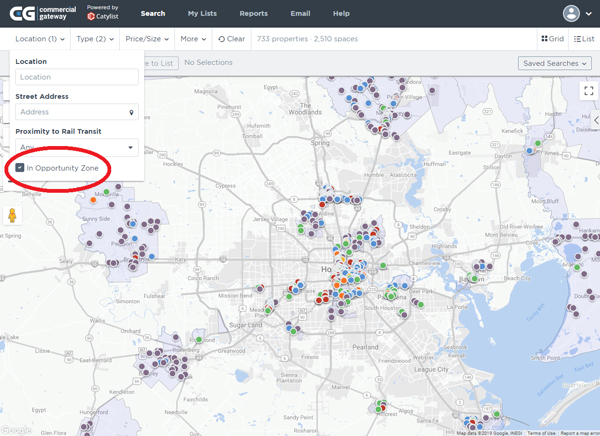

Commercial Gateway has added a Qualified Opportunity Zones search feature. Locate commercial properties within opportunity zones in Texas and across the country.

Qualified Opportunity Zones, sometimes referred to as Opportunity Zones or simply O-Zones, were created as an economic development tool to promote long-term investment and job creation in economically-distressed communities. Opportunity Zones were established by the 2017 Tax Cuts and Jobs Act, based on low-income census tracts, which were recommended by the governor, and then designated by the U.S. Treasury Department.

The goal of this legislation is to spur economic development by providing tax benefits to investors. The IRS provides the following information:

First, investors can defer tax on any prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in a QOF is sold or exchanged, or December 31, 2026. If the QOF investment is held for longer than 5 years, there is a 10% exclusion of the deferred gain. If held for more than 7 years, the 10% becomes 15%. Second, if the investor holds the investment in the Opportunity Fund for at least ten years, the investor is eligible for an increase in basis of the QOF investment equal to its fair market value on the date that the QOF investment is sold or exchanged.

https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions

For more information on Qualified Opportunity Zones, visit www.irs.gov. To learn more about how Commercial Gateway can help you identify properties within Opportunity Zones, please call 713-629-1900 ext. 363 or visit www.CommGate.com.