where we can truly say that balance has been restored.”

Foreclosure property sales reported in the HAR Multiple Listing Service (MLS) fell again, diving 46.6 percent compared to June 2013. Foreclosures now comprise just 4.4 percent of all property sales, down from an 8.4 percent share a year earlier. The median price of foreclosures jumped 20.0 percent to $108,000.

June sales of all property types totaled 9,099 units, a 5.3-percent increase compared to the same month last year. Total dollar volume for properties sold rose 12.9 percent to $2.4 billion versus $2.2 billion a year earlier.

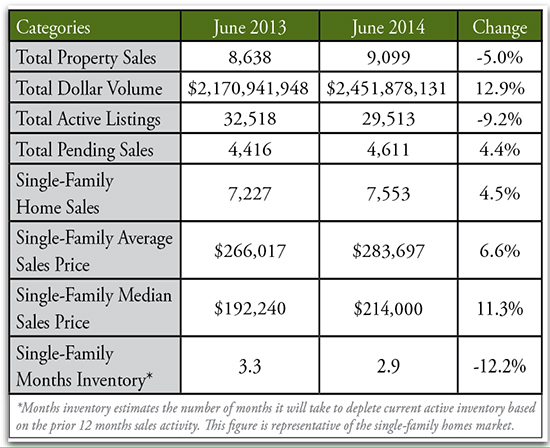

June Monthly Market Comparison

The Houston housing market experienced solid gains in total property sales, total dollar volume and average and median pricing when compared to June 2013.

Month-end pending sales for all property classes totaled 4,611, up 4.4 percent versus last year, and a possible indicator of further sales growth when the July numbers are tallied. Active listings, or the number of available properties, at the end of June fell 9.2 percent to 29,513.

Houston’s housing inventory continues to grow incrementally. After holding at a 2.6-months supply from last December to April, and then reaching 2.8 months in May, months inventory edged up to a 2.9-months supply in June. Nonetheless, it is down from the 3.3-months supply of one year ago. The months inventory of single-family homes across the U.S. currently stands at 5.6 months, according to the National Association of REALTORS®’ latest report.

Single-Family Homes Update

June single-family home sales totaled 7,553. That is up 4.5 percent from June 2013 and represents the first sales increase since March. Sales were flat in April and down 8.3 percent in May. June’s 6.7-percent increase in new listings likely provided the added inventory needed to push sales into the black.

Home prices reached record high levels in June. The single-family median price climbed 11.3 percent from last year to $214,000 and the average price jumped 9.6 percent year-over-year to $280,346. At 46, Days on Market—the number of days a home takes to sell¬—reached the lowest level of all time, illustrating how quickly transactions are going.

Broken out by housing segment, June sales performed as follows:

- $1 – $79,999: decreased 29.1 percent

- $80,000 – $149,999: decreased

- 6.4 percent

- $150,000 – $249,999: increased

- 3.8 percent

- $250,000 – $499,999: increased

- 25.0 percent

- $500,000 – $1 million and above: increased 7.2 percent

HAR also breaks out the sales performance of existing single-family homes for the Houston market. In June 2014, existing home sales totaled 6,628. That is 6.1 percent ahead of the same month last year. The average sales price increased 6.5 percent year-over-year to $270,670 while the median sales price jumped 10.3 percent to $198,500.

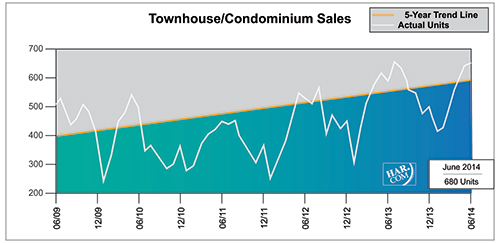

Townhouse/Condominium Update

June townhouse and condominium sales climbed 11.5 percent from one year earlier. A total of 680 units sold last month compared to 610 properties in June 2013. The average price rose 5.5 percent to $205,026 and the median price increased 5.8 percent to $152,250. Inventory was down to a 2.6-months supply versus a 3.4-months supply in June 2013 but unchanged from the May 2014 level.

Lease Property Update

Lease properties were again in strong demand in June. Single-family home rentals shot up 18.6 percent compared to June 2013 while year-over-year townhouse/condominium rentals rose 7.5 percent. The average rent for a single-family home increased 5.3 percent to $1,800 and the average rent for a townhouse/condominium jumped 7.9 percent to $1,618.

Houston Real Estate Milestones in June

- After a flat sales performance in April and the first decline in three years in May,

single-family home sales increased 4.5 percent versus June 2013; - Total property sales rose 5.3 percent;

- Total dollar volume climbed 12.9 percent, from $2.2 billion to $2.4 billion on a year-over-year basis;

- At $214,000, the single-family home median price achieved a new record high for Houston;

- At $283,697, the single-family home average price also reached an historic high;

- Days on Market for single-family homes was 46, the lowest level of all time;

- Months inventory continues to grow incrementally after holding steady at a 2.6-months supply from December 2013 to April 2014 and edging up to 2.8 months in May. It was 2.9 months in June, down from a 3.3-months supply in June 2013 and well below the national average of 5.6 months;

- Rentals of single-family homes surged 18.6 percent while rentals of townhouses/condominiums rose 7.5 percent.