Home sales and prices soar again as inventory shrinks

If the Houston real estate market were a car, it would be fair to say its driver had the pedal to the metal. September sped its way into the history books as the 28th consecutive month of positive home sales, and there still is no let-up in sight. The pace of home buying drove months of inventory down to 3.2 months compared to 4.7 months at this time last year.

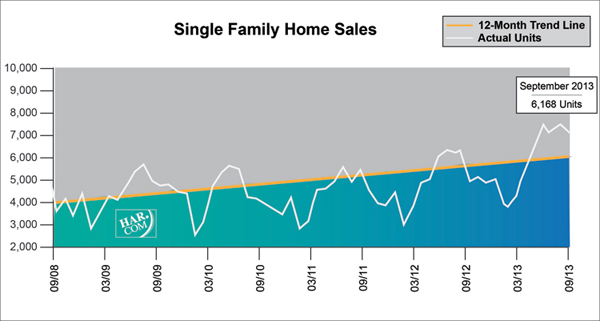

Home sales soared 23.5 percent year-over-year, with contracts closing on 6,168 single-family homes, according to the newest monthly report prepared by the Houston Association of REALTORS®. That is the lowest one-month sales volume since March and follows four months in a row of home sales that exceeded 7,000 units.

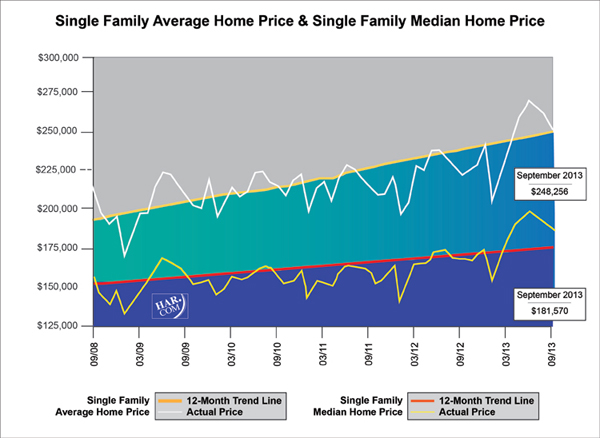

The median price of a single-family home—the figure at which half the homes sold for more and half for less—rose 10.2 percent to $181,750. The average price increased 13.1 percent year-over-year to $248,256. Both figures represent the highest prices for a September in Houston.

As we have observed for the past several months, September brought gains to all housing segments except the under-$80,000 market. Homes selling from $250,000 through the millions scored the greatest increase in sales volume.

“Houston continues to benefit from a confluence of very positive economic forces: strong job growth, low interest rates and reasonable home prices compared to other parts of the country,” said HAR Chairman Danny Frank with Coldwell Banker, United REALTORS®. “Home prices have steadily risen all year and I’m often asked if our market risks experiencing a bubble. That only becomes a possibility if we don’t soon see a reversal in our shrinking inventory of homes – the fundamental concept of supply and demand.”

The latest Texas Workforce Commission’s report indicated that nearly 81,000 net new jobs had been added to the Houston metropolitan area over the past year, representing 3.0 percent growth in local employment.

Foreclosure property sales reported in the HAR Multiple Listing Service (MLS) declined 45.0 percent compared to September 2012. Foreclosures currently make up just 7.4 percent of all property sales, down from 19.6 percent at the beginning of the year. The median price of foreclosures rose 6.6 percent to $87,450.

September sales of all property types in totaled 7,466, a 25.7 percent increase over the same month last year. Total dollar volume for properties sold shot up 40.2 percent to $1.75 billion versus $1.25 billion a year earlier.

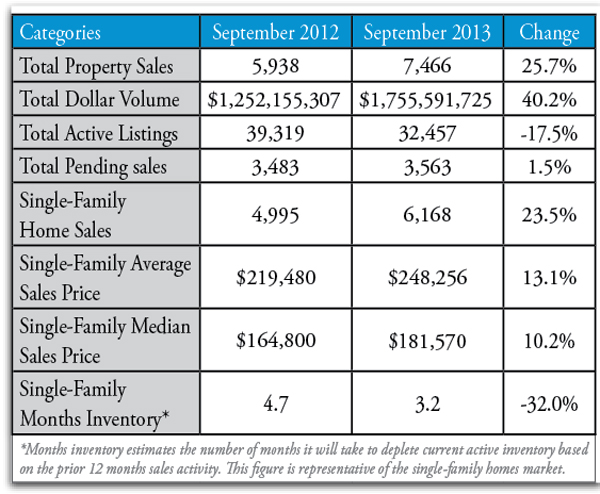

September Monthly Market Comparison

Houston’s real estate market enjoyed across-the-board gains in September when comparing sales to September 2012. On a year-over-year basis, total property sales, total dollar volume and average and median pricing all rose.

Month-end pending sales totaled 3,563, a 1.5 percent gain over last year and the same rate of increase the market saw in August. As HAR reported last month, while pending sales typically serve as a bellwether of the following month’s sales activity, this statistic apparently reflects the unprecedented pace of home sales that has kept many transactions from ever attaining “pending” status. Active listings, or the number of available properties, at the end of September declined 17.5 percent to 32,457.

Houston’s inventory of available homes dipped from 3.3 months in August to 3.2 months in September, down from the year-ago level of 4.7 months of inventory. The inventory of single-family homes across the United States currently stands at 4.9 months, according to the latest report from the National Association of REALTOR® (NAR).

Single-Family Homes Update

September sales of single-family homes in Houston totaled 6,168, up 23.5 percent from September 2012. That marks the 28th consecutive monthly increase.

Home prices achieved the highest levels ever recorded in Houston for a September. The single-family median price rose 10.2 percent from last year to $181,570 and the average price climbed 13.1 percent year-over-year to $248,256.

Broken out by housing segment, September sales performed as follows:

- $1 – $79,999: decreased 31.5 percent

- $80,000 – $149,999: increased 16.9 percent

- $150,000 – $249,999: increased 32.6 percent

- $250,000 – $499,999: increased 44.8 percent

- $500,000 – $1 million and above: increased 55.8 percent

HAR also breaks out the sales performance of existing single-family homes throughout the Houston market. In September 2013, existing home sales totaled 5,348, a 26.4 percent increase from the same month last year. The average sales price rose 13.4 percent year-over-year to $234,321 while the median sales price rose 11.1 percent to $170,000.

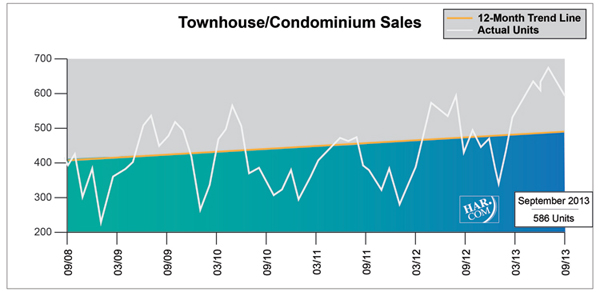

Townhouse/Condominium Update

September sales of townhouses and condominiums shot up 42.2 percent from one year earlier. A total of 586 units sold last month compared to 412 properties in September 2012. The average price rose 6.4 percent to $181,532 while the median price was flat at $137,540. Months inventory was 3.1 months versus 5.3 months in September 2012.

Lease Property Update

Houston’s lease property market grew further in September. Rentals of single-family homes rose 15.9 percent compared to September 2012 while year-over-year townhouse/condominium rentals were flat. The average rent of a townhouse/condominium reached an historic high of $1,519 while single-family average rent slipped from its record high of $1,747 last month to $1,700.

Houston Real Estate Milestones in September

- Single-family home sales increased 23.5 percent year-over-year, accounting for the market’s 28th consecutive monthly increase;

- Total property sales rose 25.7 percent compared to one year earlier;

- Total dollar volume soared 40.2 percent, increasing from $1.25 billion to $1.75 billion on a year-over-year basis;

- At $181,570, the single-family home median price reached the highest level for a September in Houston;

- At $248,256, the single-family home average price also reached a September high;

- 3.2 months inventory of single-family homes is down from 3.3 months in August 2013 and down from 4.7 months in September 2012 while comparing to the national average of 4.9 months;

- Sales of townhouses/condominiums rose 42.2 percent year-over-year.

- Rentals of single-family homes rose 15.9 percent while and townhouse/condominium units were flat.

- Townhome/condominium average rents reached a record high of $1,519.