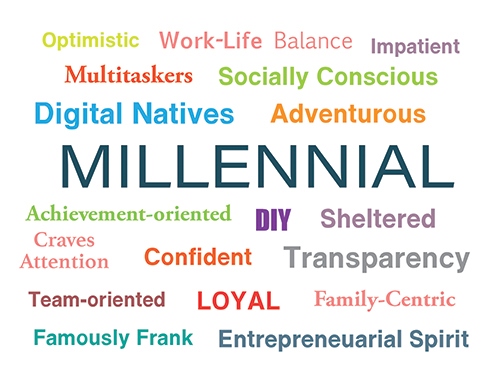

Barely a day goes by without another article, survey or marketing revelation about the Millennial generation. Every industry, including real estate, is pouring over their metadata trying to figure out the distinctive characteristics of this obsession of demographers everywhere.

More millennials are pursuing homeownership now than ever before. As 2018 drew to a close, the national homeownership rate rose to 64.4 percent according to the U.S. Census Bureau. That’s largely attributed to the rise in new, first-time home buyers.

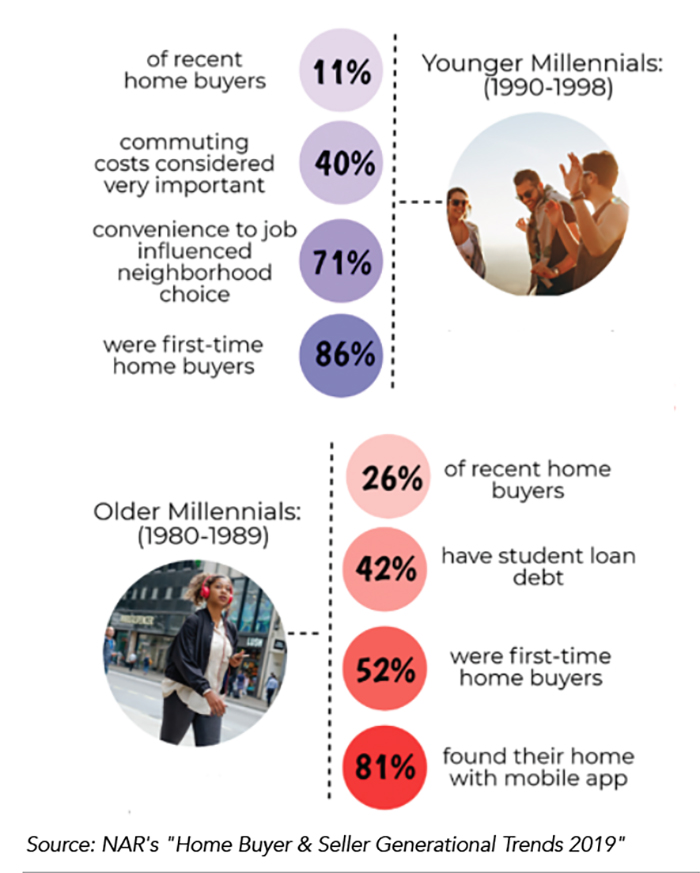

As millennials age and grow in their careers, they are acquiring more purchasing power. According to the 2018 National Association of REALTORS® Home Buyer and Seller Generational Trends Report, 30 percent of millennials purchased homes for $300,000 and higher in 2018, up from 14 percent in 2013. That means millennials and boomers are going head-to-head for the same homes today. Real estate industry observers expect that trend to continue growing in 2019.

Both groups also seek similar amenities, including walkable neighborhoods and smaller home sizes with more upgrades, experts say. For sellers and agents, catering to two different generations in marketing homes will also be a challenge. Millennial buyers are becoming more savvy to renovations and repairs. They are doing their online research and entering the market prepared.

Experts expect social media to continue to influence millennials’ homebuying habits. This generation relies heavily on online reviews and social media presence to make purchasing decisions. A strong online reputation for real estate professionals is a must in catering to this market. Showcasing homes on social media—particularly Instagram—is essential for appealing to millennial clients.

What is a Millennial?

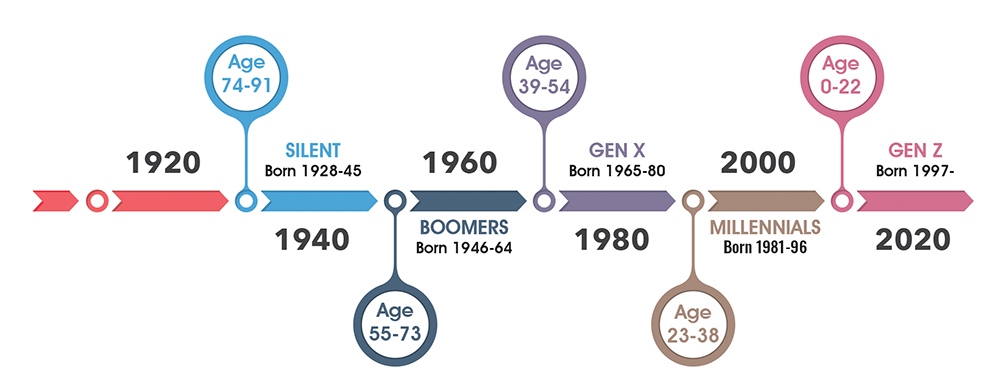

According to the Pew Research Center, a Millennial is anyone born between 1981 and 1996, ranging from 23 to 38 years old in 2019. There are 81 million Millennials in America. As of 2018, this makes them the biggest single demographic cohort in the United States, surpassing the Baby Boomers.

A Word About Generation Generalizations

Broad generalizations will always have exceptions. For example, the needs and interest of a buyer who is 24 years old are likely to be very different from those of a buyer who is 38 years old. As always every buyer is different with his or her own challenges and opportunities.

According to the Pew Research Center, a Millennial is anyone born between 1981 and 1996, ranging from 23 to 38 years old in 2019. There are 81 million Millennials in America. As of 2018, this makes them the biggest single demographic cohort in the United States, surpassing the Baby Boomers.

Do Millennials Want to Be Homeowners?

Every day we can read online how Millennials are changing commerce. ‘Millennials don’t buy tuna fish. Millennials don’t have can openers. Millennials don’t want cars. But do they buy homes? According to Zillow, Millennials are now the largest single group of homebuyers, and 46 percent of all first time homebuyers. Most Millennial renters who are asked if they want to buy a home say yes!

What Are the Challenges Facing a Millennial Buyer?

While Millennials will be the largest generation of home buyers in 2019, only two in 10 have a mortgage or home loan. The challenges they face as first time home buyers can be daunting. As the generation that grew up during the 2008 recession, they are saddled with numerous obstacles that previous generations were not.

A recent study shows that only 20% believe they can afford to buy a home. These studies have also shown that while Millennials believe they can find their home online without an agent, they do value the expertise of a trusted advisor as they might view their agent’s role.

- Millennials as a group have more student loan debt than earlier generations. Even buyers with qualifying incomes may have trouble coming up with a 20% down payment and will need advice from their agent. This student debt means many millennials will have lower credit scores than older buyers

- Millennials are putting off marriage. 46% of Millennials under the age of 32 are not married. This means that fewer have higher qualifying dual income households when looking for their first house.

- “Life events such as getting married or having children are typical triggers to buying a home,” Meyer said. “The longer this age group lives with parents or independently, the more homeownership will be delayed.” According to a study by Bank of America Merrill Lynch.

- Since the 2008 recession, lenders have tightened lending requirements. This significantly impacts Millennials who not only may have low credit scores and student debt but do not meet the lender definition of steady employment. Millennials are clearly less committed to their employers and tend to change jobs much more frequently than previous generations.

All of this means Millennials are more likely to need help finding sources of lower down payment financing.

What Do Millennials Want in a Home?

- Sophisticated and urban look

- Mixed Use communities

- Walkability and public transportation

- Greenspace

- Open floor plan

Source: Urban Land Institute’s What’s Next? Real Estate in the New

Economy report.