Sales of homes priced at $500K and above lead the way as inventory hits a two-year high

Consumers kept the high end of the Houston housing market humming in September even as the market collectively continued transitioning to more normal, pre-pandemic levels. Sales overall were off for a sixth consecutive month due largely to the persistent lack of inventory and inflationary headwinds that include rising interest rates. However, the inventory landscape is showing signs of improvement for consumers as an uptick in new listings helped boost overall supply to its highest level in two years.

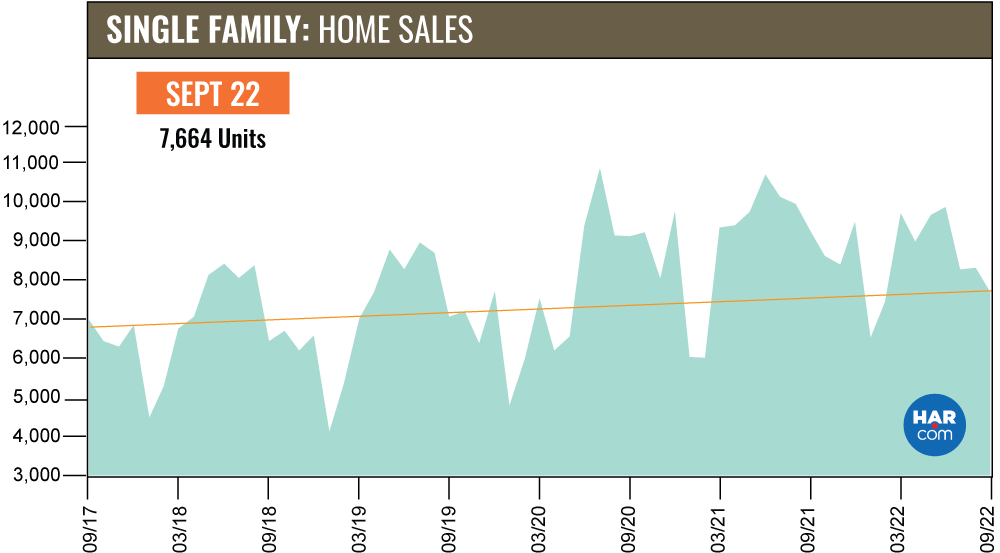

According to the Houston Association of REALTORS®’ (HAR) September 2022 Market Update, single-family home sales fell 17.0 percent, with 7,664 units sold compared to 9,235 in September 2021. On a year-to-date basis, the market now trails 2021’s record-setting volume by 5.1 percent.

The top sales volume performer was the $500,000 to $1 million housing segment, which rose 12.6 percent. The only other segment to remain in positive territory was $1M and above housing, which increased 7.2 percent. Many would-be homebuyers continued to turn to rental housing options in September. HAR will examine those trends in the September 2022 Rental Home Update, to be released next Wednesday, October 19.

“The Houston housing market consists of many concurrent trends,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “The high end of the market continues to perform well, as is the rental market. But because of a lack of homes priced below $400,000, the market as a whole is slowing to levels we were accustomed to before the pandemic. The most encouraging news of all is the gradual build-back of inventory, which should yield more options for consumers going forward.”

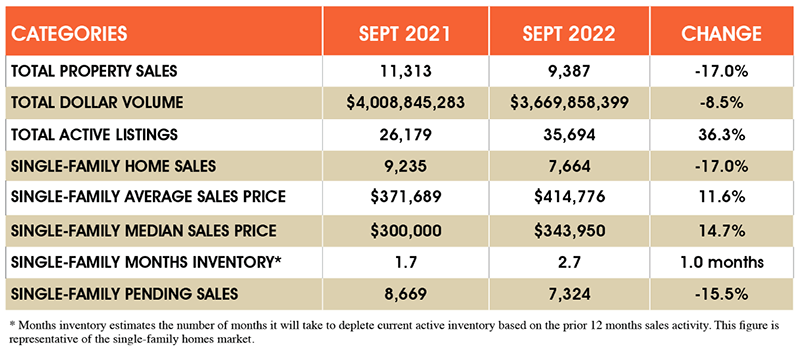

Housing across Greater Houston has experienced historic appreciation since the pandemic struck in early 2020. The average price of a single-family home rose 11.6 percent in September to $414,776 – well below the record high of $438,384 reached in May 2022. The median price jumped 14.7 percent to $343,950, which is also below the highest median of all time, $354,100, reached in June 2022. The average price for a single-family home in Houston first broke the $400,000 mark in March of this year. The median price has held above $300,000 since May of 2021.

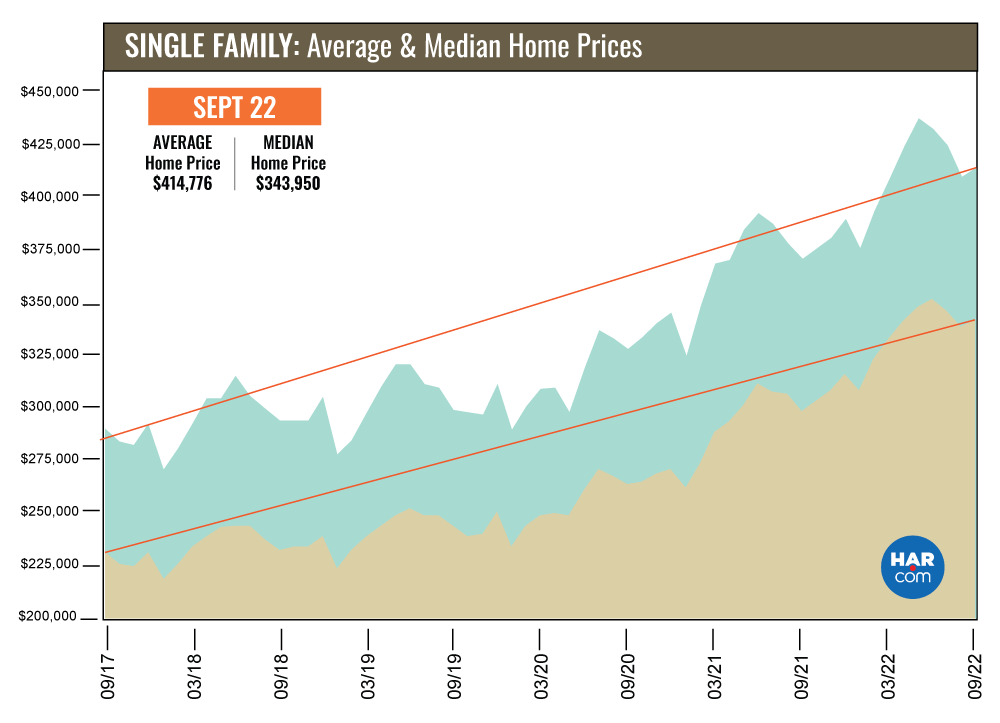

September Monthly Market Comparison

Homebuying activity slowed for a sixth straight month in September, with mortgage interest rates exceeding six percent for the first time in years, as well as a continued lack of housing inventory below $400,000. Year-over-year single-family home sales fell 17.0 percent. On a year-to-date basis, sales are trailing last year’s record pace by 5.1 percent.

Market indicators provided mixed readings in September. In addition to the drop in single-family home sales, total property sales and total dollar volume declined and pending sales fell 15.5 percent. Active listings (the total number of available properties) jumped 36.3 percent.

Months of inventory grew again in September, reaching a 2.7-months supply. That is the highest level since July of 2020 when it was 2.9 months. Housing inventory nationally stands at a 3.2-months supply, according to the latest report from the National Association of Realtors® (NAR). A 6.0-months supply is generally considered make up a “balanced market,” in which neither the buyer nor the seller has an advantage.

Single-Family Homes Update

Single-family home sales fell 17.0 percent in August with 7,664 units sold across the Greater Houston area compared to 9,235 a year earlier. In September, the median price climbed 14.7 percent to $343,950 while the average price rose 11.6 percent to $414,776.

For a pre-pandemic perspective, September sales are up 8.7 percent compared to three years ago, in September 2019, when a total of 7,050 single-family homes sold. The median price then was 40.6 percent lower, at $244,679, and the average price, at $299,600, was 38.4 percent lower. Sales are 10.2 percent above where they were five years ago, in September 2017, when volume totaled 6,953. Back then, the median price was $232,000 and the average price was $290,683 – reflecting pricing jumps of 48.3 percent and 42.7 percent, respectively.

Days on Market, or the actual time it took to sell a home, grew from 29 to 37 days. Inventory registered a 2.7-months supply compared to 1.7 months a year earlier. That is the greatest supply of homes on the market since July 2020. The current national inventory stands at 3.2 months, as reported by NAR.

Broken out by housing segment, September sales performed as follows:

- $1 – $99,999: decreased 31.7 percent

- $100,000 – $149,999: decreased 25.5 percent

- $150,000 – $249,999: decreased 44.7 percent

- $250,000 – $499,999: decreased 11.3 percent

- $500,000 – $999,999: increased 12.6 percent

- $1M and above: increased 7.2 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 6,058 in September, down 22.8 percent from the same month last year. The average sales price rose 11.4 percent to $409,384 while the median sales price increased 11.9 percent to $330,000. Those figures are significantly below the pricing records that were set earlier this year.

For HAR’s Monthly Activity Snapshot (MAS) of the September 2022 trends, please click HERE to access a downloadable PDF file.

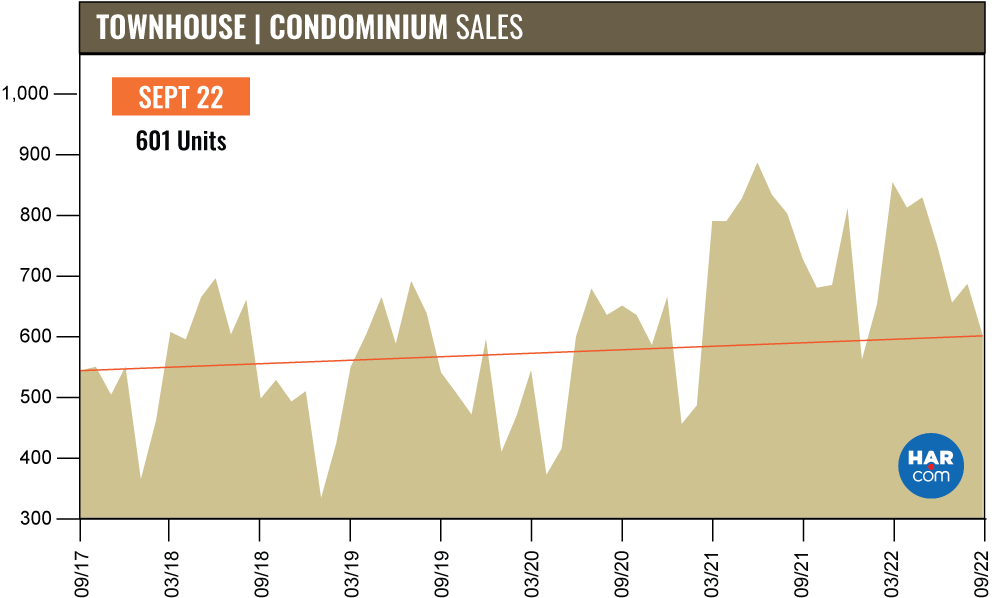

Townhouse/Condominium Update

Townhouses and condominiums experienced their fourth consecutive monthly decline, falling 17.6 percent year-over-year with 601 closed sales versus 729 a year earlier. The average price increased 7.5 percent to $257,781 and the median price rose 4.8 percent to $220,000. Both figures are below the historic highs reached in April 2022. Inventory fell from a 2.3-months supply to 2.0 months.

Houston Real Estate Highlights in September

- Single-family home sales fell 17.0 percent year-over-year, the sixth consecutive decline of 2022 as the market continues toward a more normalized, pre-pandemic pace;

- Despite the overall sales volume decline, the high end of the market flourished with the $500,000 to $1M housing segment establishing itself as the top-performing segment in September, up 12.6 percent year-over-year;

- Days on Market (DOM) for single-family homes grew from 29 to 37 days;

- Total property sales were down 17.0 percent with 9,387 units sold;

- Total dollar volume was off 8.5 percent at $3.7 billion;

- The single-family average price rose 11.6 percent to $414,776;

- The single-family median price increased 14.7 percent to $343,950;

- Single-family home months of inventory registered a 2.7-months supply, up from 1.7 months a year earlier. That is the greatest inventory level since July of 2020;

- Townhome/condominium sales experienced their fourth consecutive monthly decline, falling 17.6 percent, with the average price up 7.5 percent to $257,781 and the median price up 4.8 percent to $220,000.