The Houston real estate market showed continued resiliency in the aftermath of Hurricane Harvey, with home sales and rentals in positive territory for a second consecutive month in October. The strong demand, however, has constrained housing inventory, which had finally reached more balanced levels before the storm struck in late August.

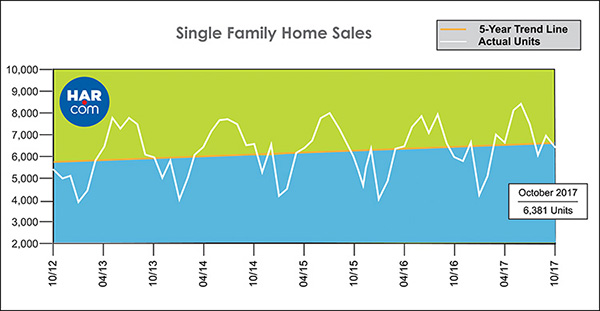

According to the latest monthly report prepared by the Houston Association of REALTORS® (HAR), single-family home sales rose 7.5 percent, marking a further recovery since Harvey’s assault. All segments of the housing market experienced gains except for homes priced below $150,000. The greatest sales volume was observed among homes priced at $750,000 and above. On a year-to-date basis, home sales remain 2.8 percent ahead of 2016’s volume as some flood-ravaged neighborhoods continue to rebuild.

Housing inventory edged up from a 3.8-months supply in October 2016 to 3.9 months this October. However, that is down from the 4.3-months peak reached in the weeks immediately preceding Harvey.

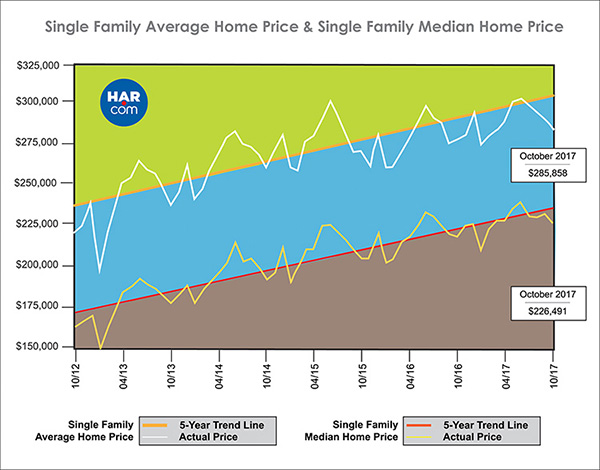

The single-family home median price (the figure at which half of the homes sold for more and half sold for less) increased 3.9 percent to $226,491. The average price rose 2.7 percent to $285,858. Both figures represent records highs for an October.

“The overall Houston real estate market wasted little time recovering from Hurricane Harvey’s devastation, but we’d like to see supply grow to meet ongoing consumer demand for housing,” said HAR Chair Cindy Hamann with Berkshire Hathaway HomeServices Anderson Properties. “Hopefully, more balanced inventory levels can be restored by early in the new year.”

October sales of all property types in Houston totaled 7,614, an increase of 6.6 percent versus the same month last year. Total dollar volume climbed 10.8 percent to $2.1 billion.

Lease Property Update

Still propelled largely by consumers displaced from housing as a result of Harvey’s destruction, demand for lease properties across Houston remained strong in October. Single-family home leases rose 13.6 percent while townhome/condominium leases shot up 34.8 percent. The average rent for single-family homes was up 2.8 percent to $1,776 while the average rent for townhomes/condominiums increased 2.9 percent to $1,533.

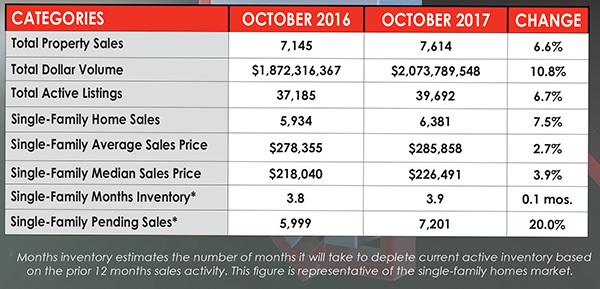

October Monthly Market Comparison

Houston’s monthly housing market indicators yielded positive readings across the board in October, with single-family home sales, total property sales, median and average pricing and total dollar volume all up versus October 2016.

Month-end pending sales for single-family homes totaled 7,201, up 20.0 percent compared to last year. Total active listings, or the total number of available properties, increased 6.7 percent from October 2016 to 39,692.

Single-family homes inventory edged up from a 3.8-months supply to 3.9 months, but is down from a pre-Harvey (July-August) peak of 4.3-months that dwindled as demand for undamaged and repaired homes outpaced supply. For perspective, housing inventory across the U.S. currently stands at a 4.2-months supply, according to the latest report from the National Association of REALTORS®(NAR).

Single-Family Homes Update

Single-family home sales totaled 6,381, continuing their post-Harvey rebound for a second consecutive month. That is up 7.5 percent from October 2016 when sales volume was 5,934. On a year-to-date basis, home sales are 2.8 percent ahead of the 2016 volume.

Prices reached the highest levels ever for an October in Houston. The median price increased 3.9 percent to $226,491. The average price rose 2.7 percent to $285,858.

Days on Market (DOM), or the number of days it took the average home to sell, increased from 56 days in October 2016 to 61 days this October. Inventory rose slightly from a 3.8-months supply to 3.9 months year-over-year, but was down from a pre-hurricane level of 4.3 months.

Broken out by housing segment, October sales performed as follows:

- $1 – $99,999: decreased 2.9 percent

- $100,000 – $149,999: decreased 18.5 percent

- $150,000 – $249,999: increased 13.7 percent

- $250,000 – $499,999: increased 14.4 percent

- $500,000 – $749,999: increased 2.2 percent

- $750,000 and above: increased 18.7 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 5,262 in October, up 6.8 percent versus the same month last year. The average sales price increased 5.0 percent to $271,414 while the median sales price rose 4.5 percent to $210,000.

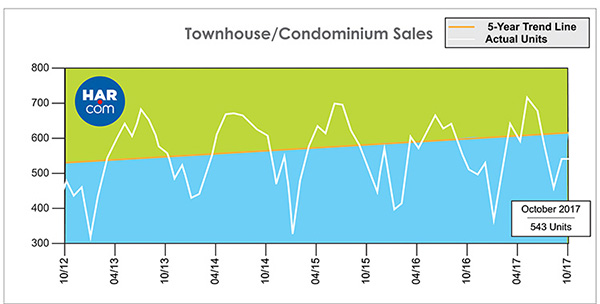

Townhouse/Condominium Update

The townhome and condominium market began its post-Harvey rebound in October with a total of 543 units sold, marking a year-over-year increase of 5.8 percent. The average price declined 1.1 percent to $195,393 while the median price declined 3.1 percent to $153,000. Inventory expanded from a 3.7-months supply to 3.9 months, but is down from its pre-Harvey peak of 4.5 months.

Houston Real Estate Highlights in October

- Single-family home sales continued their post-Hurricane Harvey rebound as volume rose 7.5 percent year-over-year with 6,381 units sold;

- Single-family home sales remain 2.8 percent ahead of 2016’s year-to-date volume;

- Total property sales increased 6.6 percent with 7,614 units sold;

- Total dollar jumped 10.8 percent to $2.1 billion;

- The single-family home median price rose 3.9 percent to $226,491, which represents an October high;

- The single-family home average price increased 2.7 percent to $285,858, also the highest level for an October;

- Single-family homes months of inventory grew year-over-year to a 3.9-months supply, but is down from a 4.3-months pre-Harvey peak – the result of a surge in consumer demand for housing;

- Townhome/condominium sales rose 5.8 percent, with the average price down 1.1 percent to $195,393 and the median price down 3.1 percent to $153,000;

- Leases of single-family homes rose 13.6 percent with the average rent up 2.8 percent to $1,776;

- Volume of townhome/condominium leases jumped 34.8 percent with average rent up 2.9 percent to $1,533.

- HAR still encourages anyone who has housing available for temporary occupancy (up to 12 weeks) to please post it on our Harvey Temporary Housing page at www.har.com/temporaryhousing to provide housing to those in need.