Supply of homes keeps pace with demand, climbing to a nearly two-year high

Encouraged by continued low interest rates and a growing selection of housing options, home buyers kept the greater Houston real estate market in positive territory for a fourth straight month in May. As it did in April, the luxury segment (homes priced at $750,000 and above) led the way in sales volume, and rental properties moved briskly. Housing inventory grew to its largest level since August 2017, meeting consumer demand as the market prepares to segue into summer.

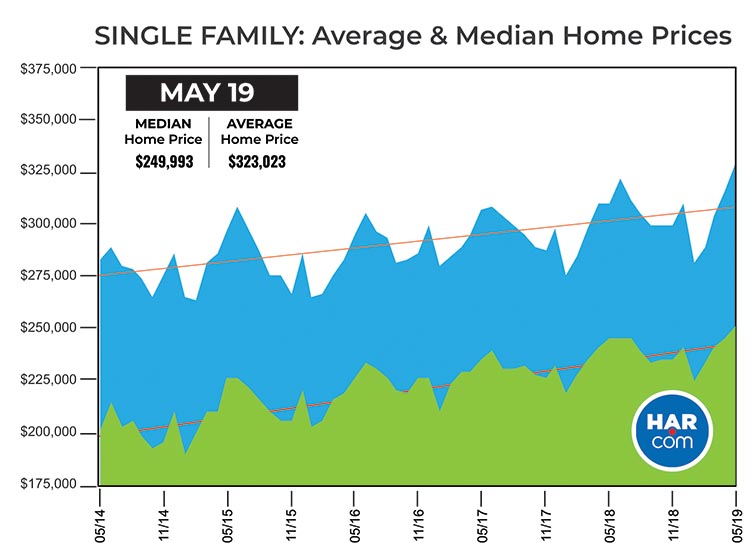

Sales of single-family homes increased 2.8 percent in May, according to the latest monthly report from the Houston Association of Realtors® (HAR), with 8,346 homes sold compared to 8,117 in May 2018. On a year-to-date basis, home sales are running 2.7 percent ahead of 2018’s record pace.

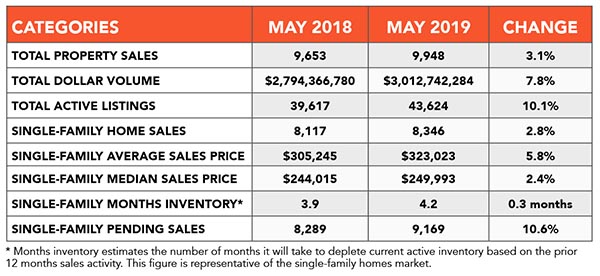

The prices of a single-family home reached historic highs in May. The median price (the figure at which half of the homes sold for more and half sold for less) rose 2.4 percent to $249,993 and the average price climbed 5.8 percent to $323,023. The last pricing highs were reached almost a year ago, in June 2018.

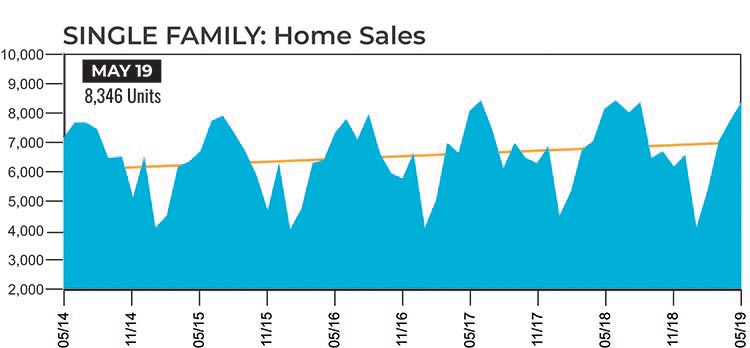

May sales of all property types totaled 9,948, up 3.1 percent compared to the same month last year. Total dollar volume for the month jumped 7.8 percent to slightly more than $3 billion.

“We are seeing signs of a healthy and sustainable housing market throughout greater Houston, and that is due to a more plentiful supply of homes, continued low interest rates and a strong local economy,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “In addition to solid home sales, consumers are still snapping up rental properties, and that is also driving the local housing market.”

Lease Property Update

The rental market experienced double-digit gains in May. Leases of single-family homes jumped 11.1 percent compared to a year earlier while leases of townhomes and condominiums surged 19.3 percent. The average rent for a single-family home rose 1.6 percent to $1,874 while the average rent for townhomes and condominiums increased 5.6 percent to $1,666.

May Monthly Market Comparison

The Houston real estate market registered across-the-board gains in May. Single-family home sales, total property sales, total dollar volume and pricing were all up compared to May 2018. Month-end pending sales of single-family homes totaled 9,169, a 10.6 percent increase over last year. Total active listings, or the total number of available properties, went up 10.1 percent to 43,624.

Single-family homes inventory grew to a 4.2-months supply in May. That is up from 3.9 months a year earlier and marks the greatest supply of homes since August of 2017. For perspective, housing inventory across the U.S. also currently stands at a 4.2-months supply, according to the latest report from the National Association of Realtors® (NAR).

Single-Family Homes Update

May marked the fourth consecutive month of positive single-family home sales across greater Houston, with 8,346 units sold versus 8,117 a year earlier. On a year-to-date basis, single-family home sales are running 2.7 percent ahead of 2018’s record pace.

Prices climbed to the highest levels of all time. The median price increased 2.4 percent to $249,993. The average price rose 5.8 percent to $323,023. These prices surpassed the last record highs that were reached back in June 2018.

Days on Market (DOM), or the number of days it took the average home to sell, held steady at 53 days. Inventory expanded to a 4.2-months supply. That is up from 3.9 months a year earlier and represents the greatest supply of homes in almost two years (August 2017). It matches the national inventory of 4.2 months reported by NAR.

Broken out by housing segment, May sales performed as follows:

- $1 – $99,999: decreased 9.9 percent

- $100,000 – $149,999: decreased 19.0 percent

- $150,000 – $249,999: increased 2.9 percent

- $250,000 – $499,999: increased 5.8 percent

- $500,000 – $749,999: increased 6.3 percent

- $750,000 and above: increased 17.6 percent

HAR also breaks out sales activity for existing single-family homes. Existing home sales totaled 7,202 in May, up 6.7 percent versus the same month last year. The average sales price rose 6.7 percent to $316,945 while the median sales price increased 4.1 percent to $240,550.

Townhouse/Condominium Update

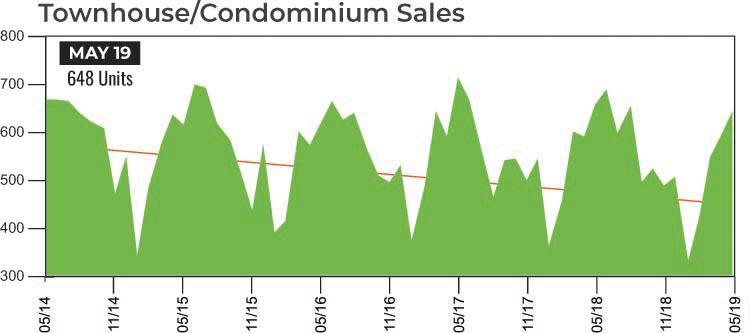

Townhouse and condominium sales have faced a challenging 2019, with declines every month except April when they eked out a 0.5 percent gain. In May, 648 townhouses and condominiums sold, down 2.6 percent from a year earlier when 665 units sold. The average price fell 2.3 percent to $209,497 while the median price declined a fractional 0.6 percent to $169,000. Inventory grew from a 4.1-months supply to 4.6 months.

Houston Real Estate Highlights in May

- Single-family home sales rose 2.8 percent year-over-year, with 8,346 units sold, marking the fourth consecutive month of positive sales;

- On a year-to-date basis, single-family home sales are 2.7 percent ahead of 2018’s record pace;

- Days on Market (DOM) for single-family homes was flat at 53 days;

- Total property sales increased 3.1 percent, with 9,948 units sold;

- Total dollar volume jumped 7.8 percent to slightly more than $3 billion;

- The single-family home median price rose 2.4 percent to $249,993, achieving an all-time high;

- The single-family home average price was up 5.8 percent to $323,023 – also a record high;

- Single-family homes months of inventory reached a 4.2-months supply, up from 3.9 months last May and the most plentiful level since August 2017. For comparison, the national inventory is also at a 4.2-months supply, according to NAR;

- After a fractional sales gain in April, townhome/condominium sales fell 2.6 percent with 648 units sold. The average price was down 2.3 percent to $209,497 and the median price fell a fractional 0.6 percent to $169,000;

- Single-family home rentals rose 11.1 percent with the average rent up 1.6 percent to $1,874;

- Volume of townhome/condominium leases surged 19.3 percent with the average rent up 5.6 percent to $1,666.