Houston real estate resists Mother Nature to complete its strongest year ever

Despite the devastating assault that Hurricane Harvey waged on the greater Houston area last summer – from which many property owners are still recovering – the Houston real estate market set new records by the time the sun set on 2017. Single-family home sales for the full year rose 3.5 percent compared to 2016, the previous record year. However, as 2018 gets underway, the supply of housing remains constrained. Inventory had begun to reach more balanced levels when Harvey’s widespread flooding sent affected residents scrambling for whatever undamaged rental and sales homes were available to provide safe shelter for themselves and their families.

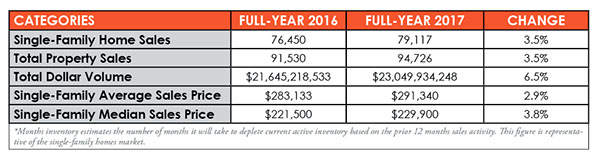

According to the latest report produced by the Houston Association of REALTORS® (HAR), sales of all property types in 2017 totaled 94,726 units, a 3.5-percent increase over 2016’s volume, which was 91,530. Total dollar volume for single-family homes sold in 2017 rose 6.5 percent to $23 billion.

“No one could ever have imagined 2017 turning out to be a record-setting year for the Houston real estate market, which had weathered the effects of the energy slump only to have Harvey strike such a devastating blow,” said HAR Chair Kenya Burrell-VanWormer with JP Morgan Chase. “We know that many are still working tirelessly to rebuild their lives after Harvey, but overall, this clearly illustrates the incredible resilience of the people and the economy of Houston, Texas. We also know that some neighborhoods are performing better than others, so it’s always advisable to consult a Realtor® when thinking about buying or selling a home.”

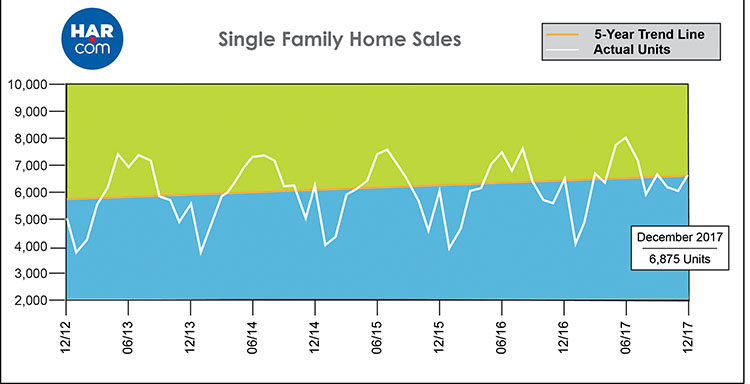

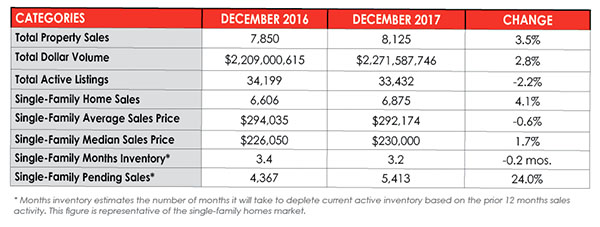

December single-family home sales rose 4.1 percent to 6,875 versus December 2016. The strongest sales performance took place among homes priced between $250,000 and $500,000.

Total property sales for the month climbed 3.5 percent to 8,125.

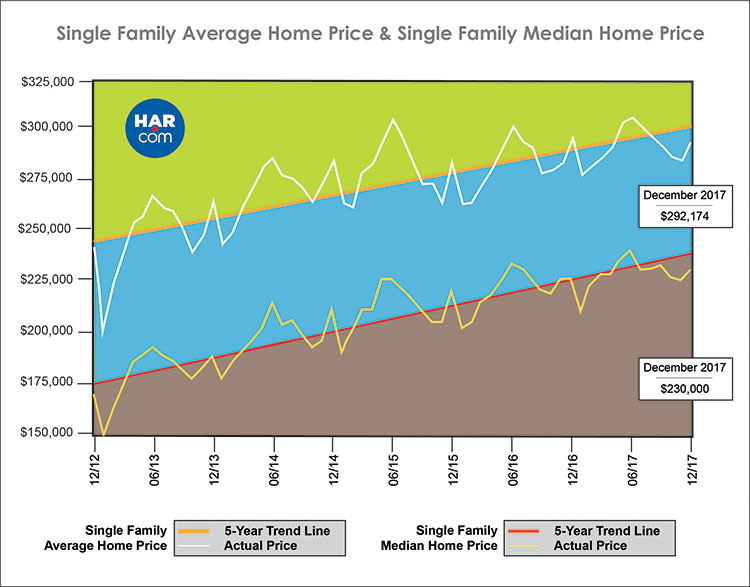

The single-family home median price (the figure at which half of the homes sold for more and half sold for less) rose 1.7 percent to

$230,000. That marks the highest median price ever for a December. The average price declined 0.6 percent to $292,174.

2017 Annual Market Comparison

As 2017 began, the high end of the Houston real estate market was showing welcomed signs of recovery from the effects of the weakened energy sector, and inventory levels in all housing categories finally began to rise. Strong employment numbers translated to an influx of home buyers and renters to the Houston area from across the country and around the world. However, Harvey’s late August rampage interrupted hiring and forced those whose homes and apartments were damaged or destroyed to seek immediate housing anywhere they could, causing inventory to shrink.

Fortunately, the setbacks resulting from this historic weather catastrophe were much shorter-lived than anticipated. By the end of September – just four weeks after Harvey hit – the “Houston Strong” housing market saw home sales rebound and the greatest rental activity of all time. The positive momentum continued through the final months of 2017.

By the end of December, a record 79,117 single-family homes had sold. That represents an increase of 3.5 percent from the previous record of 76,450 in 2016.

On a year-to-date basis, the average price rose 2.9 percent to $291,340 while the median price increased 3.8 percent to $229,900. Total dollar volume for full-year 2017 jumped 6.5 percent to $23 billion.

The strongest one-month sales volume of 2017 was recorded in June with 8,362 single-family homes sold. By contrast, the lightest one-month sales volume took place in January with 4,104 sales.

Months of inventory began the year at a 3.3-months supply, and while it grew to a 4.3-months supply just before Harvey struck the region, it ended 2017 at a 3.2-months supply. Months of inventory estimates the number of months it will take to deplete current active inventory based on the prior 12 months sales activity.

December Monthly Market Comparison

The Houston housing market registered largely positive measurements in December, with single-family home sales, total property sales, total dollar volume and median pricing all up compared to December 2016.

Month-end pending sales for single-family homes totaled 5,413, an increase of 24.0 percent versus 2016. Total active listings, or the total number of available properties, declined 2.2 percent from December 2016 to 33,432.

Single-family homes inventory shrank from a 3.4-months supply to 3.2 months. For perspective, housing inventory across the U.S. currently stands at a 3.4-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales totaled 6,875, up 4.1 percent from December 2016. The median price rose 1.7 percent to a December high of $230,000. The average price declined a fractional 0.6 percent to $292,174. Days on Market (DOM), or the number of days it took the average home to sell, was unchanged at 62.

Broken out by housing segment, December sales performed as follows:

- $1 – $99,999: increased 5.7 percent

- $100,000 – $149,999: decreased 7.3 percent

- $150,000 – $249,999: increased 4.5 percent

- $250,000 – $499,999: increased 9.1 percent

- $500,000 – $749,999: unchanged

- $750,000 and above: decreased 11.2 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 5,460 in December, up 3.7 percent versus the same month last year. The average sales price rose 2.6 percent to $276,738 while the median sales price increased 1.2 percent to $211,000.

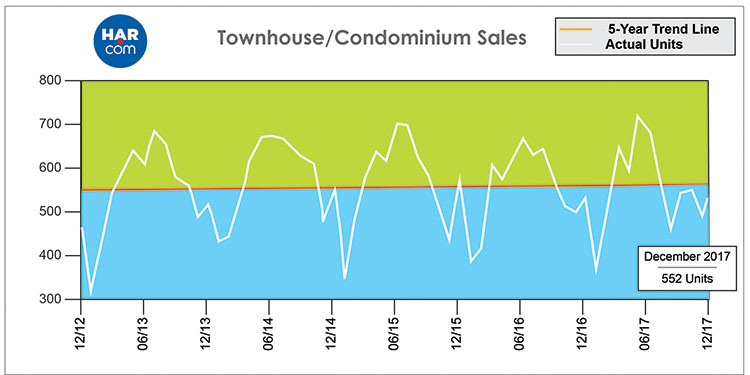

Townhouse/Condominium Update

Townhome and condominium sales increased 3.2 percent in December, with 552 units selling versus 535 a year earlier. The average price fell 5.5 percent to $199,197 and the median price dropped 9.3 percent to $158,250. Inventory went from a 3.4-months supply to 3.3 months.

Lease Property Update

Houston’s lease market had a mixed performance in December. Single-family home leases fell 3.6 percent and townhome/condominium leases rose 7.3 percent. The average rent for single-family homes increased 3.3 percent to $1,745, while the average rent for townhomes/condominiums rose 2.4 percent to $1,532.

Houston Real Estate Highlights for December and Full-Year 2017

- Despite the devastation caused by Hurricane Harvey, 2017 proved to be a record year for Houston home sales with 79,117 single-family homes sold versus 76,450 in 2016, the last record-setting year.

- That represents an increase of 3.5 percent;

- Total dollar volume for single-family homes in 2017 rose 6.5 percent to $23 billion;

- December single-family home sales climbed 4.1 percent year-over-year with 6,875 units sold;

- Total December property sales increased 3.5 percent to 8,125 units;

- Total dollar volume for December increased 2.8 percent to $2.3 billion;

- At $230,000, the single-family home median price rose 1.7 percent to a December high;

- The single-family home average price declined 0.6 percent to $292,174;

- Single-family homes months of inventory declined slightly to a 3.2-months supply;

- Townhome/condominium sales rose 3.2 percent, with the average price down 5.5 percent to $199,197 and the median price down 9.3 percent to $158,250;

- Leases of single-family homes fell 3.6 percent with average rent up 3.3 percent to $1,745;

- Leases of townhomes/condominiums climbed 7.3 percent with average rent up 2.4 percent to $1,532.