Prices reach March highs as home buyers gobble up new listings

After February’s decline in sales volume, Houston home sales returned to positive territory in March, with consumers buying newly listed homes before they ever had a chance to replenish the local housing supply. Sales of single-family homes rose 3.8 percent year-over-year in March, with most activity taking place among homes priced between $250,000 and $500,000. The high end of the market also had a gain after experiencing its first decline in many months in February.

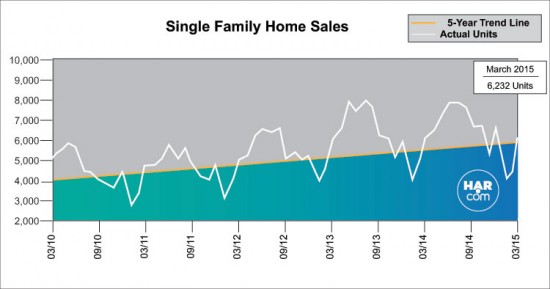

March single-family home sales totaled 6,232 units compared to 6,005 a year earlier, according to the latest monthly report prepared by the Houston Association of REALTORS® (HAR). Buyer demand offset a 7.3 percent increase in new listings, keeping inventory levels down. Months of inventory, the estimated time it would take to deplete the current active housing inventory based on the previous 12 months of sales, increased only fractionally to a 2.8-months supply. That remains well below the current national supply of 4.6 months of inventory.

Home prices achieved record highs for a March. The average price of a single-family home rose 6.5 percent year-over-year to $276,837. The median price—the figure at which half the homes sold for more and half for less—jumped 8.9 percent to $208,000.

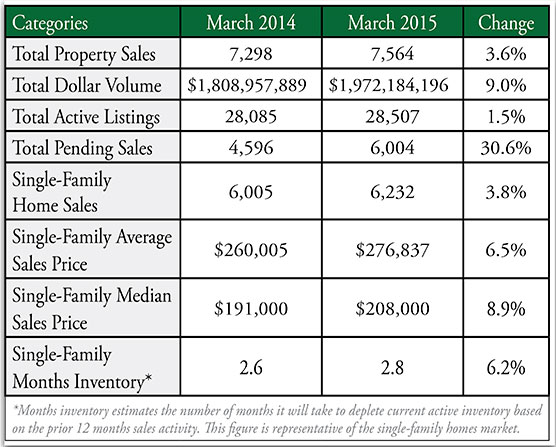

March sales of all property types totaled 7,564 units, up 3.6 percent compared to the same month last year. Total dollar volume increased 9.0 percent to $1.9 billion versus $1.8 billion a year earlier.

“It was great to have sales back in the black in March after February’s decline, but in order to satisfy the long-term needs of the Houston housing market, we need to see substantive growth in inventory levels, which remain at record lows,” said HAR Chair Nancy Furst with Berkshire Hathaway HomeServices Anderson Properties.“It could take the remainder of this year to begin approaching what we consider a ‘balanced market,’ which is typically a five- to six-month supply of homes.”

March Monthly Market Comparison

The Houston housing market grew in all categories in March, with single-family home sales, total property sales, total dollar volume and pricing all up compared to March 2014.

Month-end pending sales for all property types totaled 6,004, a 30.6 percent increase versus one year earlier. Active listings, or the number of available properties, at the end of March rose 1.5 percent to 28,507. New listings totaled 9,389, an increase of 7.3 percent. However, the pace of home buying prevented those new listings from replenishing inventory levels.

Houston’s housing inventory grew only slightly in March to a 2.8-months supply versus the 2.6-months supply of a year earlier. According to the National Association of REALTORS®, the current supply of homes nationally stands at a more robust 4.6-months supply.

Single-Family Homes Update

March single-family home sales totaled 6,232, up 3.8 percent from March 2014. This came on the heels of February’s sales decline – the first the market had seen since last July.

Home prices reached record highs for a March in Houston. The single-family average price increased 6.5 percent from last year to $276,837 and the median price climbed 8.9 percent year-over-year to $208,000. The average number of days it took to sell a home, or Days on Market (DOM), was 53 in March. It reached an historic low of 45 days last July. In March 2014, DOM stood at 60 days.

Broken out by housing segment, March sales performed as follows:

- $1 – $79,999: decreased 29.8 percent

- $80,000 – $149,999: decreased 19.1 percent

- $150,000 – $249,999: increased 17.6 percent

- $250,000 – $499,999: increased 22.3 percent

- $500,000 and above: increased 7.0 percent

HAR also breaks out the sales figures for existing single-family homes. In March, existing home sales totaled 5,296. That is up 6.4 percent from the same month last year. The average sales price rose 9.3 percent year-over-year to $262,266 while the median sales price increased 10.3 percent to $193,000.

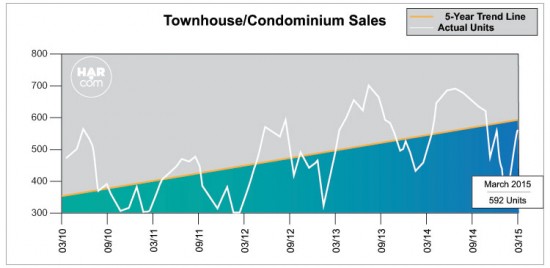

Townhouse/Condominium Update

After starting off 2015 with a 22.7 percent decline in sales, followed by an 8.6 percent increase in February, townhouse and condominium sales shot up 13.8 percent in March. A total of 592 units sold compared to 520 properties in March 2014. The average price, however, tumbled 6.8 percent to $193,175 and the median price dropped 8.1 percent to $142,500. Inventory declined slightly from a 2.7-months supply to 2.6 months.

Lease Property Update

Demand for lease properties waned in March. Single-family home rentals fell 2.0 percent compared to March 2014, while year-over-year townhouse/condominium rentals were flat. The average rent for a single-family home rose 5.3 percent to $1,723 and the average rent for a townhouse/condominium increased 4.8 percent to $1,567.

Houston Real Estate Milestones in March

- Single-family home sales rose 3.8 percent versus March 2014;

- Total property sales were up 3.6 percent year-over-year;

- Total dollar volume increased 9.0 percent, rising from $1.8 billion to $1.9 billion;

- At $208,000, the single-family home median price achieved a record high for a March;

- At $276,837, the single-family home average price also reached a March high;

- Days on Market for single-family homes was 53 days versus 60 days a year earlier;

- Townhouse/condominium sales rocketed 13.8 percent versus March 2014.