New listings of single-family rentals rose 18.4 percent in June.

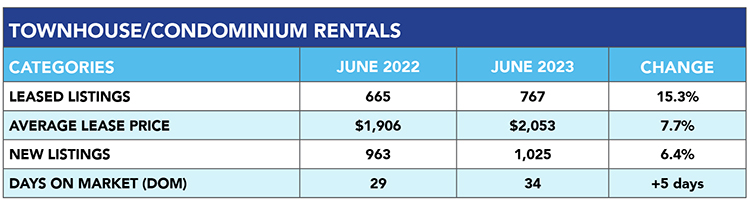

Demand for rental housing across Greater Houston was strong in June, drawing steady consumer interest as uncertainty about mortgage rates and inflation kept home sales below seasonal norms. Rentals of single-family homes as well as townhomes and condominiums drew equal interest throughout the month.

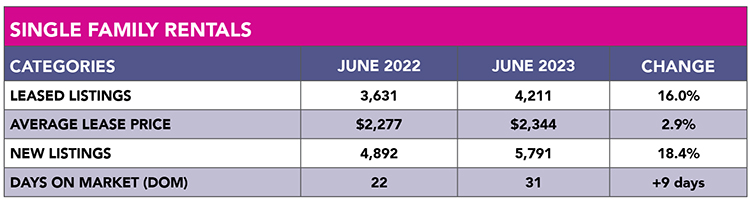

According to the Houston Association of REALTORS’ (HAR’s) June 2023 Rental Market Update, leases of single-family homes jumped 16.0 percent year-over-year with the average lease price climbing 2.9 percent to $2,344 – a record high. A total of 4,211 leases were signed compared to 3,631 in June 2022.

New listings of single-family rentals rose 18.4 percent in June, providing a sufficient supply of homes to meet the steady demand. Days on Market, or the actual number of days it took to lease a home, rose from 22 to 31 days.

“The Houston rental market remains strong, and that’s a good place to be while consumers who really want to buy a home wait for more favorable economic conditions to do so,” said HAR Chair Cathy Treviño with Side, Inc. “For a while, single-family rentals were leading the way each month, however we are now seeing across-the-board interest in all rental property types.”

Pre-pandemic Perspective: Compared to the last June before the pandemic, single-family home rentals are up 20.2 percent. In June 2019, leases were signed for 3,503 single-family homes. The average rent is currently 21.7 percent higher than it was back then – $1,926. Townhome/condominium rentals totaled 729 in June 2019. That is 5.2 percent below the June 2023 volume. The average townhome/condo rent is currently 27.9 percent above its June 2019 price of $1,605.

HAR’s Rental Market Update is distributed on the third Wednesday of each month, one week after the release of the monthly Sales Market Update. An archive of all these reports is available in the HAR Online Newsroom.