Strong sales momentum through mid-March helps offset COVID-19’s market impact later in the month

HOUSTON — (April 8, 2020) — As COVID-19 ravages the physical and business health of the nation, its impact on the Houston real estate market only began to set in during the last week of March, and therefore caused little disruption to the month’s overall performance. The full effect of the pandemic is expected to become more apparent when the April housing numbers are tallied.

Even with some transactions interrupted before Governor Greg Abbott designated real estate as an “essential” service statewide as part of his March 31 stay-at-home order, Houston home sales were more than 11 percent ahead of the levels at this point in 2019. Consumers were still taking advantage of historically low mortgage interest rates through the first half of the month.

Single-family homes priced between $500,000 and $750,000 led the way in March sales, followed by homes in the $250,000 to $500,000 range. Leases of single-family homes were also up for the month.

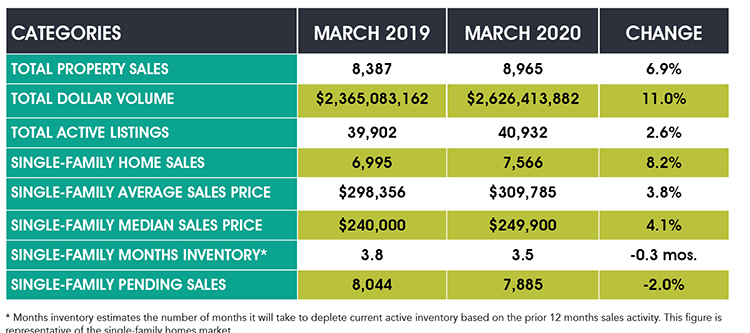

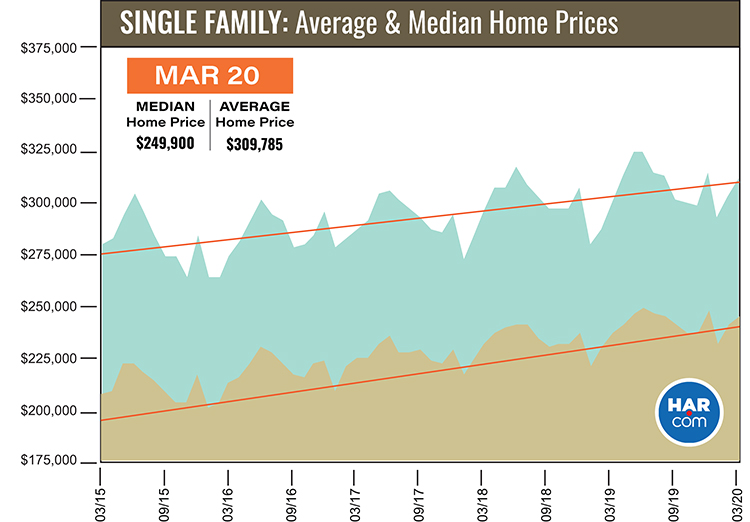

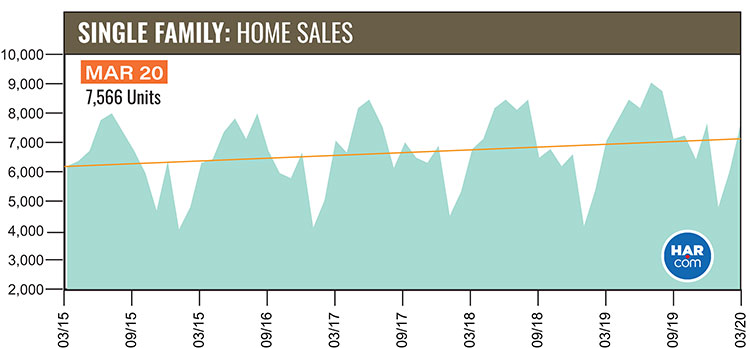

According to the latest monthly Market Update from the Houston Association of Realtors (HAR), 7,566 single-family homes sold in March compared to 6,995 a year earlier, accounting for an 8.2 percent increase and the ninth consecutive month of positive sales. The single-family home median price (the figure at which half of the homes sold for more and half sold for less) rose 4.1 percent to $249,900, and the average price climbed 3.8 percent to $309,785. Both figures represent the highest prices ever for a March. Sales of all property types totaled 8,965, up 6.9 percent from March 2019. Total dollar volume for the month jumped 11.0 percent to slightly more than $2.6 billion

“What’s about to happen to Houston real estate reminds me of Hurricane Harvey in that we are bracing for impact, but don’t yet know what the full extent on the market will be,” said HAR Chairman John Nugent with RE/MAX Space Center. “There are consumers out there for whom finding a home is critical, however, HAR has urged all Realtor members to conduct as much business as possible online, using technology such as virtual open houses, virtual tours and electronic signature documents, in the interest of protecting everyone’s health. What’s most important during this pandemic is for everyone to be responsible community stewards and heed the warnings of health experts and local officials,” added Nugent.

On March 20, all (in-person) open houses were removed from HAR.com out of an abundance of caution for the health and safety of consumers and real estate agents alike. In the next few days, the website will introduce a virtual tour feature allowing Realtors to host and post virtual open houses and conduct virtual showings. Consumers can watch them live on HAR.com at scheduled times and Realtors can then share the recordings on their own websites and social media platforms.

Lease Property Update

March saw a mixed performance for lease properties across the greater Houston area. Leases of single-family homes rose 1.2 percent year-over-year, however leases of townhomes and condominiums fell 9.7 percent. The average rent for single-family homes increased 2.4 percent to $1,788 while the average rent for townhomes and condominiums increased 4.2 percent to $1,604.

March Monthly Market Comparison

Market readings for March were largely positive. The exceptions were inventory, which lowered due to strong consumer demand during the first half of the month, and pending sales, which declined in the latter half due to market uncertainty as the pandemic struck. Single-family home sales, total property sales and total dollar volume all rose compared to March 2019, and pricing levels reached March highs. Total active listings, or the total number of available properties, rose 2.6 percent to 40,932.

Single-family homes inventory recorded a 3.5-months supply in March, down from a 3.8-months supply a year earlier. For perspective, housing inventory across the U.S. stands at a 3.1-months supply, according to the most recent report from the National Association of Realtors (NAR).

Single-Family Homes Update

Single-family home sales rose 8.2 percent in March with 7,566 units sold throughout greater Houston compared to 6,995 a year earlier. This marks the ninth straight month of positive sales. Prices reached the highest levels ever for a March. The median price increased 4.1 percent to $249,900. The average price rose 3.8 percent to $309,785.

Days on Market (DOM), or the number of days it took the average home to sell, remained unchanged at 65 days. Inventory registered a 3.5-months supply. That compares to 3.8 months a year earlier and is above the current national inventory level of 3.1 months reported by NAR.

Broken out by housing segment, March sales performed as follows:

- $1 – $99,999: decreased 37.8 percent

- $100,000 – $149,999: decreased 17.7 percent

- $150,000 – $249,999: increased 9.4 percent

- $250,000 – $499,999: increased 13.2 percent

- $500,000 – $749,999: increased 17.5 percent

- $750,000 and above: increased 9.1 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 5,888 in March, up 6.3 percent compared to the same month last year. The average sales price increased 4.8 percent to $300,164 while the median sales price rose 4.9 percent to $236,000.

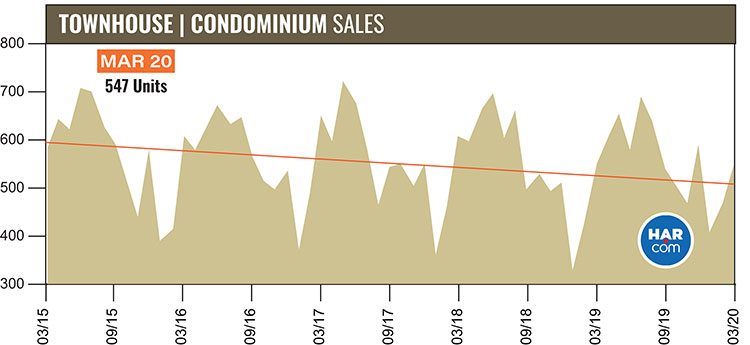

Townhouse/Condominium Update

Townhomes and condominiums ended three straight months of gains with a fractional year-over-year decline of 0.5 percent, with 547 units sold compared to 550 one year earlier. The average price jumped 6.0 percent to $224,038 while the median price increased 4.6 percent to $183,000. Inventory was unchanged at a 4.3-months supply.

Houston Real Estate Highlights in March

- Single-family home sales rose 8.2 percent year-over-year, with 7,566 units sold, marking the ninth consecutive month of positive sales;

- The Days on Market (DOM) figure for single-family homes was unchanged at 65 days;

- Total property sales rose 6.9 percent, with 8,965 units sold;

- Total dollar volume jumped 11.0 percent to more than $2.6 billion;

- The single-family home median price rose 4.1 percent to $249,900, reaching a March high;

- The single-family home average price climbed 3.8 percent to a March high of $309,785;

- Single-family homes months of inventory was at a 3.5-months supply, down from 3.8 months last March but above the national inventory level of 3.1 months;

- Townhome/condominium sales declined 0.5 percent, with the average price up 6.0 percent to $224,038 and the median price up 4.6 percent to $183,000;

- Lease properties experienced a mixed performance, as single-family home rentals increased 1.2 percent with the average rent up 2.4 percent to $1,788;

- Volume of townhome/condominium leases fell 9.7 percent with the average rent up 4.2 percent to $1,604.