Houston real estate conquers energy slump to complete its strongest year ever

Despite the slowdown that economists predicted as falling oil prices and resulting energy industry layoffs carried over from 2015, the Houston housing market held steady throughout 2016 and gained momentum in the final months of the year to set a new record for home sales. Homes priced at $500,000 and up, which experienced declining sales from August 2015 through October 2016 as a result of the energy slump, achieved an impressive turnaround with double-digit sales increases in November and December.

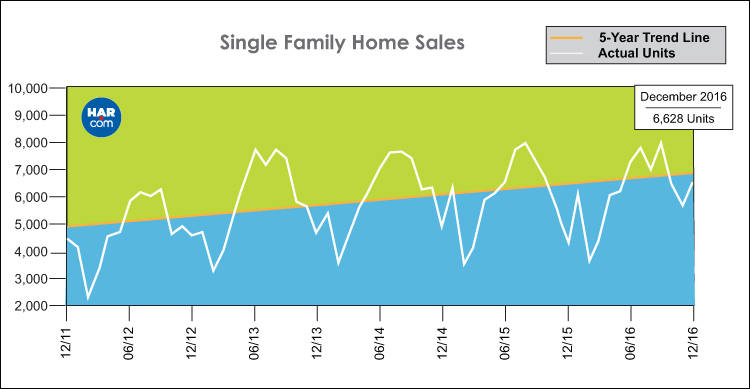

Full-year 2016 single-family home sales totaled 76,449, according to the latest report produced by the Houston Association of Realtors (HAR). That represents an increase of 3.0 percent from 2015 and is 1.3 percent above the previous record of 75,470 homes sold in 2014. Total dollar volume for properties sold in 2016 rose 4.2 percent to $24.5 billion.

To the delight of home buyers, inventory levels grew during the first half of 2016, peaking at a 4.0-months supply in July. However, with the increased pace of home sales, inventory levels retreated, ending the year exactly where they began – at a 3.3-months supply.

“We could not be happier with the Houston housing market’s 2016 performance,” said HAR Chair Cindy Hamann with Heritage Texas Properties. “The year began on a cautionary note because of energy-related layoffs that did affect our higher-priced housing. But what we saw by the end of 2016 is the reflection of a truly diversified Houston economy that continues to benefit from hiring in other industries and a steady influx of consumers from markets across the country and around the world.”

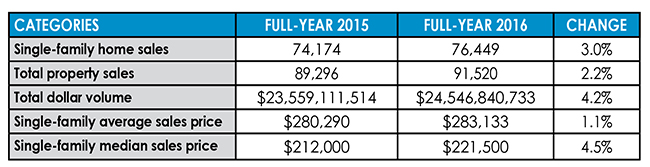

December single-family home sales rose 5.3 percent to 6,628 versus December 2015. As with the luxury market, homes priced between $150,000 and $500,000 enjoyed double-digit year-over-year sales gains in December. Total property sales for the month climbed 5.1 percent to 7,868.

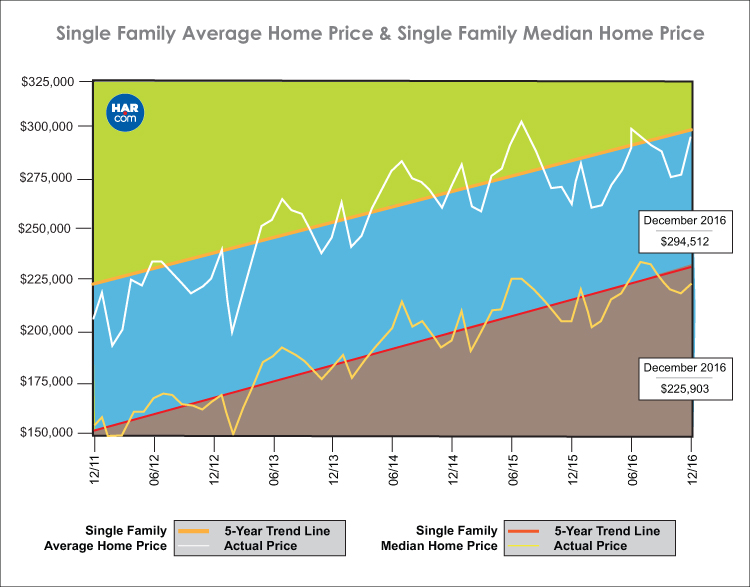

The single-family home median price (the figure at which half of the homes sold for more and half sold for less) rose 2.7 percent to $225,903 That marks the highest median price ever for a December. The average price increased 4.3 percent to $294,512, which also represents a December high.

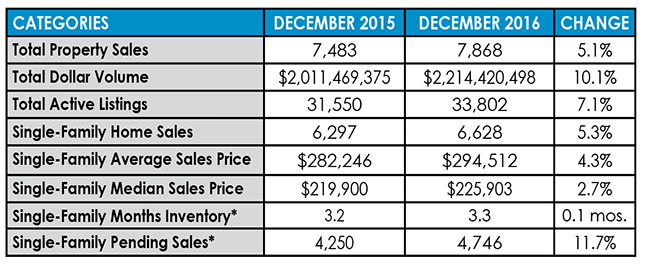

2016 Annual Market Comparison

When 2015 segued to 2016, home sales had been on the decline as plummeting oil prices and energy layoffs sparked jitters throughout the Houston economy. But the housing market demonstrated resiliency, with sales up during all but three months of 2016. By the end of December, a record 76,449 single-family homes had sold. That represents an increase of 3.0 percent from 2015 and is up 1.3 percent from the previous record of 75,470 home sales set in 2014.

On a year-to-date basis, the average price rose 1.1 percent to $283,133 while the median price increased 4.5 percent to $221,500. Total dollar volume for full-year 2016 rose 4.2 percent to $24.5 billion.

The greatest one-month sales volume of 2016 was recorded in August, with 7,920 single-family home sold. By contrast, the lightest one-month sales volume took place in January with 4,011 sales.

Months inventory began the year at a 3.3-months supply, and while it grew to a 4.0-months supply over the summer, it ended 2016 back at a 3.3-months supply. Months of inventory estimates the number of months it will take to deplete current active inventory based on the prior 12 months sales activity.

December Monthly Market Comparison

The Houston housing market recorded across-the-board gains in December, with single-family home sales, total property sales, total dollar volume and pricing all up compared to December 2015.

Month-end pending sales for single-family homes totaled 4,746, an increase of 11.7 percent compared to last year. Total active listings, or the total number of available properties, rose 7.1 percent from December 2015 to 33,802.

Single-family homes inventory grew fractionally from a 3.2-months supply to 3.3 months. For perspective, housing inventory across the U.S. currently stands at a 4.0-months supply, according to the latest report from the National Association of Realtors (NAR).

Single-Family Homes Update

Single-family home sales totaled 6,628, up 5.3 percent from December 2015. The median price rose 2.7 percent to a December high of $225,903. The average price climbed 4.3 percent to $294,512, also a record high for a December. Days on Market

(DOM), or the number of days it took the average home to sell, edged up to 62 days versus 60 last year.

Broken out by housing segment, December sales performed as follows:

- $1 – $79,999: decreased 16.6 percent

- $80,000 – $149,999: decreased 8.0 percent

- $150,000 – $249,999: increased 19.5 percent

- $250,000 – $499,999: increased 17.5 percent

- $500,000 and above: increased 22.7 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 5,345 in December, up 6.4 percent versus the same month last year. The average sales price rose 5.4 percent to $270,731 while the median sales price jumped 7.2 percent to $209,000.

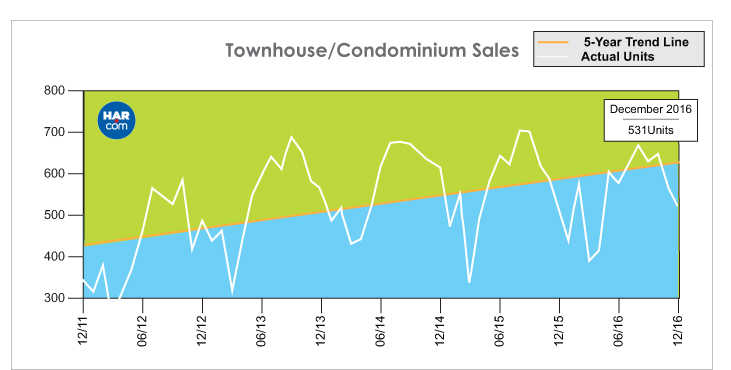

Townhouse/Condominium Update

Townhome and condominium sales declined 8.1 in December, with 531 units selling versus 578 a year earlier. The average price rose 3.7 percent to $208,905, while the median price increased 5.8 percent to $169,250. Inventory expanded from a 2.9-months supply to 3.4 months.

Lease Property Update

The lease market had a strong December. Single-family home leases rose 5.2 percent and townhome/condominium leases jumped 9.5 percent. The average rent for single-family homes dropped slightly to $1,690, while the average rent for townhomes/condominiums edged up to $1,497.

Houston Real Estate Highlights for December and Full-Year 2016

- 2016 was a record year for Houston home sales with 76,449 single-family homes sold versus 74,174 in 2015. That represents an increase of 3.0 percent. It is also 1.3 percent above the previous record sales volume of 75,470 set in 2014;

- Total dollar volume for 2016 rose 4.2 percent to $24.5 billion;

- December single-family home sales climbed 5.3 percent with 6,628 units sold;

- Total December property sales increased 5.1 percent to 7,868 units;

- Total dollar volume for December increased 10.1 percent to $2.2 billion;

- At $225,903, the single-family home median price rose 2.7 percent to a December high;

- The single-family home average price increased 4.3 percent to $294,512, which was also the highest level for a December;

- Single-family homes months of inventory edged up to a 3.3-months supply;

- Townhome/condominium sales fell 8.1 percent, with the average price up 3.7 percent to $208,905 and the median price up 5.8 percent to $169,250;

- Leases of single-family homes rose 5.2 percent with average rent down slightly to $1,690;

- Leases of townhomes/condominiums climbed 9.5 percent with average rent up slightly to $1,497.